Table of Contents

Mining risk is mostly operational, not market-based, and this is one of the most misunderstood realities in Bitcoin mining today. Many investors believe that price volatility is the main threat to mining profitability, but in practice, most losses come from poor infrastructure decisions, unstable electricity pricing, downtime, and inefficient operational management.

Bitcoin price cycles come and go. Operational mistakes compound every single day.

Understanding this difference is what separates long-term mining portfolios from short-lived experiments.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

The biggest misconception in Bitcoin mining risk

New miners often assume that Bitcoin price movements define success or failure. This mindset usually comes from traders entering mining without understanding its mechanics. Mining is not a short-term speculative activity. It is a capital-intensive infrastructure business with recurring operational costs.

When Bitcoin price drops, efficient miners with stable operations continue mining.

When electricity spikes, machines shut down.

When cooling fails, ASICs degrade.

When maintenance is slow, uptime collapses.

None of these are market risks. They are operational risks.

That is why mining risk is mostly operational, not market-based.

Market volatility is visible, operational risk is silent

Market risk is obvious. Everyone sees price charts.

Operational risk hides in:

- electricity contracts

- facility design

- cooling efficiency

- power distribution

- maintenance response time

- monitoring systems

- hosting reliability

These factors don’t trend on Twitter, but they decide whether your ASICs survive two cycles or die before breakeven.

This is also why miners who survive bear markets are usually hosted in professional facilities rather than running setups at home or in improvised locations.

Electricity stability defines operational survival

Electricity is the largest recurring cost in mining. Even the most efficient ASIC spends more on electricity over its lifetime than on purchase price.

Unstable electricity pricing creates unpredictable cash flow and shortens survival windows. When electricity costs rise suddenly, daily mining margins disappear instantly.

This is why mining risk is mostly operational, not market-based for investors planning long-term exposure.

Facilities with fixed or predictable electricity frameworks allow miners to plan:

- breakeven timelines

- reinvestment schedules

- expansion phases

- risk buffers

Without electricity stability, ROI models are guesswork.

Downtime is the real killer of mining ROI

An ASIC that is powered off produces zero Bitcoin.

Downtime is often caused by:

- overheating

- poor ventilation

- grid instability

- delayed repairs

- lack of on-site technicians

- weak monitoring systems

Market volatility does not turn miners off. Operational failures do.

This is why professional hosting environments consistently outperform solo setups, even if the hardware is identical.

Operational risk compounds faster than market risk

Bitcoin price moves up and down, but operational inefficiencies stack daily.

Examples:

- 5% downtime per month becomes over 50% lost production annually

- overheating shortens ASIC lifespan permanently

- unstable power damages components

- inefficient cooling increases failure rates

- delayed maintenance extends downtime

These losses don’t recover when price rallies.

This is another reason why mining risk is mostly operational, not market-based for serious investors.

Why professional hosting reduces mining risk

Professional hosting solves problems that most individual miners cannot manage alone:

- engineered power distribution

- industrial cooling systems

- redundancy planning

- on-site maintenance teams

- real-time monitoring

- structured operational processes

This is why institutional and high-net-worth miners almost always outsource operations instead of self-hosting.

The Bitmern approach to operational risk

Bitmern Mining is built around minimizing operational risk, not chasing short-term narratives.

The infrastructure focuses on:

- stable electricity environments

- industrial-grade facilities

- uptime-first design

- hands-off operations for investors

- professional maintenance response

This structure allows investors to focus on capital allocation and scaling, instead of daily operational firefighting.

Scaling exposes operational weaknesses fast

The bigger the fleet, the more visible operational risk becomes.

A single miner running at home can hide inefficiencies.

Ten miners expose them.

One hundred miners magnify them.

This is why scaling without professional infrastructure often ends badly.

Bitmern’s hosting model is designed specifically for scale, not hobby mining.

