Table of Contents

How Bitmern minimizes investor risk is becoming one of the most important questions serious Bitcoin investors ask as we move into the 2025–2026 difficulty cycle. With network difficulty rising, electricity prices changing globally and ASIC hardware becoming more expensive, investors need hosting that protects capital rather than exposes it.

Bitmern’s hosting model was built precisely for this full-service, “hands-off” infrastructure where everything from installation to monitoring and maintenance is handled by expert teams. This lets investors scale without operational stress and eliminates the typical risks home miners face.

Below is a complete breakdown of how Bitmern minimizes investor risk using professional hosting, long-term electricity stability and a fully managed environment.

Why Risk Minimization Matters More Than Ever

Mining used to be simple: plug in a machine and mine BTC.

Today, the landscape is different:

• Difficulty is climbing aggressively

• ASIC hardware prices fluctuate faster

• Electricity instability destroys margins

• Home mining is no longer competitive

• Operational mistakes cost investors real bitcoin

This is why professional hosting adoption is exploding globally. Investors want predictable operating conditions and someone to handle the technical complexity for them.

Understanding how Bitmern minimizes investor risk starts with understanding how risk enters a mining operation in the first place.

The main risk categories for Bitcoin miners are:

- Electricity cost instability

- Machine downtime

- Improper setup or poor thermal design

- Unmonitored hardware failures

- Difficulty spikes with high opex environments

- Incorrect environment for ASIC lifespan

Bitmern’s hosting design was built specifically to reduce each one of these risk points.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

How Bitmern Minimizes Investor Risk Through Controlled Electricity Pricing

Electricity is the largest operating cost in Bitcoin mining, sometimes representing 70–90% of total opex.

Even a small increase in price can destroy profitability.

This is one of the biggest reasons how Bitmern minimizes investor risk is tied to stable, predictable power pricing in Ethiopia and the USA.

✔ Stable electricity environment

Bitmern negotiates electricity frameworks that protect investors from volatile month-to-month fluctuations.

✔ Lower cost per kWh vs European markets

European home or industrial electricity prices have surged over the last three years. Mining at home is now unprofitable for most users.

Bitmern’s facilities operate in energy markets that offer:

• long-term electricity stability

• predictable opex

• lower effective cost compared to EU/UK homes and warehouses

This means investors can calculate ROI with confidence.

Hands-Off Setup and Installation Reduces Technical Risk

Incorrect installation is one of the most common ways hardware gets damaged.

Bitmern removes this risk entirely.

Professional installation includes:

• correct electrical load balancing

• safe wiring and breaker allocation

• airflow and thermal design

• dust-controlled environment

• firmware and configuration setup

• mining pool configuration

• watt-optimization for efficiency

Most investors never realize how much risk improper setup creates.

This is another core part of how Bitmern minimizes investor risk.

