Bitcoin price outlook 2025 mining profits is becoming an important focus for miners and investors as the new cycle begins..

The connection between Bitcoin’s price trajectory and the profitability of ASIC machines is stronger than ever, and 2025 is setting up to be a decisive year. With macro trends shifting, supply tightening, and global hosting costs changing, miners need clear data to understand how revenue may evolve.

Below is a realistic, research-based breakdown of how Bitcoin’s price outlook affects mining profitability and how hosting with Bitmern Mining remains one of the most efficient ways to secure long-term returns.

Table of Contents

1. Bitcoin Price Outlook 2025 Mining Profits: Market Overview

Most analysts agree that Bitcoin’s 2025 price trajectory will be driven by four primary factors: liquidity returning to markets, ETF flows, post-halving scarcity, and institutional accumulation. Historical data shows that when Bitcoin stabilizes or moves higher, bitcoin price outlook 2025 mining profits improves almost immediately, because miner revenue is directly tied to BTC output multiplied by market price.

This is why bitcoin price outlook 2025 mining profits is closely tied to market liquidity.

Even during sideways markets, miners with efficient hosting still generate competitive returns, provided their electricity costs remain low and predictable.

For a neutral reference on how the mining process works, you can review the technical overview here:

https://bitcoin.org/en/mining

2. Why Bitcoin Price Matters More Than Ever for Miners

In 2025, the sensitivity between Bitcoin price movements and mining revenue is at its strongest point in history. Post-halving block rewards are leaner, meaning USD-denominated profits depend disproportionately on BTC’s market price.

When price levels rise, bitcoin price outlook 2025 mining profits increases sharply.

When price levels fall, only miners with low hosting cost survive comfortably.

High electricity regions (EU, parts of Asia) are already seeing many miners unplug, proving once again that the price environment rewards efficiency rather than scale alone.

3. Mining Difficulty vs Price: The Profit Equation

Mining difficulty reached record highs entering 2025, driven by new ASIC deployments and hosting expansions worldwide. This means miners must focus on the balance between rising difficulty and Bitcoin’s price outlook.

Historical data shows that bitcoin price outlook 2025 mining profits improve as the market recovers.

If Bitcoin trends upward, difficulty becomes manageable and bitcoin price outlook 2025 mining profits stay positive even for mid-range setups.

If Bitcoin stagnates, only miners operating in low-cost zones retain strong margins.

This equation is why location matters more than ever.

4. Hosting Costs and How They Influence BTC Earnings

Electricity pricing is the number one component that defines bitcoin price outlook 2025 mining profits.

A miner paying 4–6 cents/kWh has a completely different outlook than one paying 15–20 cents.

For many miners, bitcoin price outlook 2025 mining profits depends on electricity stability and hosting location.

This is precisely why investors increasingly shift to hosting partners instead of home mining.

Hosting in low-cost countries dramatically widens the profit margin, especially in a year where BTC price movements will be unpredictable.

5. Why Stable Infrastructure Matters for 2025 Miners

Miners in unstable hosting environments (frequent outages, variable tariffs, limited cooling) will experience severe volatility in their profits. On the other hand, stable facilities with constant uptime preserve consistent BTC output.

Many analysts believe that bitcoin price outlook 2025 mining profits will favor low-cost hosting companies.

For this reason, bitcoin price outlook 2025 mining profits is not only about the market price but also about the infrastructure supporting your machines.

6. Bitmern Mining: Infrastructure Built for Profit Stability

Bitmern Mining offers hosting options built for one purpose:

keeping miners online with predictable costs and zero-surprise electricity pricing.

Here’s why many investors choose Bitmern Mining:

- Ethiopia hosting offers extremely competitive energy rates

- USA hosting provides regulatory stability and predictability

- 24/7 technical maintenance included

- Cooling, setup, repairs, and monitoring handled entirely by the Bitmern team

- 20% fee on net profit, ensuring aligned incentives

Bitmern Mining offers infrastructure optimized for bitcoin price outlook 2025 mining profits through efficiency and uptime.

This makes bitcoin price outlook 2025 mining profits significantly stronger, because uptime and cost structure remain stable regardless of market conditions.

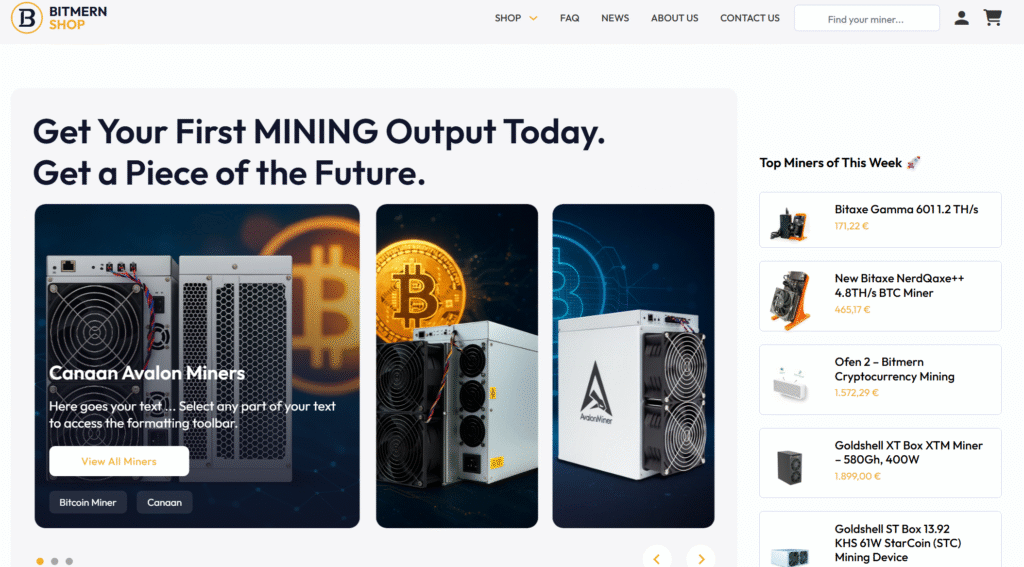

7. ASIC Hardware for 2025 ROI – Bitmern Shop

To maximize returns, miners need efficient hardware capable of competing with rising difficulty.

The Bitmern Shop offers:

- Latest-generation ASIC miners

- Up to 260 TH/s performance for top-tier models

- Competitive pricing

- Direct support for hosting installation

Accessing modern equipment significantly improves bitcoin price outlook 2025 mining profits, especially when combined with low-cost hosting.

Visit: https://shop.bitmernmining.com

Conclusion

The bitcoin price outlook 2025 mining profits dynamic is clear:

miners who combine modern ASIC hardware with stable, low-cost hosting are positioned to outperform the market.

Bitmern Mining and Bitmern Shop deliver both making 2025 a strong year for investors focused on smart, infrastructure-driven Bitcoin accumulation.