Table of Contents

If you are evaluating Bitcoin mining as an investment, the mistake most people make is treating mining like a simple hashrate-to-profit equation. In reality, mining performance is dominated by operational variables: uptime, electricity pricing, facility stability, fees, and how difficulty and the halving reshape the payout curve over time.

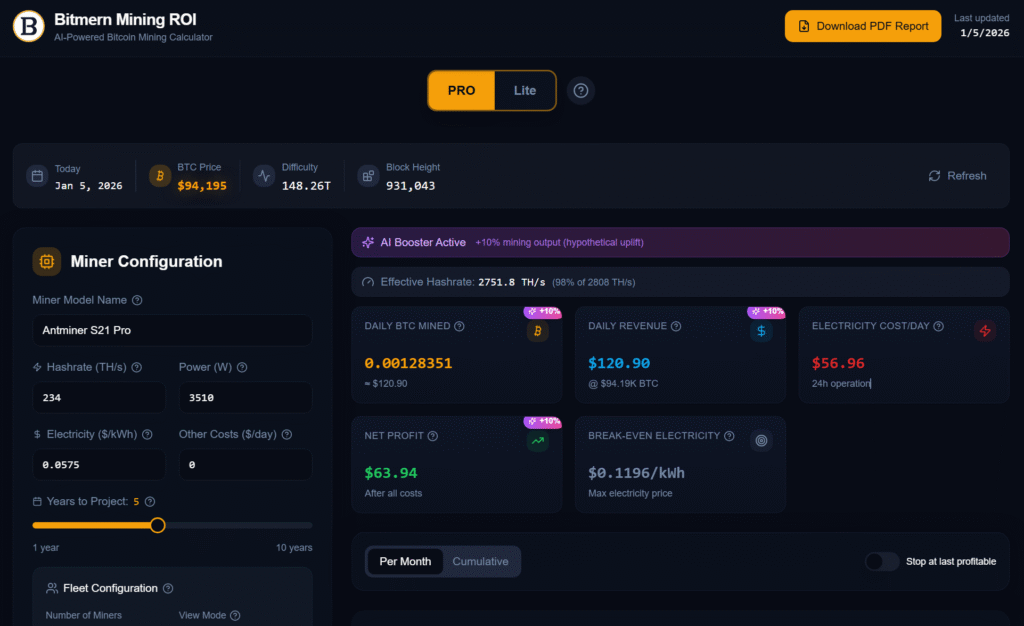

That is exactly why Bitmern Mining built the bitcoin mining ROI calculator at calculator.bitmernmining.com. Instead of giving you a single “profit number,” it lets you model a mining position the way real operations behave: with power draw, electricity cost per kWh, uptime assumptions, projections across years, and a halving-aware timeline. You can then export the output into a PDF report or CSV projections for deeper analysis.

This article explains what the calculator does, what makes it different from most ROI tools, and how to use it to make cleaner decisions, whether you are buying one miner or building a serious fleet.

Why most ROI calculators mislead buyers

Most public mining calculators look precise, but they often hide the variables that actually decide your outcome:

- They assume 100% uptime, which is not how mining works in the real world.

- They do not model operational fees and the true structure of hosting costs.

- They ignore the fact that profitability is not “flat.” It changes as difficulty changes and as halvings reduce block rewards.

- They do not make it easy to compare scenarios side-by-side over time.

If you are planning to buy hardware, the goal is not to find the best case. The goal is to understand what happens under realistic conditions. A calculator should help you stress-test your plan, not sell you a dream.

What the Bitmern Mining ROI Calculator includes

The Bitmern Mining ROI Calculator is built around practical inputs that matter in day-to-day mining:

1) Miner configuration you can actually control

You can select a miner model (for example, Antminer S21 Pro) and work with real operating assumptions like:

- Hashrate (TH/s)

- Power draw (W)

- Electricity price ($/kWh)

- Other daily costs (fixed operational overhead)

- Uptime percentage, so you stop assuming perfect production

2) Market context you cannot control, but must model

The dashboard reflects current network context such as BTC price, network difficulty, and block height. That matters because ROI is not only about your machine. It is about the payout curve you are buying into.

