Table of Contents

Why Miner Capitulation Is a Long-Term Bullish Signal

Miner capitulation bullish signal is one of the most misunderstood but consistently reliable dynamics in the Bitcoin market cycle. While price action dominates headlines, what happens behind the scenes among miners often tells a far more important story about where the market is headed next.

When miners capitulate, the market does not become weaker. It becomes structurally stronger.

Understanding why miner capitulation is a long-term bullish signal requires shifting perspective from price speculation to network economics and operational behavior.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

What Miner Capitulation Really Means

Miner capitulation occurs when a significant number of miners are forced to shut down operations or liquidate reserves due to sustained unprofitability. This typically happens during periods of:

• prolonged price compression

• rising difficulty

• high energy costs

• inefficient infrastructure

• poor execution

It is not simply about price falling. It is about the network applying economic pressure until only efficient operators remain.

This is not a failure of the system. It is the system working as designed.

Why Capitulation Strengthens the Network

Bitcoin is not governed by central policy. It is governed by competition and economic survival.

When inefficient miners exit, several things happen:

• Hashrate consolidates among stronger operators

• Network efficiency improves

• Remaining miners enjoy better relative margins

• Structural sell pressure reduces

• Operational discipline increases

This is why miner capitulation bullish signal repeats across cycles. It marks the transition from excess to efficiency.

Historical Perspective: Capitulation Before Expansion

Every major Bitcoin expansion phase has followed miner capitulation.

2012–2013

Post-early miner exit, BTC entered its first major parabolic move.

2015–2016

After miners shut down en masse post-Mt.Gox collapse, a multi-year bull cycle began.

2018–2019

Mining shakeout preceded the institutional adoption wave.

2022–2023

Energy crisis and post-China relocation flushed inefficient operators, laying the foundation for the current cycle.

Miner capitulation is not the end of growth. It is the reset before growth.

Why Price Alone Is a Misleading Indicator

Markets often mistake miner capitulation for network distress.

Price drops → miners struggle → fear spreads.

But this ignores a critical reality: Bitcoin mining is a competitive production industry. Inefficiency must exit for profitability to return.

Price-based analysis focuses on emotions. Miner behavior focuses on survival.

That is why miner capitulation bullish signal is more reliable than short-term price action for long-term investors.

The Role of Infrastructure in Capitulation Survival

Not all miners are affected equally during capitulation phases.

Miners with:

• low-cost power

• professional hosting

• optimized cooling

• structured deployment

• disciplined capital management

survive.

Those without these advantages do not.

