Table of Contents

Bitcoin network fees miner revenue is becoming one of the most important profitability variables for miners entering the next cycle.

Why Bitcoin Network Fees Matter More Than Ever

Bitcoin mining revenue is undergoing a structural shift. For most of Bitcoin’s history, miners relied primarily on block subsidies. Fixed rewards, predictable issuance, and a simple equation: more hashrate meant more Bitcoin. That model is changing.

Bitcoin network fees and miner revenue are becoming increasingly interconnected, and the next cycle will accelerate that trend. As block rewards continue to decline through halvings, transaction fees are no longer a secondary variable. They are becoming a core revenue driver.

This transition is not theoretical. It is already visible in on-chain data, miner balance sheets, and infrastructure decisions. The miners who understand this shift will survive and compound. Those who ignore it will struggle regardless of hardware efficiency.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

How Bitcoin Network Fees Fit Into Miner Revenue

Every Bitcoin block contains two revenue streams:

- The block subsidy

- Transaction fees paid by users

Historically, the subsidy dominated. Fees were variable and often negligible during low-congestion periods. That balance is changing.

As issuance declines, bitcoin network fees and miner revenue begin to converge. Fees are no longer “extra.” They increasingly determine whether a mining operation remains profitable during periods of price stagnation or difficulty expansion.

Why the Next Cycle Will Be Different

Several forces are aligning simultaneously:

- Reduced block rewards post-halving

- Increased on-chain activity during market expansions

- Growing use of Bitcoin for settlement, inscriptions, and alternative transaction types

- More competition for block space

These factors create fee spikes that materially impact miner income. In previous cycles, fee revenue was episodic. In the next cycle, it is expected to be structural.

Bitcoin Network Fees and Miner Revenue During Congestion

When network demand increases, users compete for block inclusion. This competition manifests as higher fees. Miners with stable uptime and consistent block participation capture this upside.

This is a critical point: fee revenue favors operational reliability over raw hashrate. A miner that is offline during congestion captures nothing. A miner with lower hashrate but near-perfect uptime captures consistent fee income.

This reality is reshaping how professional miners evaluate hosting partners, power stability, and geographic diversification.

The Declining Role of Subsidy, The Rising Role of Fees

Bitcoin’s monetary policy is immutable. Block subsidies will continue to decline. This is not a risk. It is a design feature.

What changes is how miners adapt.

In the next cycle:

- Fee volatility will increase

- Average fee contribution per block will trend higher

- Revenue smoothing will depend on infrastructure quality, not luck

This makes bitcoin network fees and miner revenue forecasting a core competency rather than an afterthought.

