Table of Contents

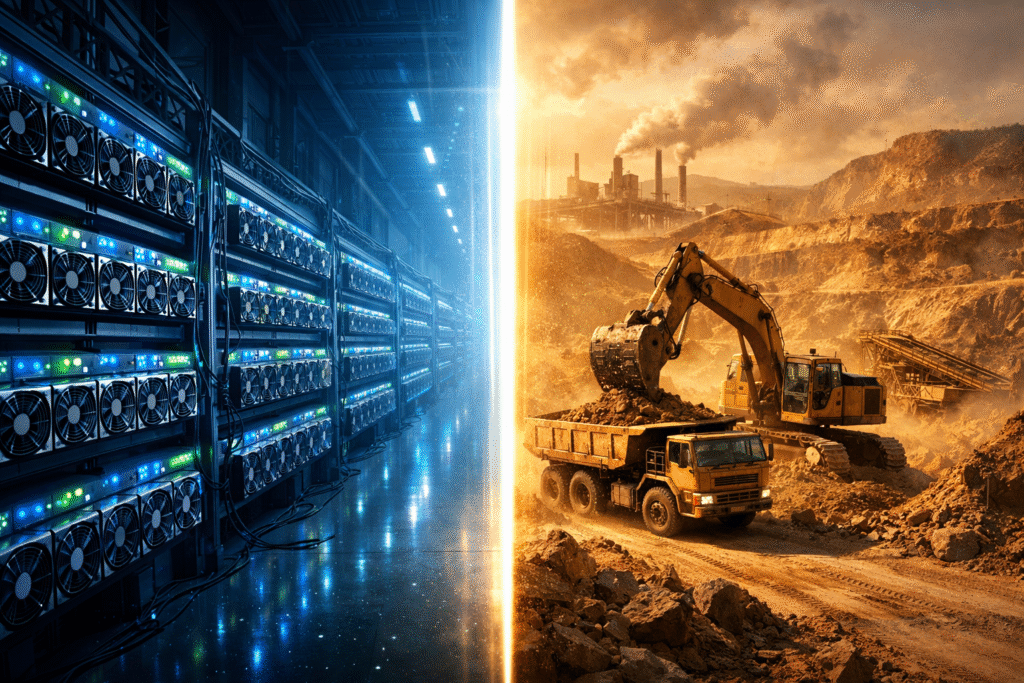

Bitcoin mining competes with data centers, not with other miners. This is one of the most misunderstood realities in the industry and one of the main reasons many mining strategies fail.

At the surface level, mining looks like a competition between hashrate. Bigger farms, newer ASICs, higher efficiency. But underneath, Bitcoin mining is competing in the same arena as hyperscale data centers, cloud providers, AI compute clusters, and high-density server facilities.

The real competition is not who owns more ASICs.

The real competition is who controls infrastructure.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Why the “Miner vs Miner” Narrative Is Wrong

Most mining discussions frame the industry as miners competing against miners. This framing is incomplete.

Miners do not primarily compete on:

- hashpower

- hardware brand

- pool selection

They compete on:

- power access

- grid priority

- cooling capacity

- physical space

- uptime discipline

These are the exact same constraints faced by data centers.

Bitcoin mining competes with data centers because both industries draw from the same finite infrastructure pool.

The Shared Infrastructure Layer

Bitcoin mining and data centers rely on the same foundational resources:

- electrical generation

- transmission capacity

- substations

- land zoning

- cooling systems

- fiber connectivity

- operational staffing

When a region allocates power to a hyperscale data center, that capacity is no longer available to miners. When miners lock long-term energy contracts, that capacity is no longer available to AI clusters.

This is not theoretical. It is already happening globally.

Power Is the Primary Battleground

Power is the most obvious overlap.

Data centers and mining operations both require:

- continuous baseload power

- predictable pricing

- grid stability

- redundancy

The grid does not care whether electrons power GPUs or ASICs.

