Table of Contents

Bitcoin hashrate growth warning is not a popular narrative, but it is a necessary one. In most market commentary, rising hashrate is framed as an unambiguous sign of network health, miner confidence, and long-term security. While this is partially true, it is incomplete.

Hashrate growth can also function as an early warning signal.

Not for the Bitcoin network itself, but for miners, margins, and capital efficiency.

Understanding when hashrate growth is healthy and when it becomes dangerous is essential for anyone operating or investing in mining infrastructure.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Why Hashrate Growth Is Usually Celebrated

At a protocol level, rising hashrate means:

- Higher network security

- Increased cost to attack Bitcoin

- Strong miner participation

- Continued capital inflow into mining

These are positive structural signals.

However, miners do not earn security. They earn margins.

And margins respond very differently to hashrate growth than the network does.

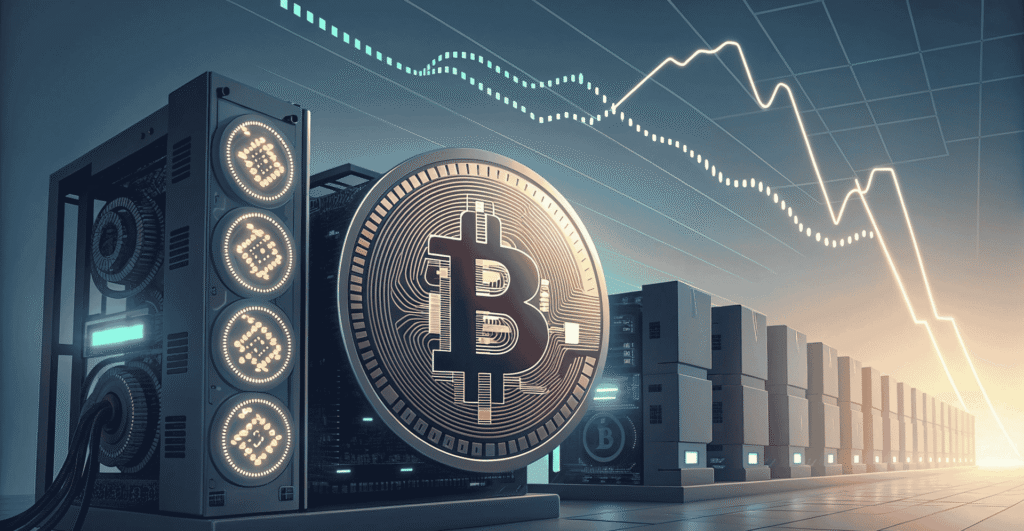

The Disconnect Between Network Health and Miner Profitability

Bitcoin is designed so that total block rewards are fixed per block, not per miner.

As hashrate increases:

- Total rewards stay the same

- Competition increases

- Individual miner share declines

- Difficulty adjusts upward

This means hashrate growth redistributes revenue rather than creating it.

When hashrate grows faster than price, profitability per unit of hash declines.

This is where the bitcoin hashrate growth warning begins to matter.

When Hashrate Growth Becomes a Warning Signal

Hashrate growth becomes concerning under specific conditions:

- Rapid expansion over short periods

- Growth driven by leverage or speculation

- Growth during flat or declining price environments

- Growth concentrated in inefficient hardware generations

In these scenarios, hashrate growth compresses margins faster than operators can adapt.

The network looks stronger. Miners become weaker.

Capital Misallocation Drives Dangerous Hashrate Expansion

Not all hashrate growth is organic.

In many cycles, growth is driven by:

- Cheap financing

- Overconfidence during bull markets

- Delayed deployment of already-purchased hardware

- Pressure to “scale or be left behind”

This creates a lag effect.

Hardware ordered months earlier comes online regardless of current economics. Hashrate rises even when margins do not justify it.

This is one of the most reliable precursors to miner stress.

Difficulty Adjustments Amplify the Pressure

Bitcoin’s difficulty adjustment mechanism is neutral and automatic.

When hashrate rises:

- Difficulty increases

- Blocks return to ~10-minute intervals

- Revenue per hash declines

There is no relief valve.

Miners experiencing margin pressure cannot slow the network. They must adapt or exit.

This is why rising hashrate often precedes miner capitulation, not price rallies.

Historical Context: Hashrate Peaks Before Stress Events

Across multiple cycles, a consistent pattern emerges:

- Hashrate accelerates

- Difficulty climbs

- Margins compress

- Inefficient miners struggle

- Capitulation follows

- Hashrate temporarily declines

- Survivors gain efficiency

The warning signal is not hashrate growth itself, but unselective hashrate growth.

When everyone expands simultaneously, someone will fail.

Why Retail Miners Misread Hashrate Signals

Retail participants often interpret hashrate growth emotionally:

- “Big miners are bullish”

- “Network confidence is high”

- “This confirms the bull market”

What they miss is timing.

By the time hashrate data confirms growth, capital is already deployed. The risk has already been taken.

Professional operators watch rate of change, not absolute numbers.

Hashrate Growth and Energy Market Constraints

Another overlooked factor is energy competition.

Rapid hashrate growth:

- Pushes miners into higher-cost power sources

- Increases grid strain

- Reduces access to discounted energy

- Forces geographic compromises

As more miners chase limited low-cost energy, operational quality declines.

This creates structural fragility masked by headline hashrate numbers.

Why Efficient Infrastructure Wins During Hashrate Surges

During aggressive hashrate expansion phases:

- Efficient operators survive

- Inefficient ones bleed slowly

- Poorly designed facilities collapse first

This is where infrastructure, not intelligence, determines outcomes.

Operators with:

- Stable power contracts

- High uptime

- Optimized cooling

- Disciplined deployment schedules

Can endure margin compression longer.

