Table of Contents

The Difference Between Downtime Risk and Revenue Risk Explained

In Bitcoin mining, the word “risk” is often used loosely. Most operators think risk means machines going offline. In reality, downtime is only one visible symptom. The real threat to mining profitability is revenue risk, and the two are not the same.

Downtime risk refers to periods when hardware is not hashing. Revenue risk refers to situations where miners are technically online, yet underperforming, losing efficiency, or producing below expectations. The most successful mining operations design their infrastructure to minimize revenue risk first, not just avoid downtime.

This distinction is critical for anyone scaling mining operations professionally.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Downtime Risk: The Visible Problem Everyone Watches

Downtime risk is the easiest risk to measure. When machines are offline, hashrate drops to zero. The losses are immediate and obvious.

Downtime usually comes from:

- Power outages

- Network failures

- Cooling system breakdowns

- Hardware faults

- Human error during maintenance

Because downtime is binary (online or offline), it gets most of the attention. Dashboards flash red, alerts fire, and operators react quickly.

But here’s the problem: avoiding downtime alone does not guarantee profitability.

Revenue Risk: The Silent Profit Killer

Revenue risk exists even when machines are running.

This includes:

- Throttled hashrate due to thermal stress

- Inefficient firmware configurations

- Voltage instability reducing ASIC performance

- Suboptimal pool routing

- Latency and stale share issues

- Poor power quality impacting efficiency

A miner can show “online” status while producing 5–15% less BTC than expected. Over time, this compounds into massive hidden losses.

This is why revenue risk is far more dangerous than downtime risk. It often goes unnoticed until profitability is already damaged.

Why Downtime Risk Is Easier to Fix Than Revenue Risk

Downtime is reactive. When it happens, the response is straightforward: restore power, fix hardware, reboot systems.

Revenue risk is systemic. It requires:

- Continuous monitoring

- Infrastructure-level optimization

- Preventive maintenance

- Firmware and efficiency tuning

- Experienced operational oversight

Many miners solve downtime issues but never realize they are still bleeding revenue every day.

The Infrastructure Layer Where Revenue Risk Lives

Revenue risk is deeply tied to infrastructure quality.

Key factors include:

- Power stability and voltage consistency

- Cooling design and airflow management

- Rack density and heat dispersion

- Cable quality and electrical layout

- Environmental conditions

Professional facilities treat infrastructure as a profit lever, not a background cost.

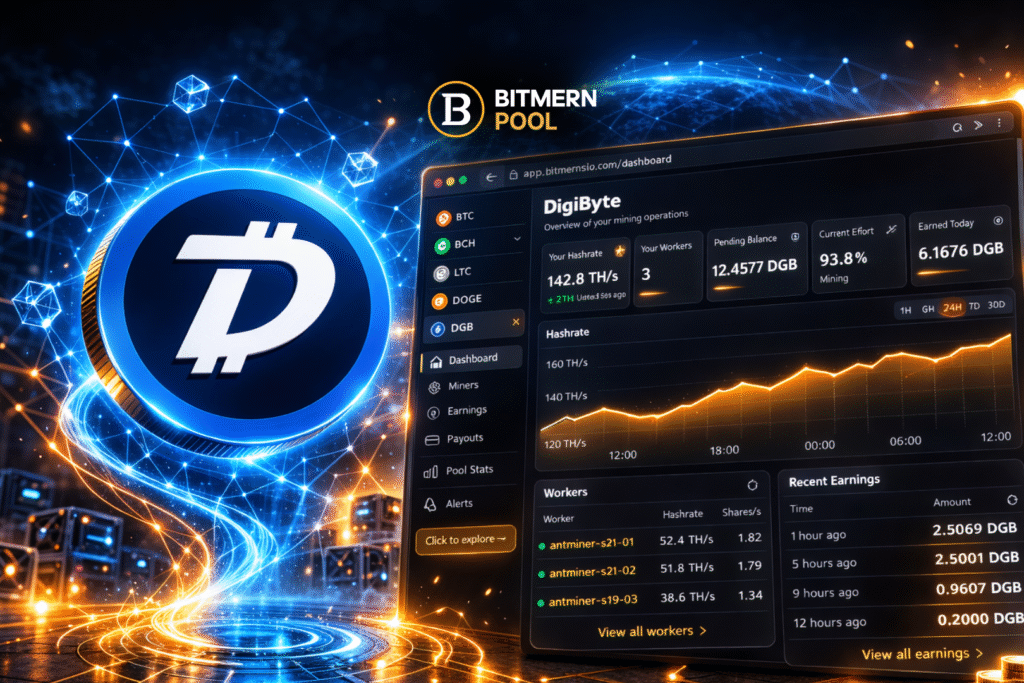

This is exactly where Bitmern Mining differentiates itself: infrastructure-first design that prioritizes consistent revenue generation, not just uptime metrics.

Why High Uptime Does Not Equal High Revenue

A facility can advertise 98% uptime and still underperform financially.

Why?

- Machines may be running in thermal throttling ranges

- PSU efficiency degrades under unstable power

- ASICs may auto-limit performance to protect hardware

- Poor airflow increases fan power draw

Revenue risk hides behind impressive uptime numbers.

Revenue Risk Compounds Over Time

Downtime losses are linear. Revenue losses are exponential.

Losing 5% efficiency:

- Lowers daily BTC mined

- Extends payback periods

- Reduces capital efficiency

- Delays reinvestment cycles

Over months or years, this difference determines whether a mining operation scales or stagnates.

How Professional Miners Manage Revenue Risk

Institutional-grade mining operations focus on:

- Stable power contracts

- Redundant cooling systems

- Firmware optimization

- Real-time performance analytics

- Preventive maintenance schedules

They do not chase peak hashrate numbers. They optimize for consistent, predictable production.