3) Revenue and cost outputs that are decision-grade

Instead of one headline number, you get a structured snapshot:

- Daily BTC mined (estimate)

- Daily revenue (estimate)

- Electricity cost per day (based on your kWh input and power draw)

- Net profit (after costs)

- Break-even electricity rate, which is one of the most useful “sanity check” metrics for investors

4) Long-term projections with halving awareness

The calculator includes a Halving Schedule panel and shows the current block reward and the next halving milestone on the timeline. This is crucial because mining is a long-duration cash-flow strategy, and halvings change the shape of returns.

5) Reporting and exports

The interface supports exporting your modeling into formats you can share internally or compare across scenarios, including PDF reporting and CSV exports.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

How to use the calculator properly (step-by-step)

Here is a clean process that avoids the common “calculator trap” where people only test optimistic assumptions.

Step 1: Start with the miner you can actually source

If you plan to buy, do not model hypothetical gear you cannot acquire in volume. Pick the hardware that you can secure from a trusted provider.

If your goal is efficient scaling, you should also consider purchasing hardware through the Bitmern Shop at https://shop.bitmernmining.com/, where the focus is on verified miners and clean procurement rather than grey-market uncertainty.

Step 2: Set electricity price as a real number, not a wish

Electricity is the largest ongoing cost in mining. If you are self-hosting, use the actual all-in rate you can lock in. If you are hosting, use your contracted electricity structure and include any facility-level discounts.

The calculator’s break-even electricity metric helps you understand how sensitive your plan is to energy variance.

Step 3: Put uptime where it belongs: in the model

Uptime is not a vanity metric. It is directly correlated with realized revenue.

A small change in uptime has a large effect on annual output. Many investors underestimate this and then wonder why “the calculator was wrong.” The calculator was not wrong. The assumption was wrong.

Step 4: Model one miner first, then scale

Start with one unit and check the cash-flow profile. Then move to fleet configuration and scale the number of miners.

This prevents a classic scaling error: buying too many units before you know if your operational assumptions hold in practice.

Step 5: Use the projection timeline to identify your risk window

Mining returns are not evenly distributed. Difficulty shifts, halving cycles, and cost structures create “risk windows” where operations must be resilient.

The projection chart and monthly table help you see when a strategy becomes fragile and what inputs would protect it.

Why this calculator is especially useful for hosted mining decisions

Mining is increasingly operational. Investors who do well are usually the ones who remove preventable operational failure points:

- unstable power delivery

- poor cooling design

- inconsistent maintenance

- weak monitoring

- slow response to faults

- unclear fee structures

This is where Bitmern’s model is designed to reduce investor friction: professional hosting plus operational support, and a clear purchase path through the Bitmern Shop.

If you want to buy miners and then decide between self-hosting or hosted deployment, the calculator helps you quantify the difference instead of guessing.

What this calculator does not promise (and why that is good)

A serious ROI tool should not pretend it can predict the future perfectly. Any output depends on:

- BTC price changes

- network difficulty changes

- realized uptime versus planned uptime

- fee structure and operational execution

The strength of the Bitmern Mining ROI Calculator is that it makes the operational assumptions explicit. That is the difference between “marketing math” and decision math.

Final takeaway: mining ROI is operational, and this calculator reflects that

Bitcoin mining is a cash-flow strategy built on execution. Hardware efficiency helps, but it does not replace uptime, stable power, and proper operations. If you want a realistic view of mining profitability, you need a calculator that models mining the way mining actually behaves.

The bitcoin mining ROI calculator from Bitmern Mining was built for exactly that purpose: to help investors model profitability using real operational variables, understand the halving-aware timeline, and export projections for planning and comparison.

To explore the calculator, visit:

https://calculator.bitmernmining.com/

To source verified miners and explore purchase options, visit the Bitmern Shop:

https://shop.bitmernmining.com/

And for full hosting and infrastructure support, visit:

https://bitmernmining.com/