What Are Capital Gains on Crypto?

Capital gains on crypto refer to the profit made when you sell or exchange cryptocurrency for more than you initially paid for it. Just like stocks or real estate, crypto assets are considered property for tax purposes. That means whenever you dispose of crypto—whether through selling, trading, or even using it to buy goods—you are potentially realizing a taxable capital gain. Understanding capital gains on crypto is critical for keeping more of your hard-earned profits and avoiding unexpected tax bills.

How Are Capital Gains on Crypto Calculated?

Calculating capital gains on crypto is straightforward once you know the formula. You simply subtract the cost basis (what you paid for the asset) from the sale price (what you sold it for). If the result is positive, you have a capital gain; if negative, you have a capital loss. Here’s a basic breakdown:

| Transaction | Cost Basis | Sale Price | Capital Gain/Loss |

|---|---|---|---|

| Bought Bitcoin for $10,000, sold for $15,000 | $10,000 | $15,000 | $5,000 gain |

| Bought Ethereum for $3,000, sold for $2,500 | $3,000 | $2,500 | $500 loss |

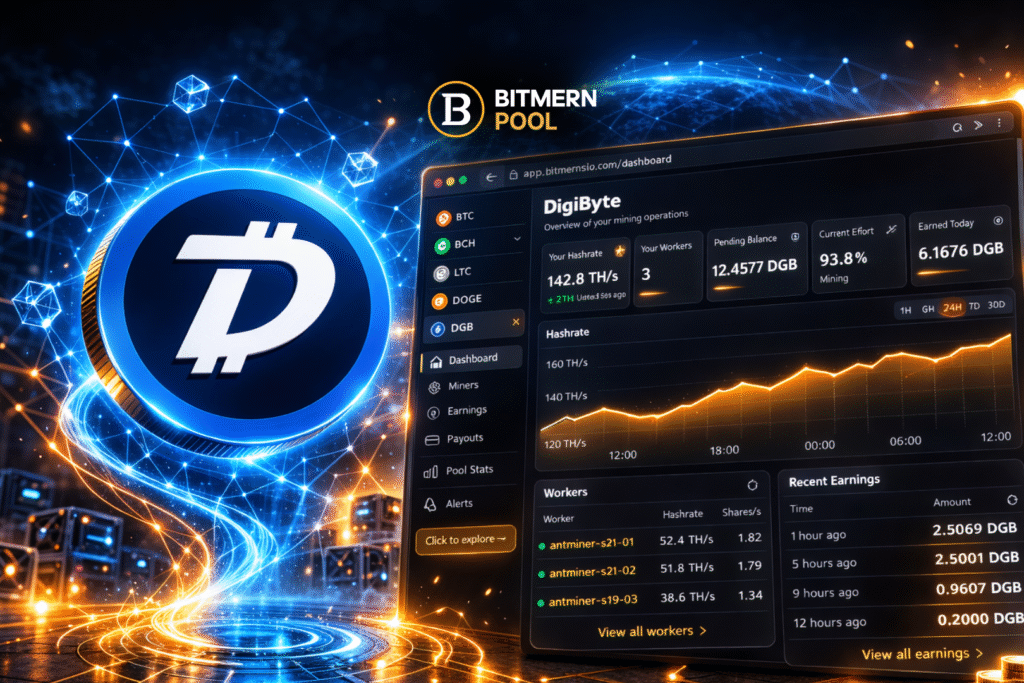

Accurately tracking each transaction is crucial. Platforms like Bitmern Mining help investors manage crypto portfolios from acquisition through mining or purchasing, making it easier to track gains.

What Activities Trigger Capital Gains on Crypto?

Many types of activities can trigger capital gains on crypto. Here are the most common:

- Selling crypto for fiat currency like USD

- Trading one cryptocurrency for another

- Spending crypto on goods or services

- Receiving crypto from mining, then later selling it

Mining rewards, such as those earned from personal mining farms, are initially treated as ordinary income, but when the mined crypto is sold, it triggers a separate capital gain or loss event.

What’s the Difference Between Short-Term and Long-Term Capital Gains?

When discussing capital gains on crypto, it’s important to differentiate between short-term and long-term gains:

- Short-Term Gains: Crypto held for less than 12 months before selling is taxed at your regular income tax rate.

- Long-Term Gains: Crypto held for more than 12 months qualifies for favorable long-term capital gains tax rates, which are usually much lower.

This distinction can have a big impact on how much tax you pay and is one reason why many investors prefer to hold crypto longer.

How Can You Reduce Capital Gains on Crypto?

Reducing your capital gains on crypto legally requires strategic planning. Here are a few methods:

- Hold crypto longer than a year to qualify for long-term rates.

- Offset gains with losses through tax-loss harvesting.

- Use specific identification methods to sell higher-cost basis coins first.

- Invest through tax-advantaged accounts if available in your jurisdiction.

Seeking expert advice through services like strategic mining consultations can help you structure your crypto strategy for maximum tax efficiency.

How Does Mining Impact Capital Gains?

Mining introduces a two-phase tax obligation. First, when crypto is mined, its fair market value at the time is taxed as ordinary income. Later, when you sell the mined crypto, you realize capital gains or losses based on the difference between the sale price and the original fair market value. This makes precise record-keeping essential for miners. Using professional mining solutions like mining infrastructure management helps miners track earnings and future gains accurately.

Are Airdrops and Forks Subject to Capital Gains?

Yes, airdrops and forks can affect your capital gains on crypto. When you receive new coins from an airdrop or hard fork, they are typically taxed as ordinary income based on their fair market value when received. If you later sell these coins, you must also calculate a capital gain or loss based on any appreciation or depreciation since the time of receipt. This dual layer of taxation makes it essential to keep careful records of all airdrop and fork events.

How Do You Report Capital Gains on Crypto to the IRS?

Reporting capital gains on crypto to the IRS involves filling out specific tax forms:

- Form 8949: Report each crypto transaction, including acquisition date, sale date, cost basis, and proceeds.

- Schedule D (Form 1040): Summarize your total capital gains and losses.

- Schedule 1 (Form 1040): Report any additional income from mining or staking.

If you’ve been mining crypto using equipment purchased through Bitmern Mining Shop, be sure to include both the mining income and subsequent capital gains when you sell the mined coins.

What Happens If You Don’t Report Capital Gains on Crypto?

Failing to report capital gains on crypto can lead to serious consequences, including:

- Fines and penalties for underreporting income

- Interest charges on unpaid tax amounts

- Potential audits targeting your financial activities

- Criminal charges in extreme cases of fraud or tax evasion

Tax authorities like the IRS have increased their scrutiny of crypto transactions, including working with exchanges to track user activity. Staying proactive is critical to protecting your wealth.

How Will Future Regulations Affect Capital Gains on Crypto?

As governments work to regulate cryptocurrency more tightly, expect changes in how capital gains on crypto are taxed and reported. More detailed reporting requirements, potential automatic data sharing by exchanges, and refined classification of different crypto activities are all likely. According to Wikipedia, global trends show increasing regulation aimed at ensuring crypto investors fulfill tax obligations. Staying informed and adapting early will help investors maximize profits and avoid regulatory pitfalls.