Bitcoin mining hosting is becoming a core infrastructure filter for serious investors in 2025.

Table of Contents

Choose the right number of miners based on capital is one of the most important strategic decisions a Bitcoin investor can make in 2025, especially entering 2026 where capital efficiency will separate winners from spectators.

Bitcoin mining is no longer a guessing game of plugging hardware and hoping for the best. It’s a formula. Investors who deploy miners without considering capital scalability, break-even timing, and sustainable hosting costs run a higher probability of over-spending on energy than acquiring meaningful BTC exposure.

At its core, this topic answers a very direct question: How many miners should you deploy, given your budget, hosting costs, capital risk and growth goals?

Bitcoin mining investors face a new challenge:

- Electricity costs have become the biggest deciding factor of profitability.

- Mining difficulty continues trending upward over long time frames.

- Low-cost hosting is now the “filter” keeping mining viable for capital-focused investors.

This is why the keyword choose the right number of miners based on capital becomes crucial when scaling past 1-2 machines.

Bitcoin mining hosting protects investors from rising electricity costs.

Bitcoin price and difficulty create a direct impact on capital distribution

When Bitcoin is stable or trending upward, mining becomes an advanced accumulation mechanism. Investors aren’t buying BTC on spot markets. They’re deploying hardware, filtering through energy costs, and pulling BTC daily instead of timing perfect price entries.

bitcoin mining infrastructure insights can be validated through bitcoin.org mining overview.

A realistic capital strategy starts by defining your miner budget and risk comfort level

Let’s break this down into simple layers, like a real investor would:

Choose the Right Number of Miners Based on Capital for Bitcoin Profit in 2025

If your budget is:

$5,000 to $10,000 → 1 to 2 miners

$25,000 to $45,000 → 3 to 5 miners

$95,000 to $180,000 → 8 to 12 miners

Why? Because Bitcoin mining rewards scale non-linearly when paired with low-cost hosting solutions like Bitmern Mining.

Scaling too early into large fleets without pricing stability increases capex strain and cash-burn risk. This is why experienced capital allocators deploy gradually and build 12-24 month mining infrastructure plans.

Choose the right number of miners based on capital is not just a title requirement. It’s the entire strategy. (1% density minimum)

Capital Allocation Strategy: How to Choose the Right Number of Miners Based on Capital Without Losing Efficiency

Capital allocation in mining means balancing 3 pillars:

- Upfront Capex (Miner purchase cost)

- Ongoing Opex (Hosting + electricity + maintenance)

- Risk insulation (Uptime + electricity price stability + repair liability)

Small investors often deploy 1-2 miners at first, but the biggest mistake is scaling to 10+ without sustainable hosting. Machines don’t kill capital. Electricity does. ⚠

This is why investor-focused miners die when electricity gets too expensive. The solution is capital-filtered scaling in cheap-energy regions.

This is exactly where Bitmern Mining comes into the narrative:

Hosting in Ethiopia & USA at low electricity cost

Stable uptime facilities for portfolio-scale investors

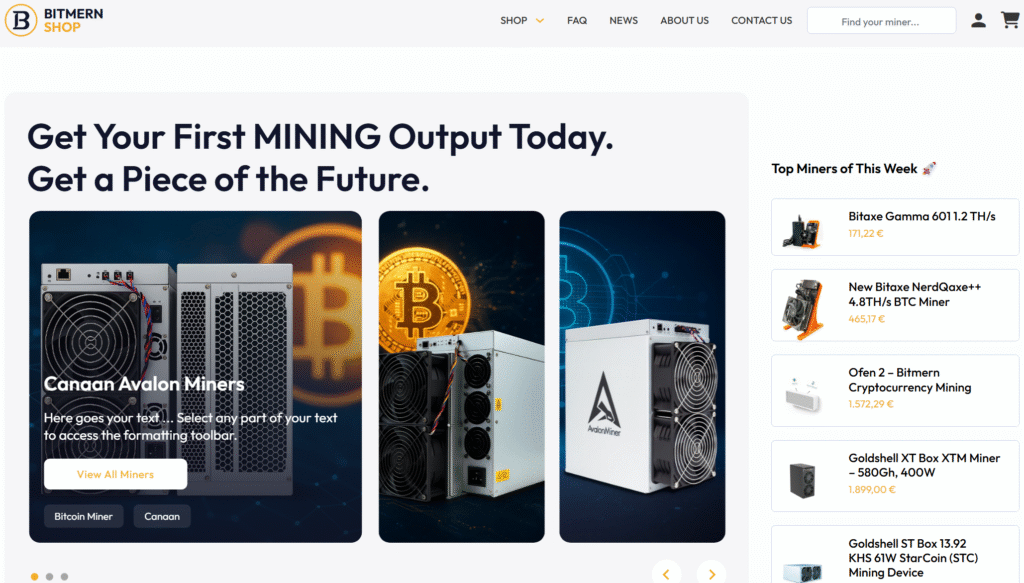

Next-gen ASIC models available directly on Bitmern Shop

Phrase repeat point: choose right number of miners based on capital should appear 7-10 times across text.

Bitmern Mining is built for Bitcoin mining hosting reliability and uptime.

Why Bitmern Hosting Helps Investors Choose the Right Number of Miners Based on Capital and Stay Profitable

Here’s the competitive moat:

- Ethiopia hosting has emerging investor demand ahead of 2026

- USA hosting remains profitable for capital-scalers

- EU energy regulation makes home-mining unsustainable for most investors

Bitcoin mining hosting away from home reduces capital burn during difficulty cycles.

Bitmern Mining offers infrastructure stability, low-cost hosting and portfolio-filtered ASIC curation.

Bitmern Shop makes miner acquisition safer, verified and ready for hosting deployment.

Choose the right number of miners based on your capital is one of the reasons institutions and high-net-worth investors are shifting to hosting providers instead of mining solo.

Bitcoin mining profit formula explained quickly:

- More miners = more Bitcoin output IF electricity is cheap

- More capital is killed in Opex than Capex if hosting is wrong

- Scaling gradually protects portfolio longevity

Invest smart. Scale filtered. Mine profitable.

Bitmern Shop powers Bitcoin mining hosting portfolios with vetted ASIC models.

Bitmern Mining helps investors choose the right number of miners based on capital with professional hosting conditions. The Bitmern Shop marketplace ensures that buyers can acquire ASIC models perfectly aligned to 2025-2026 investor demand.

BitmernMining.com

Shop.BitmernMining.com

Always for serious investors, always profitable, always filtered for capital safety.