Bitmern Mining is part of a new generation of infrastructure-driven mining companies that are transforming how serious investors approach Bitcoin mining.

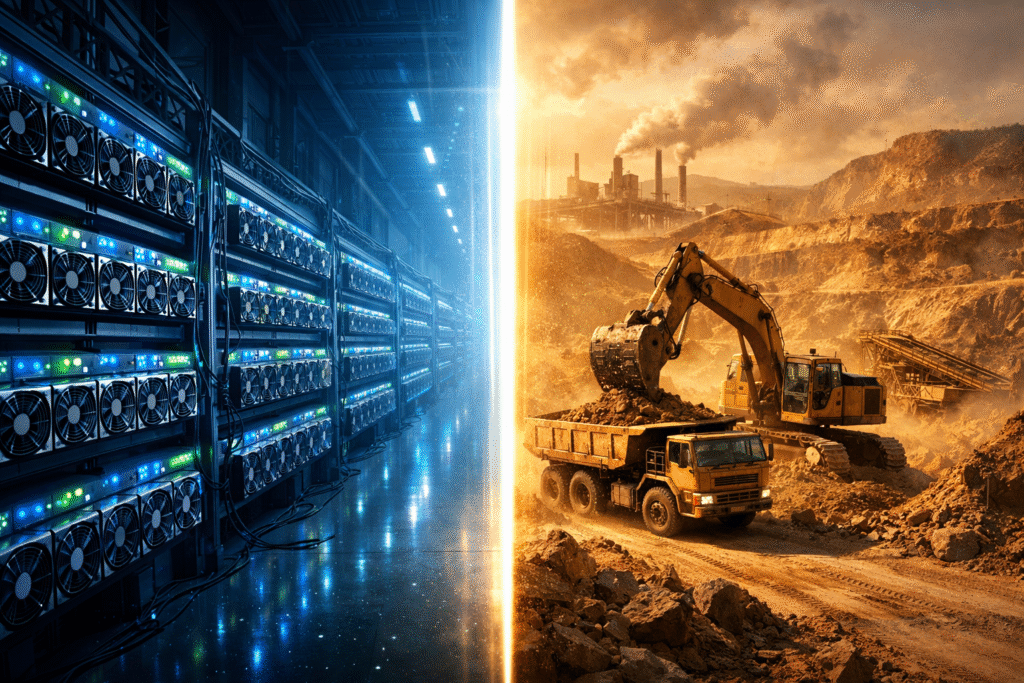

Bitcoin mining is not a hobby market any more. The days of a few home rigs in a spare room are fading. Serious investors who look at mining today are thinking in megawatts, infrastructure and structured finance, not in single machines.

That is exactly where Bitmern Mining is positioning itself.

With Bitcoin mining hosting facilities in Indiana, North Dakota and internationally in Ethiopia, and a new joint venture that starts with a 100 megawatt pilot and is designed to scale to 500 megawatts, Bitmern is moving into the space of industrial scale, finance backed mining infrastructure.

For investors, this matters for three reasons:

- It connects mining returns to a real energy and infrastructure story.

- It uses a project finance model with a clear capital structure.

- It is built on top of existing expertise in hosting, operations and proprietary technology rather than on theory.

This article explains why the 100 MW joint venture with OriginClear’s OriginSpark venture is a genuine turning point for investors who want professional exposure to Bitcoin mining, and how Bitmern Mining is building the tools and services to support that growth, from hosting facilities to its dedicated shop.

From simple hosting to infrastructure partner

Many companies in the mining space still act like basic service providers. They rent racks, plug in ASICs and pass on an electricity bill. The structure is often opaque and heavily marketing driven.

Bitmern Mining has chosen a different approach. It focuses on international Bitcoin mining hosting and infrastructure, with a clear footprint in the United States and Ethiopia and a strategy that is built around long term operations and technology.

According to the joint venture announcement and Bitmern’s own public material, the company:

- Operates Bitcoin mining hosting facilities in Indiana and North Dakota, two regions with established energy infrastructure in the United States.

- Operates internationally in Ethiopia, an emerging hub for Bitcoin mining that is tapping into surplus hydropower.

- Has developed proprietary technologies such as the Bitmern SuperApp and custom firmware for better control, transparency and performance.

For an investor, this means Bitmern is not just selling space in a container. It is combining locations, technology and operations into something that looks much more like an energy and data business.

For investors looking for large-scale, institution-grade hosting solutions, Bitmern Mining has already built the operational foundation needed to support megawatt-level expansion.

The 100 MW pilot and the path to 500 MW

The core of the new story is the joint venture between Bitmern Investments and OriginClear’s OriginSpark venture.

According to the Nasdaq press release and related coverage, the agreement:

- Starts with a planned 100 megawatt pilot project.

- Includes a path to scale up to 500 megawatts of capacity over time.

- Evaluates additional sites in Arizona and Texas, on top of Bitmern’s existing presence in Indiana, North Dakota and Ethiopia.

OriginSpark is creating a project financing model designed to deliver preferred returns and a five year capital exit for investors. Part of that model includes a planned Bitcoin treasury that allows unrealised gains to continue compounding, with the option for investors to borrow against their Bitcoin holdings if they want liquidity while keeping exposure.

This combination is important for serious capital:

- There is a clear capacity plan, from 100 MW to 500 MW.