Why Fee Sensitivity Rewards Professional Infrastructure

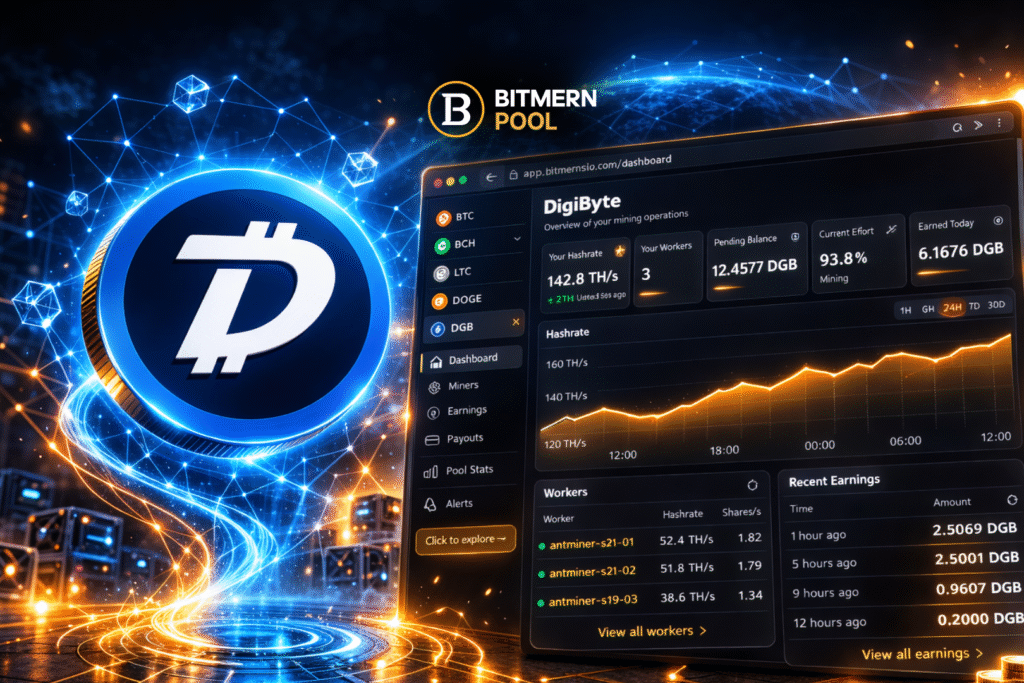

Capturing fee-driven revenue requires:

- High uptime

- Low latency pool connectivity

- Stable power delivery

- Thermal resilience under peak load

This is where infrastructure-first mining models outperform hobby or fragmented setups.

Bitmern Mining operates facilities designed for exactly this environment. Stable power, optimized cooling, and geographically diversified hosting allow miners to remain online when network conditions matter most.

Fee Volatility and Risk Management

Transaction fees are inherently volatile. They spike during congestion and compress during quiet periods. This volatility introduces revenue risk for miners who are overleveraged or operationally fragile.

Professional miners manage this risk by:

- Maintaining strong uptime metrics

- Avoiding over-deployment of capital

- Structuring hosting contracts with predictable costs

- Using realistic revenue assumptions rather than peak scenarios

Bitmern Mining emphasizes long-term revenue stability over short-term optimization. This approach aligns with a future where fee income is uneven but decisive.

Bitcoin Network Fees and Miner Revenue After the Halving

Post-halving environments historically pressure inefficient miners. In the next cycle, the pressure will be sharper. Fees will determine which miners can bridge periods of reduced subsidy.

Those mining with:

- High downtime

- Unstable hosting

- Aggressive leverage

will find fee income insufficient to offset structural weaknesses.

Those operating within robust infrastructure environments will use fee spikes to smooth revenue and extend operational runway.