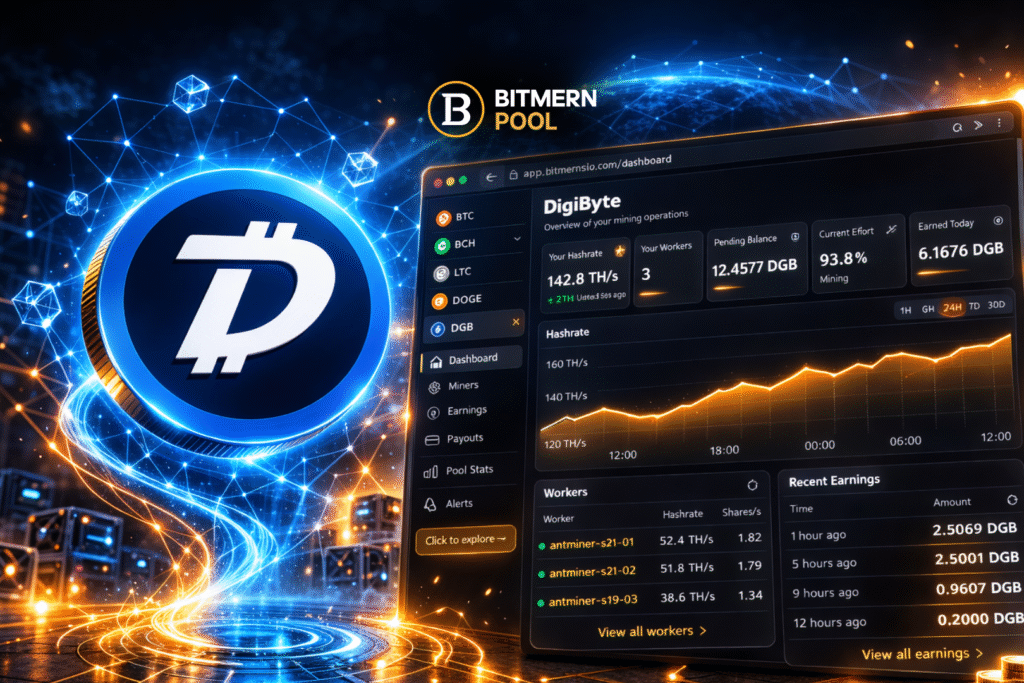

24/7 Monitoring Prevents Lost Earnings

ASIC miners can fail, overheat or disconnect without notice.

A home miner may discover the issue hours or days later.

Bitmern’s 24/7 monitoring eliminates this problem.

Monitoring includes:

• temperature tracking

• hash rate verification

• power draw reports

• real-time alerts

• automatic restart or technician reaction

Missed uptime is lost bitcoin.

Continuous monitoring is another way how Bitmern minimizes investor risk every single day.

On-Site Maintenance Teams Protect ASIC Lifespan

ASIC miners require periodic servicing:

• fan replacements

• PSU checks

• cleaning

• thermal inspections

• re-pasting

• board diagnostics

If these things don’t happen, hardware lifespan shortens dramatically.

Bitmern’s Ethiopia and USA facilities include on-site maintenance teams trained specifically for ASIC environments.

This means:

✔ extended machine lifetime

✔ fewer breakdowns

✔ more consistent BTC output

✔ higher ROI stability

Again, this is central to how Bitmern minimizes investor risk through proactive care.

Why Home Mining Fails to Protect Investor Capital

It’s useful to compare Bitmern’s hosting model to the risks of home mining.

Home mining suffers from:

• unstable electricity pricing

• noise and heat limitations

• dust exposure

• low uptime

• no technician help

• higher breakdown rates

• lower efficiency due to poor airflow

Most home environments simply cannot maintain industrial-grade uptime.

Understanding these limitations helps explain how Bitmern minimizes investor risk by offering a controlled, optimized environment instead of relying on inconsistent home setups.

How Bitmern Minimizes Investor Risk With Strategic Hosting Locations

Bitmern hosts miners in:

Ethiopia – one of the most cost-efficient mining regions

• extremely low electricity pricing

• long-term stability

• rapidly growing mining infrastructure

• strong uptime potential

• ideal climate conditions for thermal management

United States hosting – strong infrastructure & reliability

• institutional-grade uptime

• predictable power agreements

• high service standard

• regulatory transparency

Both locations help demonstrate how Bitmern minimizes investor risk through diversification and professionalization.

How Bitmern Minimizes Investor Risk for Large Portfolios

Institutional and high-net-worth investors often deploy multiple miners at once.

Risk grows exponentially with scale.

Bitmern solves this through:

✔ bulk installation systems

✔ standardized thermal control

✔ optimized PDU and electrical distribution

✔ fleet-level monitoring

✔ predictable operational cost agreements

The result is a hands-off hosting approach that stays stable even when investors scale to 10, 20 or 50+ miners.