- There is a defined financial framework, not just “we will mine and see what happens”.

- There is a specific joint venture between an infrastructure operator and a firm that specialises in project finance.

In other words, it is not just about hashrate. It is about an organised structure that professional investors can underwrite.

Why megawatt scale changes the conversation

At small scales, mining is exposed to every shock. A single site with a few megawatts can suffer from local power issues, volatile pricing and hardware cycles. At 100 MW and above, the economics start to feel very different.

Large scale capacity changes several things:

- It improves negotiation power on energy contracts and grid connections.

- It allows for better hardware pricing through bulk purchases of modern ASICs.

- It supports investment in cooling, monitoring and optimisation programs that only make sense at industrial scale.

For investors, this translates into a more resilient operation. A large, professionally financed facility is better positioned to handle difficulty adjustments, halving events and temporary price drawdowns than small, fragmented farms.

The fact that the joint venture aims to build sustainable facilities in the United States, with eventual integration of AI and data centre solutions for additional efficiency and environmental impact, adds another strategic angle that many institutional investors are now actively looking for.

Location, regulation and diversification

Bitmern’s footprint is a key part of the investment case.

The joint venture press release confirms that Bitmern Mining operates hosting facilities in Indiana and North Dakota, while also hosting internationally in Ethiopia.

This mix provides a useful balance:

- United States locations offer a clear regulatory framework, strong energy infrastructure and a growing interest from institutional capital in digital assets and related infrastructure.

- Ethiopia offers access to competitive hydropower and is emerging as a strategic destination for miners who want renewable energy and geographic diversification.

Operating in more than one jurisdiction reduces the risk that a single policy change or energy market shift will disrupt the entire operation. For investors, this is exactly the kind of structural risk management that is hard to achieve with a small private farm.

Technology, transparency and the Bitmern Mining App

This is one of the reasons many investors see Bitmern Mining as a transparent, operationally mature hosting partner rather than a short-term mining service.

Industrial capacity is one side of the equation. The other side is how much visibility the investor has on the underlying operations.

Bitmern has developed its own Bitmern SuperApp and supporting software, and it also offers a dedicated Bitmern Mining mobile app that acts as a command centre for clients.

According to the app descriptions, the Bitmern Mining app allows users to:

- Monitor miner status in real time, including hashrate, uptime and performance metrics.

- Track mining operations across multiple locations from a single dashboard.

- View billing information and manage payments conveniently.

This is not a cosmetic feature. For an investor, real visibility on machines, efficiency and payouts is a direct risk control mechanism. It helps close the gap between the financial structure at the joint venture level and the actual hardware that is producing Bitcoin.

Public posts and communication from Bitmern and its founders reinforce this focus on operational transparency, sustainability and regulatory compliance in both the joint venture and the core hosting business.

Efficient hardware and why it matters for returns

Bitmern Mining highlights this through its focus on efficient, next-generation ASICs that can remain profitable even as network difficulty grows.

In a modern mining environment, hardware efficiency can make or break the economics of a project. Older, inefficient machines consume more energy for the same hashrate and are the first to become unprofitable when difficulty rises or price weakens.

Bitmern’s own educational content makes this point very clearly. In its article on mining efficiency, the company highlights miners such as the Bitmain S21 Pro, Avalon A15 and Auradine AT2880 and explains how the ratio of watts per terahash (W/TH) directly impacts long term profitability.

The Auradine Teraflux AT2880, for example, is an air cooled miner that can reach up to around 260 terahash per second with an optimal efficiency near 16 joules per terahash, in a wide operating temperature range.

By focusing hosting capacity on modern, efficient ASICs and backing that with firmware optimisation and operational expertise, Bitmern is aligning the fleet with the realities of the next mining cycle. That alignment matters directly for investors because it extends the economic lifespan of the hardware portfolio.

How the Bitmern Shop fits into the picture

For many investors and high net worth individuals, the first step into mining is not a 100 MW joint venture, but the decision to acquire their own ASICs and place them with a trusted host.

This is where the Bitmern Shop comes in.

The shop positions itself as a gateway for clients who want to turn Bitcoin mining into reliable monthly income through a combination of high quality miners, hosting in Bitmern’s facilities and support through the Bitmern Mining app.

On the shop platform, investors can:

- Purchase modern, efficient Bitcoin miners that are suitable for industrial hosting.

- Combine hardware acquisition with hosting solutions in the same Bitmern infrastructure that underpins the larger joint venture strategy.

For serious investors, this creates a unified path:

- Start with a smaller allocation through miners purchased on the Bitmern Shop and hosted in existing facilities.

- Gain familiarity with the Bitmern Mining app, reporting and operational style.

- Scale up over time into larger structured opportunities such as the 100 MW joint venture.

Every article and campaign about Bitmern’s growth should therefore point clearly to the shop as the practical next step for readers who are ready to move from theory to action:

If you are considering an allocation to Bitcoin mining, the most direct way to start is through the official Bitmern Shop at shop.bitmernmining.com, where you can select modern ASICs and pair them with hosting inside Bitmern’s global infrastructure.

For long-term investors, Bitmern Mining offers a scalable and transparent entry point into industrial Bitcoin mining, combining proven energy strategy with reliable infrastructure under one ecosystem.