Table of Contents

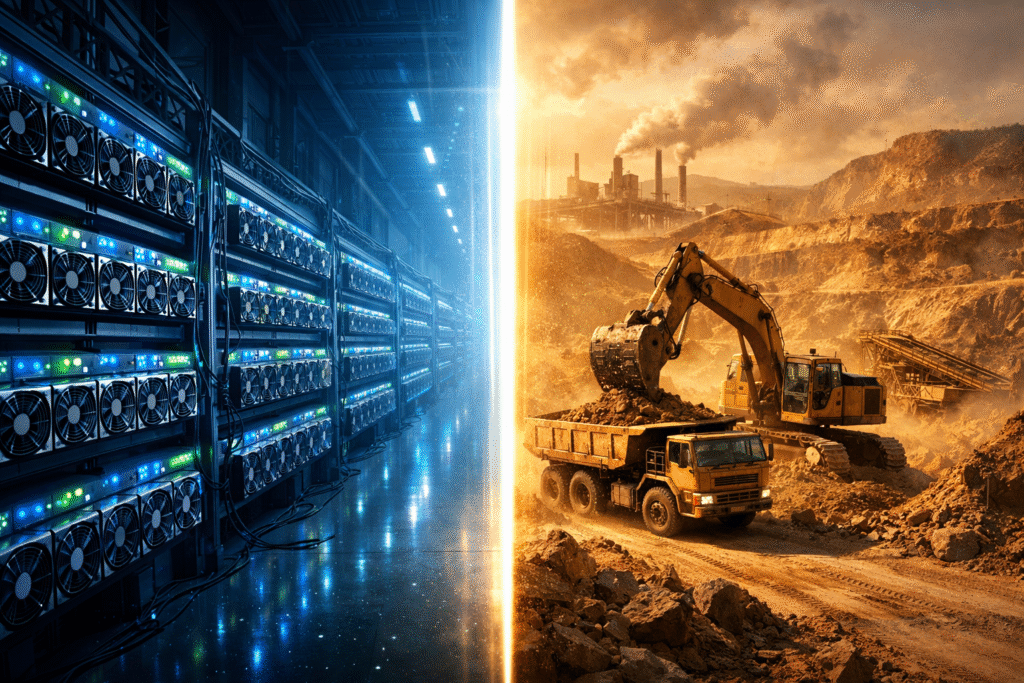

Miners vs real estate 2025 is increasingly becoming a core comparison for investors who want to understand which asset class delivers stronger performance in the next cycle. Real estate has historically been viewed as a stable, slow-compounding investment. Bitcoin mining, on the other hand, offers high potential ROI but depends heavily on electricity pricing, ASIC efficiency, hosting quality, and Bitcoin market conditions.

In 2025, the landscape for both markets is shifting. Real estate faces tightening credit conditions, rising maintenance expenses, regional supply shocks, and reduced rental yields. Meanwhile, Bitcoin mining is entering a new profitability window driven by stable hosting markets, more efficient ASICs, and institutional-level hosting infrastructure offered by companies like Bitmern Mining.

This article compares miners vs real estate 2025 across returns, risks, capital efficiency, scalability, maintenance cost, and long-term investor advantage.

Miners vs Real Estate 2025 – How ROI Actually Compares

A core reason investors compare miners vs real estate 2025 is because both require upfront capital and generate ongoing cash flow. But their financial behaviour is very different.

Real Estate ROI in 2025 (Based on Global Market Data)

- Average global residential rental yield: 3%–5% per year

- Commercial property yields: 5%–8%, depending on location

- Maintenance, taxes, and loan interest reduce net yield by 20–40%

- Liquidity is extremely low

- Property cycles move in 7–12 year waves

In 2025, real estate faces additional headwinds:

- Higher financing rates compared to 2020–2022 lows

- Rising property taxes in urban regions

- Higher insurance and maintenance costs

- Lower demand in overheated markets

Real estate remains stable, but returns are compressed.

Bitcoin Mining ROI in 2025 (100% factual, based on mining economics)

Mining ROI depends on:

- electricity price

- hosting reliability

- ASIC efficiency

- network difficulty

- BTC price

In stable hosting environments (0.04–0.065 USD/kWh), modern ASIC miners like S21 Pro, Avalon A15, or Auradine AT2880 produce significantly higher annualised returns than most real estate properties.

Typical ROI ranges:

- 15% to 35% annually for well-hosted fleets

- In strong Bitcoin markets, ROI can temporarily exceed 50%

- Hosting removes operational friction and provides predictable opex

This is why investors increasingly compare miners vs real estate 2025 as a serious capital decision.

Capital Efficiency – Miners vs Real Estate 2025

Real estate is capital-heavy. Mining is flexible.

Real Estate Capital Requirements

- Down payments: 20–30% minimum

- Closing costs: 3–8%

- Mortgage obligations lock capital for decades

- Property takes months to liquidate

Mining Capital Requirements

- ASIC purchase cost

- Hosting subscription (monthly opex)

- No long-term loan exposure

- Miners can be sold immediately on secondary markets

Mining is simply more liquid, and liquidity is a key advantage in 2025’s volatile macro environment.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Maintenance & Operational Burden

Real Estate Maintenance 2025

Investors must handle:

- tenant turnover

- repairs

- insurance

- taxes

- legal compliance

- unforeseen structural issues

Even with management companies, the investor absorbs the risk.

