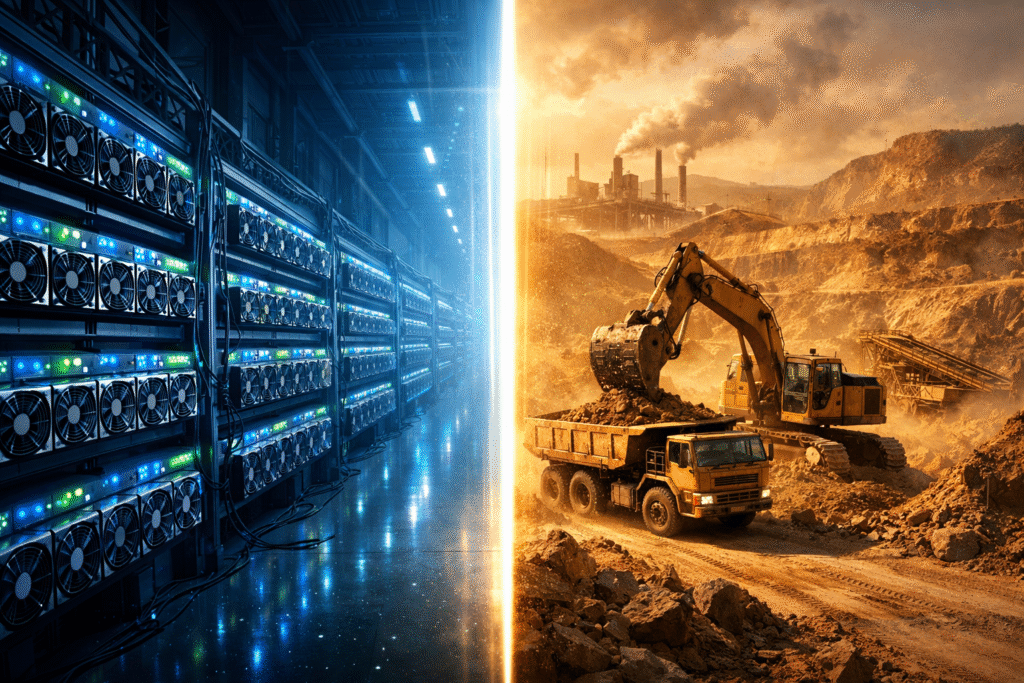

In the evolving landscape of digital money, Bitcoin and Central Bank Digital Currencies (CBDCs) are often placed in contrast. One key difference is control—and mining sits at the heart of how Bitcoin resists centralization. While CBDCs centralize power in government authorities, Bitcoin, via its mining architecture, distributes power among participants. Let’s explore how mining underpins Bitcoin’s decentralization, why that matters, and how this stands in contrast to CBDCs.

Decentralized Validation vs Central Authority

- Bitcoin’s Proof-of-Work (PoW) System

In Bitcoin, miners compete to solve cryptographic puzzles, validate transactions, and propose new blocks. Any participant who joins with valid hardware can attempt this process. This open competition means no single entity has innate authority over block creation. The protocol enforces rules and consensus.

The more distributed the miners, the harder it is for any actor to exert undue influence. - CBDCs & Centralized Control

A Central Bank Digital Currency is issued and regulated by a central bank. The bank can control issuance, monitor transactions, and even restrict spending or freeze accounts. Essentially, the central bank becomes a gatekeeper over the digital currency system.

In Bitcoin, the protocol is enforced by miners, not a central authority. That difference is foundational.

Resistance to Censorship & Transaction Control

- Because Bitcoin miners validate transactions independently, no one can easily censor or block specific transactions—so long as the majority of miners follow consensus rules.

- With a CBDC, a central authority (e.g. the central bank) can filter, reverse, or block transactions at will, depending on policy or government decisions. The architecture enables much tighter control, even over individual accounts.

Mining ensures that the rules of Bitcoin aren’t up to any one actor—they’re enforced by network consensus.

Geographic and Stake-Based Distribution

- A well-distributed mining network across regions helps prevent control by any single nation or group. That geographic diversity is one of Bitcoin’s strengths.

- Projects like OCEAN are pushing decentralization further by letting miners choose their own block templates—reducing reliance on centralized pool operators.

- When more miners globally participate, the influence of any single miner or pool diminishes.

In contrast, CBDCs are centrally issued and controlled—geography doesn’t matter much; control is inherently concentrated.

Incentives & Governance

- Mining is incentivized: miners are rewarded for honest behavior (adding valid blocks) and penalized (losing resources) for maliciousness. This aligns their interest with the network’s health and decentralization.

- With Bitcoin, changes to protocol require community consensus. No single authority can force changes unilaterally.

- In a CBDC model, governance and upgrades are decisions made by central banks or government entities—users have less power in decision-making.

Challenges & Nuances

- Mining and decentralization are under constant pressure: large mining pools, economies of scale, and capital concentration can lead to centralization tendencies (what some call a “natural oligopoly”).

- Full decentralization is an ideal; in practice, Bitcoin’s network has tradeoffs. But mining helps sustain decentralization by enabling open entry, competition, and distributed validation.

- CBDCs trade off decentralization for control, policy flexibility, and potentially regulation—often with less room for transparency or dissent.

Why It Matters for Bitmern & Its Users

- Bitmern operates in multiple geographies (Ethiopia, USA) to help sustain geographic spread of mining power.

- By enabling more miners (especially smaller or mid-sized ones) to participate, Bitmern helps avoid concentration of power in a few big players.

- Transparent hosting, community trust, and decentralization-minded principles reinforce Bitcoin’s resistance to centralized control models—even as CBDCs gain institutional interest.

Final Thought

Mining doesn’t just produce Bitcoin—it enforces the philosophy behind it: decentralization. As governments explore CBDCs—with their inherent central control—Bitcoin’s mining layer acts as a bulwark against authority, giving power back to participants, not central banks. Even as pressures and complexity grow, mining remains a fundamental mechanism preserving autonomy, transparency, and freedom in money systems.