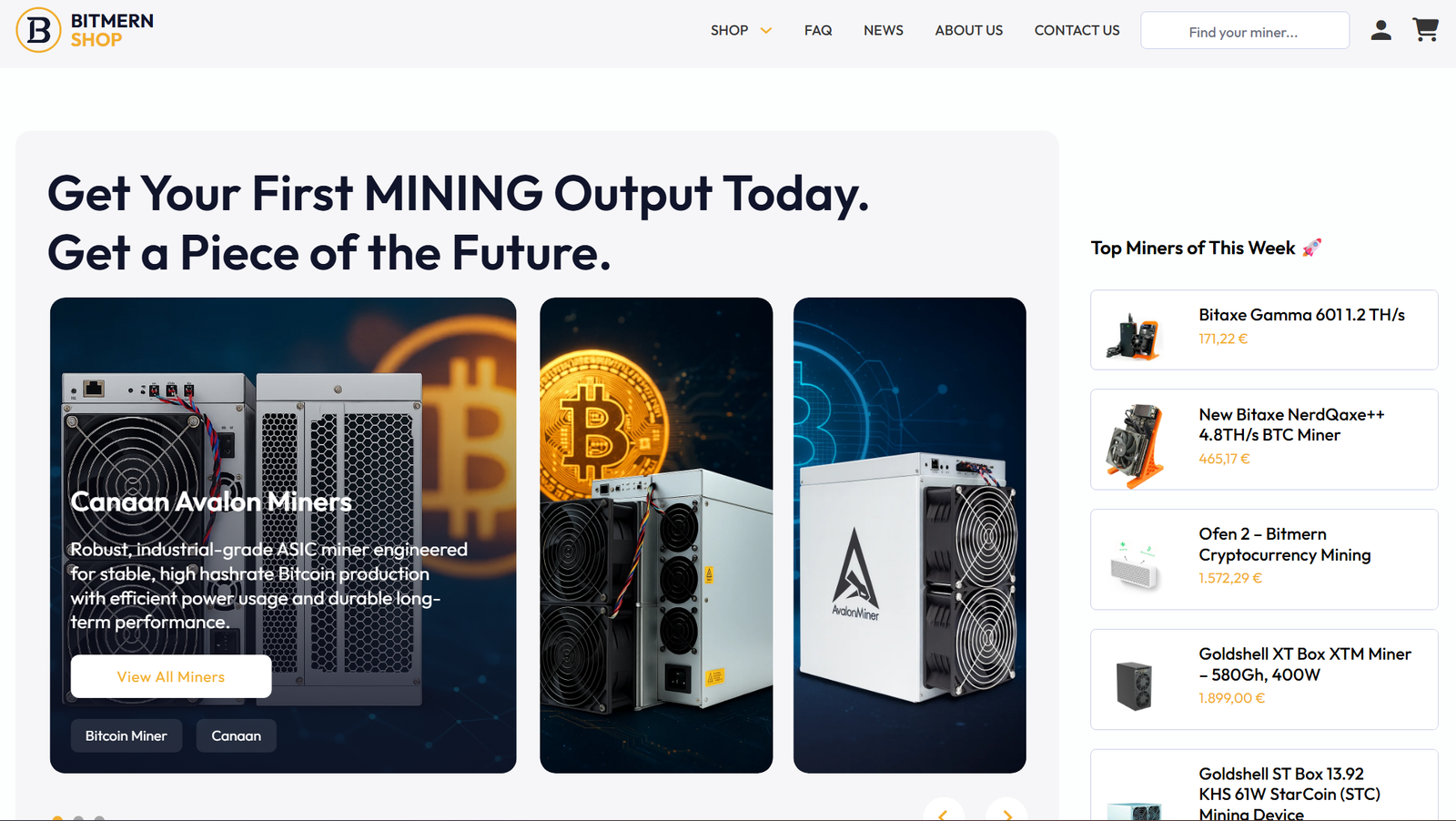

This is why professional hosting infrastructure becomes increasingly important as cycles mature. It is also why companies like Bitmern Mining exist.

How Bitmern Mining Positions Clients Through Capitulation Cycles

Bitmern Mining builds its operational philosophy around long-term survivability, not short-term speculation.

Its infrastructure is designed for:

• stable power pricing

• scalable hosting

• uptime discipline

• cost predictability

• batch-based deployment

This allows clients not only to survive capitulation phases but to accumulate advantage while others exit.

Capitulation becomes opportunity when infrastructure is built correctly.

Why Capitulation Reduces Structural Sell Pressure

One overlooked benefit of miner capitulation is its effect on sell pressure.

When weak miners exit:

• they stop selling daily mined BTC

• reserves shift to stronger hands

• forced liquidation pressure disappears

• market supply stabilizes

This reduction in constant sell pressure is a major reason why post-capitulation environments often lead to stronger price behavior.

Miner capitulation bullish signal is therefore both operational and market-structural.

The Difference Between Panic and Positioning

Retail traders panic during miner capitulation.

Professional miners reposition.

They:

• renegotiate hosting

• upgrade hardware

• optimize operations

• secure better power

• consolidate hashrate

This divergence in behavior explains why mining is not just an industrial activity but a strategic one.

Those who think structurally benefit when others think emotionally.

How the Bitmern Shop Supports Post-Capitulation Accumulation

After capitulation phases, the market offers a rare window:

• hardware prices compress

• availability improves

• competition weakens

• margins expand

The Bitmern Shop enables investors to access verified ASIC hardware during these windows with infrastructure alignment, not speculative buying.

This transforms capitulation from a threat into an acquisition phase.

Why Capitulation Is a Filter, Not a Failure

Bitcoin mining is designed to eliminate inefficiency.

This is not cruelty. It is economic discipline.

Miner capitulation bullish signal reflects:

• the cleansing of weak operations

• the strengthening of network integrity

• the restoration of sustainable profitability

• the preparation for the next expansion

The network does not grow weaker through capitulation. It becomes more resilient.

Why Long-Term Investors Watch Miners, Not Headlines

Headlines focus on price. Long-term capital focuses on structure.

Miner behavior reveals more about Bitcoin’s future than short-term market sentiment.

This is why institutions and professional investors increasingly track:

• miner reserves

• hashrate migrations

• hosting expansions

• power procurement trends

Miner capitulation bullish signal is a structural insight, not a speculative one.

Final Perspective: Capitulation Is Where Conviction Is Built

Every Bitcoin cycle teaches the same lesson:

Those who understand miner capitulation accumulate advantage.

Those who fear it surrender position.

Bitcoin mining rewards discipline, infrastructure, and patience.

Not hype.

Not noise.

Just execution.