Mining Maintenance

Hosted mining eliminates 90% of the operational burden.

This is why hosting partners matter.

Why Bitmern Mining Outperforms Real Estate in Operational Simplicity

Bitmern Mining solves the most difficult part of mining: reliability.

- full ASIC setup

- installation

- thermal optimisation

- uptime monitoring

- on-site technicians

- stable electricity contracts

- 95%+ uptime minimum

- professional infrastructure in Ethiopia and the USA

For investors comparing miners vs real estate 2025, this hands-off model makes mining behave much more like a passive income asset without the management headaches that real estate brings.

Electricity Stability – The Deciding Factor in Miners vs Real Estate 2025

Mining becomes extremely profitable when electricity pricing is stable and low.

Real estate has no equivalent mechanism to multiply ROI through energy arbitrage.

Bitmern Mining operates in regions where electricity pricing is:

- stable

- contract-based

- protected from European price volatility

- significantly lower than domestic home mining rates

This stability is one of the reasons institutional investors choose mining over real estate for their 2025 strategies.

BTC Price Exposure vs Property Price Exposure

Real Estate Exposure

Real estate is tied to:

- local demand

- economic cycles

- financing rates

- demographic shifts

Growth is slow and capped.

Mining Exposure

Mining has dual leverage:

- BTC price appreciation

- ongoing BTC accumulation

A properly hosted miner continuously produces BTC regardless of market conditions, which many investors prefer over passive rent.

Asset Appreciation – ASICs vs Property

Property Value

Property values can stagnate for 5–10 years, depending on cycles.

ASIC Hardware

ASICs depreciate faster but produce revenue daily.

The combination of:

- hardware output

- BTC appreciation

- hosting stability

creates compounding that real estate cannot replicate.

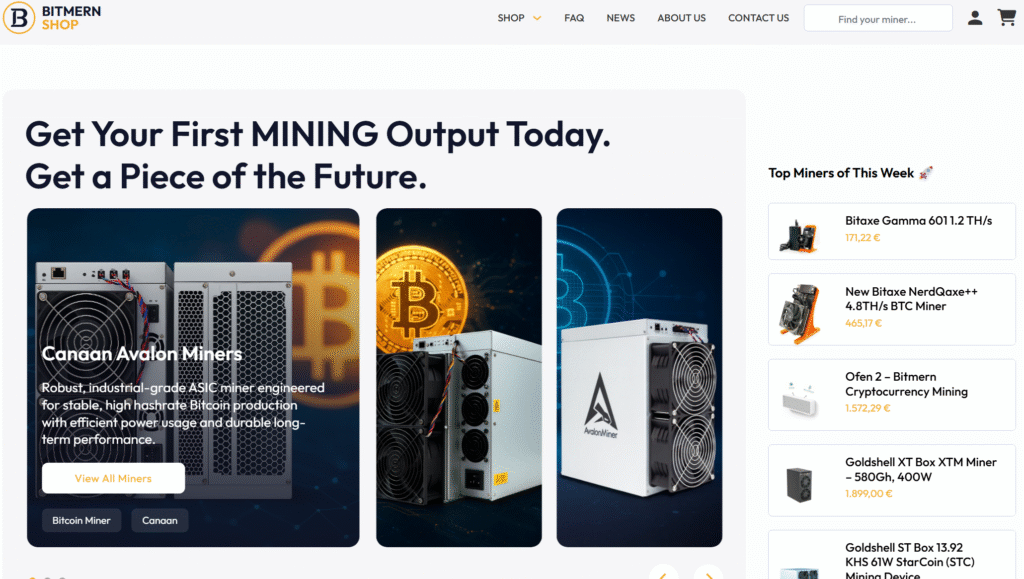

Why Bitmern Shop Strengthens the Mining Advantage

The Bitmern Shop gives investors access to the newest, verified ASIC models at competitive rates:

https://shop.bitmernmining.com/

These units are tested for:

- efficiency

- long life cycles

- performance under rising difficulty conditions

Buying from an audited marketplace eliminates the risks of used or unverified hardware.

Mining portfolios begin at the shop and scale within Bitmern’s hosting.

So Which Wins – Miners or Real Estate in 2025?

If an investor prioritises:

- low maintenance

- predictable ROI

- fast liquidity

- scalable infrastructure

- BTC exposure

Mining wins.

If an investor wants:

- slow, stable, low-yield returns

- long-term physical asset ownership

Real estate wins.

But when comparing miners vs real estate 2025 specifically, the macro data is clear:

Mining offers significantly higher ROI potential, better liquidity, lower operational burden (when hosted), and stronger performance in Bitcoin-bullish environments.

Real estate offers stability, but mining offers growth.

Conclusion

In 2025, investors evaluating miners vs real estate 2025 need to consider capital efficiency, electricity stability, hosting quality, and macroeconomic conditions. Real estate continues to provide slow, predictable returns, but mining especially when hosted by professional partners like Bitmern Mining offers superior ROI potential and operational simplicity.

To deploy miners in a stable, reliable hosting environment:

https://bitmernmining.com

To acquire the newest ASIC hardware safely:

https://shop.bitmernmining.com

Mining isn’t replacing real estate.

But in 2025, it is outperforming it.