Bitmern Mining’s Approach: Revenue First, Uptime Second

At Bitmern Mining, uptime is treated as a baseline requirement, not the final goal.

The core focus is:

- Power stability over peak power availability

- Cooling efficiency over raw airflow

- Long-term ASIC health over short-term performance spikes

This philosophy allows miners hosted with Bitmern to generate steadier returns across market cycles.

Learn more about infrastructure and hosting solutions at

https://bitmernmining.com/

Hardware Alone Cannot Solve Revenue Risk

Buying efficient ASICs is not enough.

Even top-tier hardware:

- Underperforms in poor environments

- Degrades faster under unstable conditions

- Loses efficiency without proper tuning

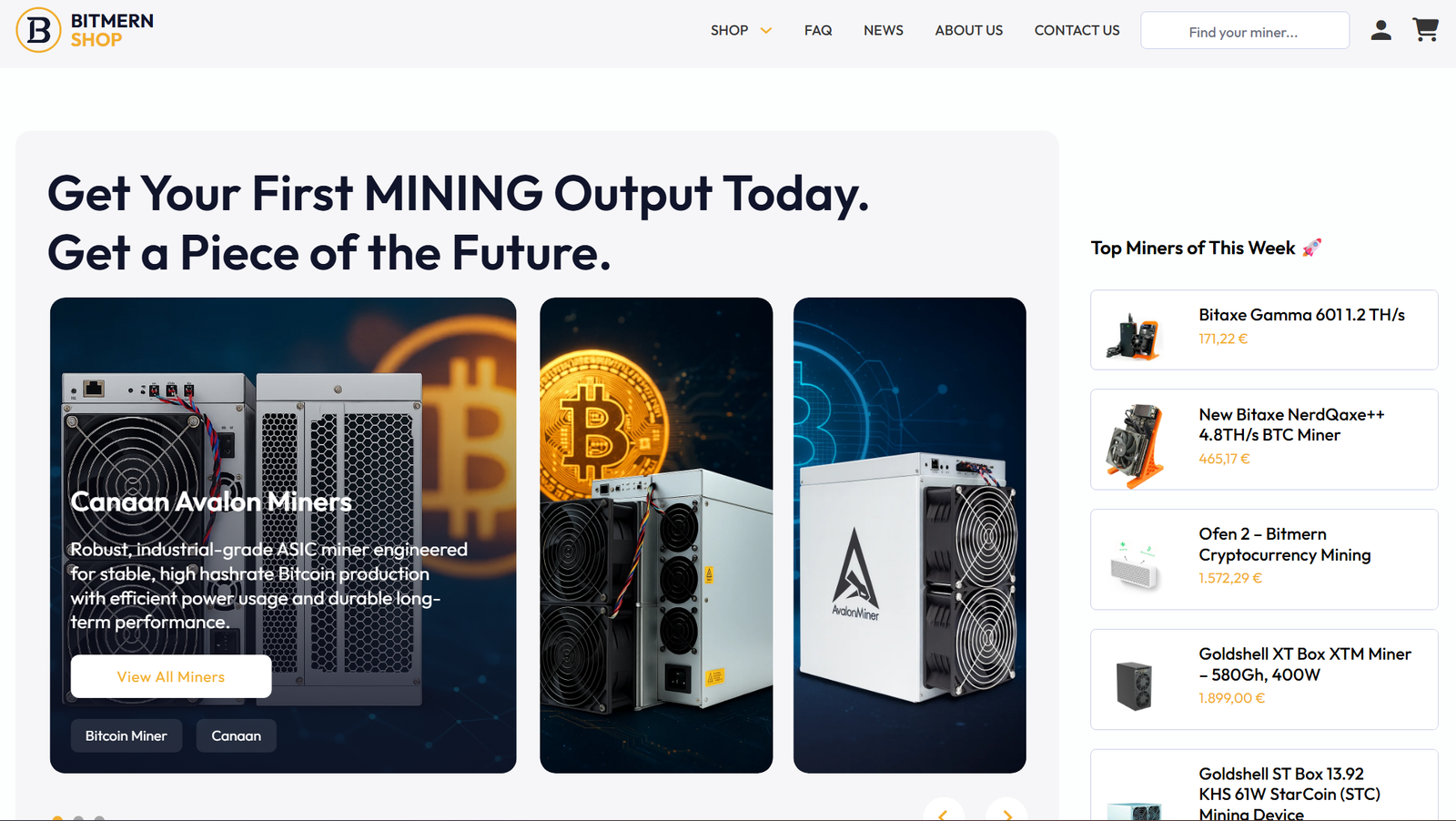

This is why Bitmern pairs hosting with verified hardware sourcing through the Bitmern Shop.

https://shop.bitmernmining.com/

The shop focuses on:

- Authentic, verified miners

- Hardware matched to hosting conditions

- Clean deployment pipelines

- Reduced operational friction

Why Revenue Risk Determines Long-Term Survival

Bitcoin mining rewards consistency.

Markets fluctuate, difficulty adjusts, and hardware evolves. Operators who survive are those who minimize revenue volatility, not just downtime events.

Revenue risk management determines:

- Cash flow stability

- Scaling ability

- Investor confidence

- Long-term operational viability

Conclusion: Downtime Is Obvious. Revenue Risk Is Existential.

Downtime risk grabs attention. Revenue risk decides outcomes.

Miners who understand this difference stop chasing superficial uptime metrics and start building infrastructure that protects profitability at every layer.

That shift marks the difference between hobbyist mining and professional mining.