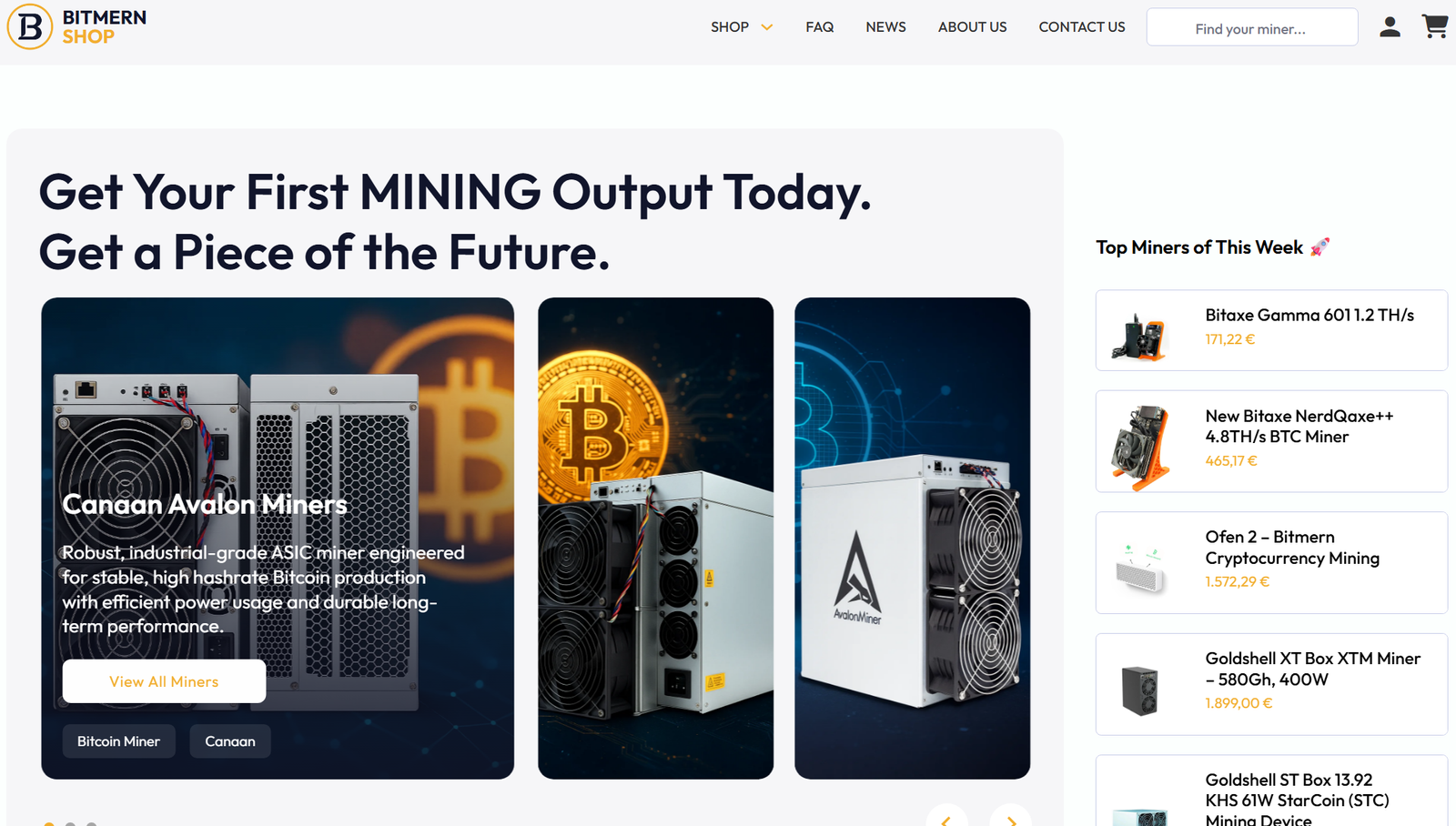

The Role of the Bitmern Shop in Fee-Driven Mining

Hardware selection matters more in a fee-dominated revenue environment. Not because of peak hashrate, but because of reliability under load.

The Bitmern Shop focuses on:

- Verified, proven ASIC models

- Hardware optimized for continuous operation

- Equipment suited for professional hosting environments

Miners who source hardware through shop.bitmernmining.com reduce exposure to failure during periods when fee revenue is most valuable.

Why This Shift Favors Long-Term Miners

Bitcoin mining is evolving from a simple production race into an infrastructure-driven cash-flow business.

As bitcoin network fees and miner revenue converge, success depends less on timing and more on execution. The miners who survive the next cycle will not be those chasing short-term efficiency metrics. They will be those who:

- Stay online

- Control operational risk

- Build for volatility

This is the philosophy behind Bitmern Mining’s infrastructure-first approach.

Preparing for the Next Cycle With Bitmern Mining

The next cycle will reward discipline, not speed. Transaction fees will amplify both competence and mistakes.

Bitmern Mining supports miners through:

- Institutional-grade hosting

- Low-cost, stable energy

- High uptime operations

- Scalable infrastructure

- Access to verified hardware through the Bitmern Shop

In a future where fees increasingly define revenue, infrastructure is no longer optional. It is decisive.

Fees Are No Longer Optional Revenue

Bitcoin’s design is working as intended. Subsidies decline. Fees rise. Miners adapt or exit.

Bitcoin network fees and miner revenue will shape the next mining cycle more than any single hardware upgrade. The miners who understand this today will still be mining tomorrow.

Bitmern Mining is built for that future.