This is why mining operations that do not think like data centers are structurally disadvantaged. They treat power as a commodity, while data centers treat it as a strategic asset.

Bitmern Mining operates with the same philosophy as professional data centers: power first, hardware second.

Cooling Density Is Where Mining and Data Centers Collide

Modern data centers are increasingly high-density. AI workloads, GPUs, and accelerated compute demand intense cooling.

Bitcoin mining already operates at high thermal density.

This creates direct competition for:

- air handling capacity

- liquid cooling infrastructure

- facility design expertise

Facilities that cannot support high-density cooling will lose relevance in both industries.

This is why mining operations that still think in “warehouse + fans” terms fall behind. The future belongs to data-center-grade mining infrastructure.

Space and Zoning Are Strategic Constraints

Land is not infinite. Industrial zoning is not unlimited.

Both miners and data centers compete for:

- industrial land

- proximity to substations

- regulatory approval

- noise and heat allowances

Data centers often win because they are perceived as “cleaner” or more politically acceptable. Mining operations must therefore operate at similar standards to remain viable long-term.

Bitmern Mining designs facilities to meet institutional expectations, not hobbyist assumptions.

Uptime Expectations Are Identical

Data centers are judged on uptime. Mining is no different.

The difference is perception, not reality.

- downtime in a data center breaks SLAs

- downtime in mining destroys revenue

The economics are identical.

This is why professional miners measure uptime the same way data centers do and why Bitmern Mining treats uptime as a first-order variable, not an operational afterthought.

Why Hashrate Is a Lagging Indicator

Hashrate growth is often mistaken for competitiveness.

In reality, hashrate is the result of infrastructure success, not the cause.

Data centers do not compete on server count alone. They compete on:

- efficiency

- scalability

- reliability

- cost control

Mining follows the same rules.

Bitcoin mining competes with data centers because both industries win or lose before hardware is even installed.

Institutional Capital Sees Mining as Infrastructure

This is a critical shift.

Institutional investors do not view mining as:

- speculative hardware bets

- short-term yield plays

They view it as:

- infrastructure deployment

- energy monetization

- long-duration operations

This places mining directly in competition with traditional data center investments.

Bitmern Mining is positioned for this reality, not the outdated miner-vs-miner narrative.

Why Smaller Miners Feel “Crowded Out”

Retail miners often feel squeezed, not because other miners are larger, but because infrastructure is scarce.

They are not losing to other miners.

They are losing to data centers.

The solution is not more ASICs.

The solution is access to professional infrastructure.

This is exactly where hosting platforms like Bitmern Mining create leverage.