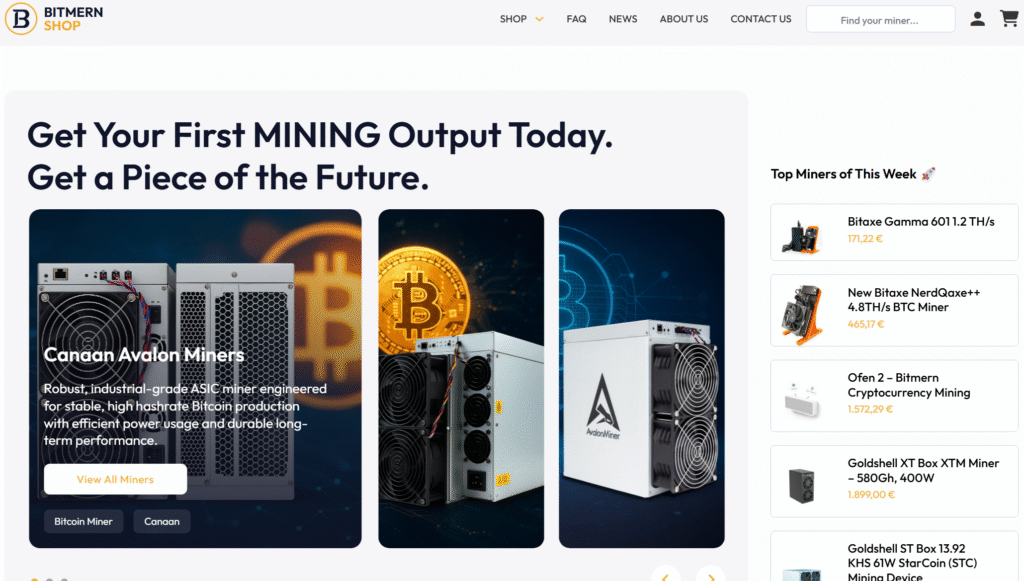

Bitmern Shop and hardware risk management

Hardware selection is another operational layer many investors underestimate.

Buying miners from unverified sellers increases risks such as:

- used or damaged units

- delayed delivery

- missing warranties

- incorrect specifications

- lack of post-sale support

The Bitmern Shop exists to reduce these risks by offering vetted, infrastructure-ready ASICs suited for professional hosting environments.

https://shop.bitmernmining.com/

Bitmern Christmas Mega Deal – Built for fast, efficient scaling

Operational risk also includes timing your expansion correctly, and right now Bitmern is running one of the most aggressive offers of the year for miners looking to scale responsibly.

BITMERN CHRISTMAS MEGA DEAL

The biggest S21 Pro offer of the year

Buy 4 Bitmain S21 Pro

→ Get the 5th miner at 50% discount

Buy 9 Bitmain S21 Pro

→ Get the 10th miner completely FREE

No catch. No limit.

This offer applies only to the Bitmain S21 Pro, currently one of the most efficient miners on the market.

For investors planning to expand hashrate before the next liquidity wave while securing professional hosting, this is a rare window.

Lock your units before inventory runs out:

https://wa.me/971585382409

Market cycles reward operational discipline

Bitcoin bull markets reward miners who survived the previous downturn.

Survival depends on:

- operational efficiency

- cost control

- uptime

- infrastructure resilience

Miners who fail operationally never make it to the upside.

That is why mining risk is mostly operational, not market-based, especially over multi-year horizons.

Why serious investors rethink “risk” in mining

Smart mining investors don’t ask:

“Where will Bitcoin price be next month?”

They ask:

- Can my miners stay online?

- Can I predict costs?

- Can I scale without breaking operations?

- Can I survive difficulty increases?

- Can I keep machines running during market stress?

These are operational questions.

Final thoughts: risk lives in infrastructure, not charts

Bitcoin price volatility is unavoidable. Operational failure is optional.

Mining portfolios that succeed over time are built on:

- stable electricity

- professional hosting

- reliable hardware sourcing

- disciplined operations

- long-term planning

That is why mining risk is mostly operational, not market-based, and why platforms like Bitmern exist to remove complexity for investors.

To host miners professionally:

https://bitmernmining.com

To source vetted ASIC hardware:

https://shop.bitmernmining.com