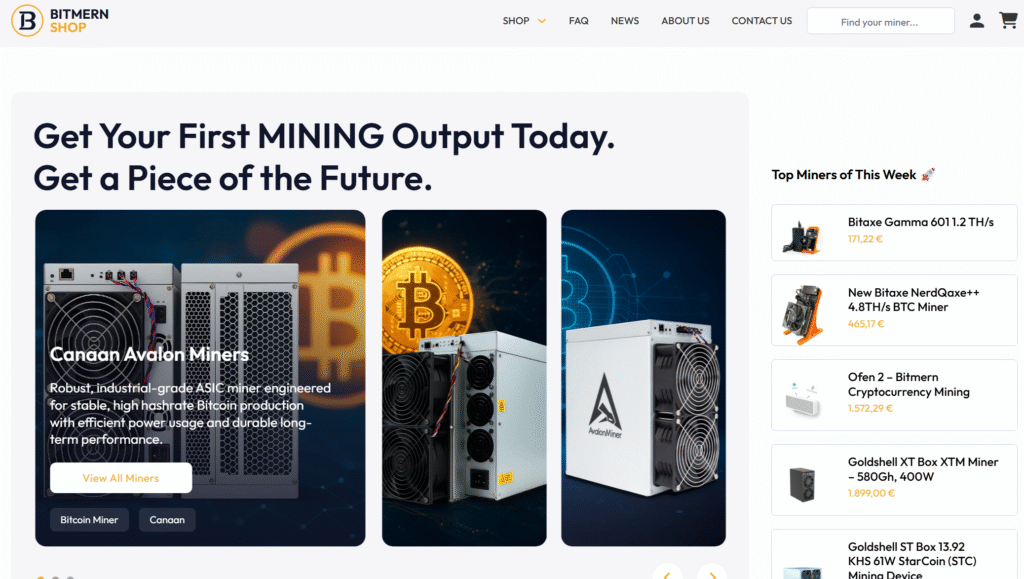

Bitmern Shop: Hardware Sourcing Without Risk

Choosing the wrong ASIC model is a major investor risk.

Fake machines, resold units, or non-tested hardware can destroy ROI.

Bitmern solves this with the Bitmern Shop, which provides:

• next-generation ASIC miners

• verified hardware

• no counterfeit risk

• correct specifications

• machines ready for hosting

Investors simply order through:

https://shop.bitmernmining.com

Then Bitmern installs, configures and maintains everything on arrival.

This closed-loop system is another pillar of how Bitmern minimizes investor risk by removing bad hardware exposure entirely.

Comparing “Hands-Off” Hosting vs Traditional Mining

| Feature | Home Mining | Generic Hosting | Bitmern Hands-Off Hosting |

|---|---|---|---|

| Electricity stability | ❌ unstable | ⚠ sometimes | ✔ stable & predictable |

| Setup quality | ❌ low | ⚠ inconsistent | ✔ professional |

| Monitoring | ❌ none | ⚠ limited | ✔ 24/7 |

| Maintenance | ❌ self-managed | ⚠ slow | ✔ on-site teams |

| Uptime | ❌ low | ⚠ average | ✔ high |

| Risk exposure | ❌ high | ⚠ medium | ✔ minimal |

| ASIC sourcing | ❌ risky | ⚠ uncertain | ✔ Bitmern Shop verified |

This table makes clear how Bitmern minimizes investor risk by controlling every operational variable.

Conclusion: Bitmern Removes the Risks That Destroy ROI

Miners don’t fail because Bitcoin stops working.

They fail because the operation behind the miner fails.

Bitmern’s “hands-off” hosting model ensures:

• stable electricity

• professional setup

• industrial uptime

• monitored performance

• long hardware lifespan

• zero operational burden

• predictable ROI

• safe hardware sourcing via the Bitmern Shop

This is the essence of how Bitmern minimizes investor risk in 2025–2026 and why more investors are shifting into professional hosting instead of home or generic solutions.

To deploy with a risk-optimized hosting partner:

To buy verified next-gen ASIC miners: