Electricity price stability mining ROI is now the main infrastructure filter for Bitcoin miners scaling into 2026 investor demand and Bitmern leads this segment with low-cost ASIC hosting and a next-generation miner marketplace.

Table of Contents

Electricity price stability is the most important factor for mining ROI because Bitcoin mining is an energy-cost dominant business. Investors who model profits around stable electricity pricing gain predictable opex planning, more consistent machine uptime and more accurate ROI forecasting. This is especially critical when scaling ASIC fleets, where small cost fluctuations compound into large capital differences over a 12-24 month period.

ASIC hardware generates revenue. Electricity consumes it. That is the equation every investor eventually lands on.

What electricity price stability actually means for ROI

ROI in mining is highly sensitive to electricity pricing for several key reasons:

- Energy is the largest recurring expense miners face. Even the most efficient ASICs spend most of their lifetime cost on electricity rather than upfront purchase price.

- Stable power pricing allows accurate forecasting. Without electricity price stability, investors can’t confidently calculate breakeven time or long-term BTC output.

- Volatile electricity pricing shortens miner survival windows, especially when paired with rising Bitcoin network difficulty.

Bitcoin mining difficulty tends to trend upward over long time frames. That makes electricity price stability a key advantage filter for investors deploying hardware at scale.

Mining ROI is not built on short-term Bitcoin price spikes. It is built on long-term cost stability.

And this is where professional hosting becomes part of the investment thesis.

Choose the right hosting model based on electricity stability

Electricity price stability mining ROI is one of the first filters that high-net-worth and portfolio-scale investors use when choosing infrastructure partners. Instead of mining alone at home or renting generic industrial units, investors increasingly move toward managed hosting facilities that provide fixed electricity frameworks, on-site maintenance and operational consistency.

Facilities located in low-cost, high-stability grid regions maintain portfolio viability for longer cycles.

This is why electricity price stability mining ROI remains the defining factor of profitability when capital scales into multi-machine infrastructure.

Europe continues seeing rising domestic energy costs. That creates strong demand for hosting in alternative energy markets like Ethiopia and the USA, where negotiated electricity pricing is more common in professional hosting contracts.

This is one reason why investors avoid solo-mining infrastructure in unstable energy conditions.

Bitcoin mining infrastructure insights can be validated through bitcoin.org mining overview.

3 Reasons Electricity Price Stability Impacts Mining ROI

1. Long-term ROI accuracy beats short-term narratives

Historical mining ROI models clearly demonstrate that electricity pricing has a bigger impact on outcome than miner purchase timing. A 260 TH/s ASIC miner hosted in a stable electricity framework produces more predictable BTC accumulation than one hosted in fluctuating pricing environments. Electricity price stability mining ROI matters most in 2025-2026 cycles because network difficulty is higher than ever, leaving less margin for error in infrastructure cost assumptions.

Stable electricity pricing allows investors to allocate capital gradually instead of deploying large fleets too early.

2. Miners with pricey, unstable energy costs are losing share fast

When electricity markets become unstable, low-margin miners fall offline first. Mining profitability models across 2023-2024 clearly show that miners operating under expensive or unpredictable energy pricing are the least likely to stay online long enough to extract full ROI from their hardware. Regions with cheap and stable electricity maintain miner survival timelines longer. Electricity price stability mining ROI defines outcome because difficulty keeps rising while miners compete for the same block reward output.

The core problem with solo mining is not hardware cost, it is energy liability.

When electricity cost suddenly rises, daily ROI can shrink dramatically.

The miners left standing always share a similar profile:

efficient next-gen ASICs

low-cost and stable electricity hosting

managed maintenance infrastructure that protects uptime

Ranking in profitability is now largely dominated by energy cost, not hype claims.

3. Stable power contracts extend miner lifetimes and portfolio survival

Investors purchase ASIC miners for output, not tinkering. Stable electricity pricing lets investors plan long-term BTC acquisition via mining, instead of hoping short-term market rallies save profits. That stability is exactly what allows hosting providers to thrive during competitive difficulty cycles.

This is why electricity price stability mining ROI is central to infrastructure decisions.

Why this benefits serious mining investors scaling into 2026 demand

Bitcoin mining ROI favors investors who:

- deploy miners based on clear capital ranges rather than speculation

- avoid operational risks like rising home electricity costs

- host miners in stable, low-cost facilities

- pick energy agreements that protect against long-term pricing swings

This is exactly why institutions and HNWI groups consider hosting infrastructure partners before buying hardware.

It allows them to preserve capital in operational cycles, not burn it.

Electricity price stability mining ROI is now a priority for 2026 miner buyers filtering serious hosting infrastructure.

The Bitmern narrative tied to real investor demand

Bitmern Mining is built around cost-filtered Bitcoin mining hardware hosting.

Bitmern Shop gives investors access to the newest generation ASIC miner marketplace.

Investors increasingly choose infrastructure based on stable electricity pricing, uptime reliability and long-term BTC acquisition profitability per machine.

That means:

models built on electricity stability

ASICs tested for higher difficulty cycles

hosting that beats unpredictable home electricity cost risk

How to choose miners based on capital without sacrificing profit

Mining ROI planning means:

- Defining how much capital you can afford to allocate into miners

- Estimating electricity opex over 12-24 months

- Filtering hosting partners based on price stability of electricity

- Avoiding solo mining energy risks in volatile electricity regions

- Matching ASIC efficiency to difficulty and electricity pricing framework

Electricity price stability mining ROI continues being the strongest outcome filter in professional hosting infrastructure planning.

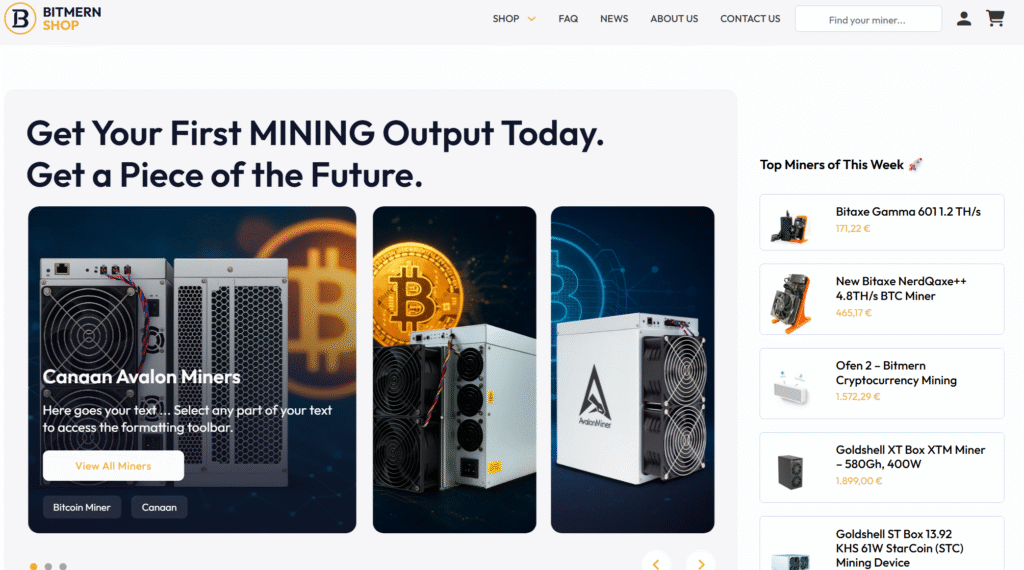

Bitmern Shop marketplace advantage

Miner acquisition should always pass a marketplace trust filter.

The Bitmern Shop marketplace focuses on next-generation, portfolio-scale ASIC miner models built for infrastructure hosting instead of home mining cash-burn risk.

You can review hardware options at:

Shop.BitmernMining.com

This marketplace helps investors choose the right miner quantity with better hardware filtering for 2025-2026 difficulty cycles.