This is not about being bullish or bearish. It is about resilience.

How Bitmern Mining Interprets Hashrate Growth Cycles

Bitmern Mining does not treat hashrate growth as inherently positive or negative.

It is treated as a contextual signal.

During rapid hashrate expansion, Bitmern emphasizes:

- Deployment discipline

- Margin protection

- Infrastructure-first scaling

- Avoidance of speculative overextension

The goal is not maximum hashrate. It is sustainable hashrate.

You can explore Bitmern’s infrastructure philosophy here: https://bitmernmining.com/

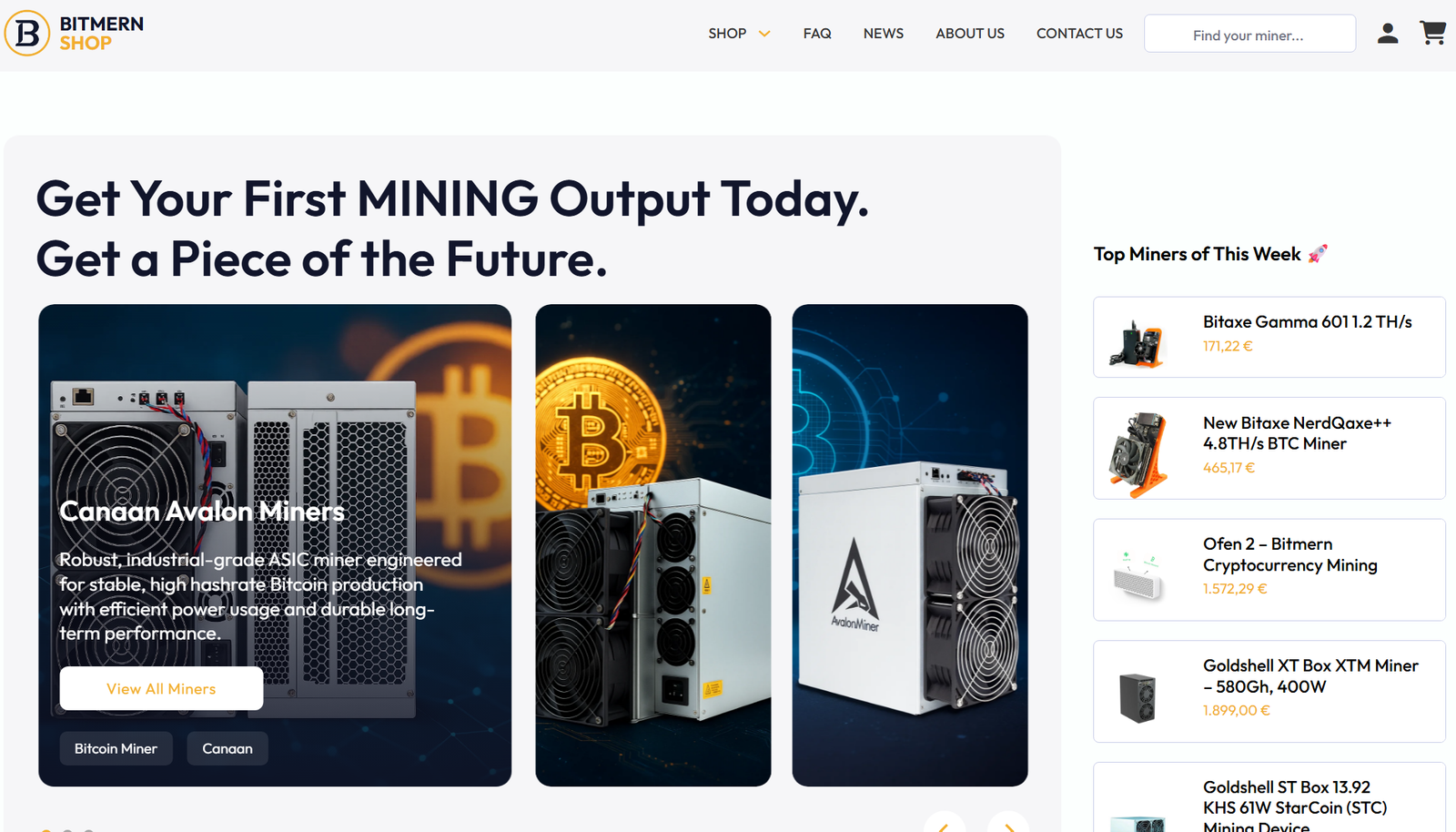

Hardware Selection Matters More During Hashrate Surges

When margins compress, hardware inefficiency is exposed immediately.

Older-generation or poorly optimized machines:

- Lose profitability faster

- Require higher uptime to break even

- Increase maintenance overhead

- Contribute to operational stress

Access to reliable, well-supported hardware becomes critical during these phases.

The Bitmern Mining Shop focuses on hardware that aligns with long-term operational stability rather than short-term hype.

Available equipment can be found here: https://shop.bitmernmining.com/

Why Hashrate Growth Can Signal the End of Easy Profits

Easy mining profits exist when:

- Hashrate is low relative to price

- Competition is limited

- Inefficiencies are tolerated

Hashrate growth signals the opposite:

- Capital is crowding in

- Margins are being competed away

- Execution matters more than optimism

This is not a bearish signal for Bitcoin.

It is a warning signal for undisciplined miners.

Final Perspective: Hashrate Growth Tests, It Does Not Reward

Bitcoin’s design ensures that growth does not guarantee profit.

Hashrate growth increases competition, not rewards.

For miners, rising hashrate is a stress test:

- Of infrastructure

- Of cost discipline

- Of operational execution

- Of capital allocation

Those who interpret hashrate growth as automatic validation often discover the warning too late.

Those who understand it as a filter survive.