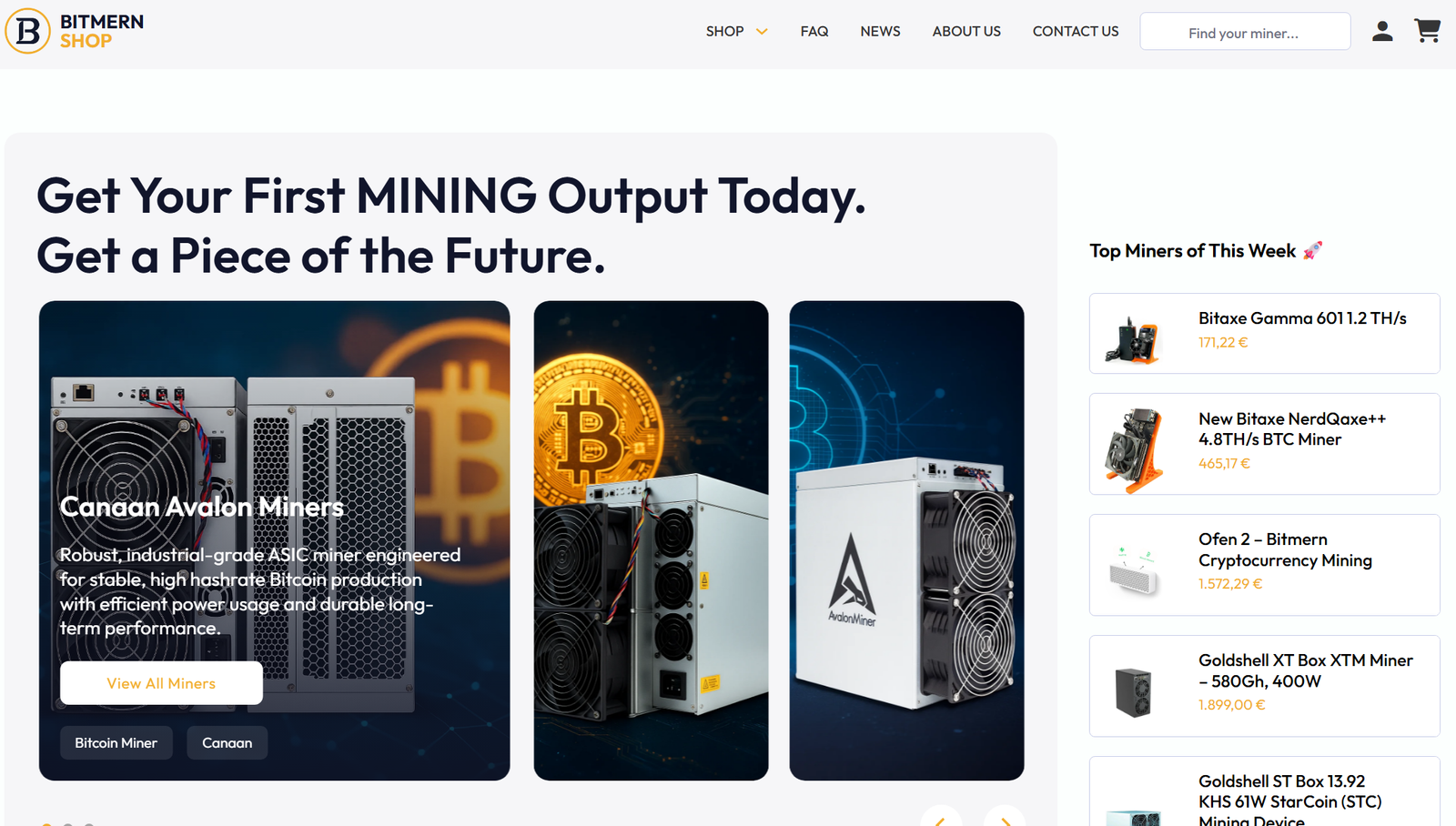

The Role of the Bitmern Shop in Infrastructure Competition

Hardware access still matters, but timing and deployment matter more.

The Bitmern Shop provides:

- verified, infrastructure-ready miners

- compatibility with professional hosting

- faster deployment cycles

This allows miners to compete at the infrastructure layer, not just at the hardware layer.

Explore available miners here: https://shop.bitmernmining.com/

Mining Is Becoming a Data Center Business

The line between mining facilities and data centers is disappearing.

Both industries now require:

- automation

- monitoring

- energy optimization

- professional operations

Bitcoin mining competes with data centers because it is becoming one.

Operators who fail to understand this will continue to lose ground, regardless of how efficient their ASICs are.

Bitmern Mining’s Infrastructure-First Model

Bitmern Mining is designed around the reality that mining competes with data centers.

This means:

- institutional-grade facilities

- geographic diversification

- energy-first site selection

- monitoring-driven operations

The goal is not to beat other miners.

The goal is to operate at the same level as the best data centers in the world.

Final Perspective: The Real Competition Is Invisible

Bitcoin mining does not lose because someone else bought more machines.

It loses when:

- power is misallocated

- infrastructure is undersized

- execution lags behind reality

Bitcoin mining competes with data centers because both industries fight over the same scarce resources. Those who understand this shift will survive the next decade. Those who don’t will keep wondering why mining feels harder every year.

Bitmern Mining exists for miners who understand that the future of mining is infrastructure, not hardware.