Table of Contents

The mistake of buying too much mining hardware too fast is one of the most common reasons miners fail when trying to scale. In Bitcoin mining, speed without structure usually leads to operational stress, downtime, and capital loss.

For new and even experienced Bitcoin miners, one mistake appears again and again across cycles: buying too much hardware too fast. On paper, scaling aggressively looks logical. More machines mean more hashrate, more BTC production and faster growth. In reality, this approach is one of the fastest ways to destroy capital, compress margins and lock yourself into operational problems that are hard to unwind.

This is not a market-timing issue. It is not about Bitcoin price volatility. It is a structural mistake tied to how mining operations actually function once machines are plugged in.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Hardware Is Easy to Buy, Hard to Operate

ASICs are liquid. Anyone with capital can buy miners in bulk within days. What is not liquid is infrastructure. Power allocation, cooling capacity, rack density, network stability and on-site response all scale much slower than hardware procurement.

When miners buy hardware faster than infrastructure can absorb it, machines sit idle, throttle, or operate under suboptimal conditions. Idle ASICs still represent capital cost, depreciation and opportunity loss. Throttled ASICs produce fewer sats while consuming nearly the same operational attention.

This mismatch is where the damage starts.

Capital Efficiency Breaks Before Hashrate Grows

The goal of scaling is not hashrate growth. It is capital efficiency. When too much hardware is deployed too quickly, capital efficiency collapses.

You pay for machines upfront. You often prepay hosting. You may lock power contracts before understanding real uptime. Meanwhile, revenue ramps gradually, not instantly. The result is a widening gap between capital deployed and cash flow generated.

Professional mining operations scale in phases because each phase must prove that capital converts into predictable output before the next one begins.

Infrastructure Bottlenecks Are Not Obvious at First

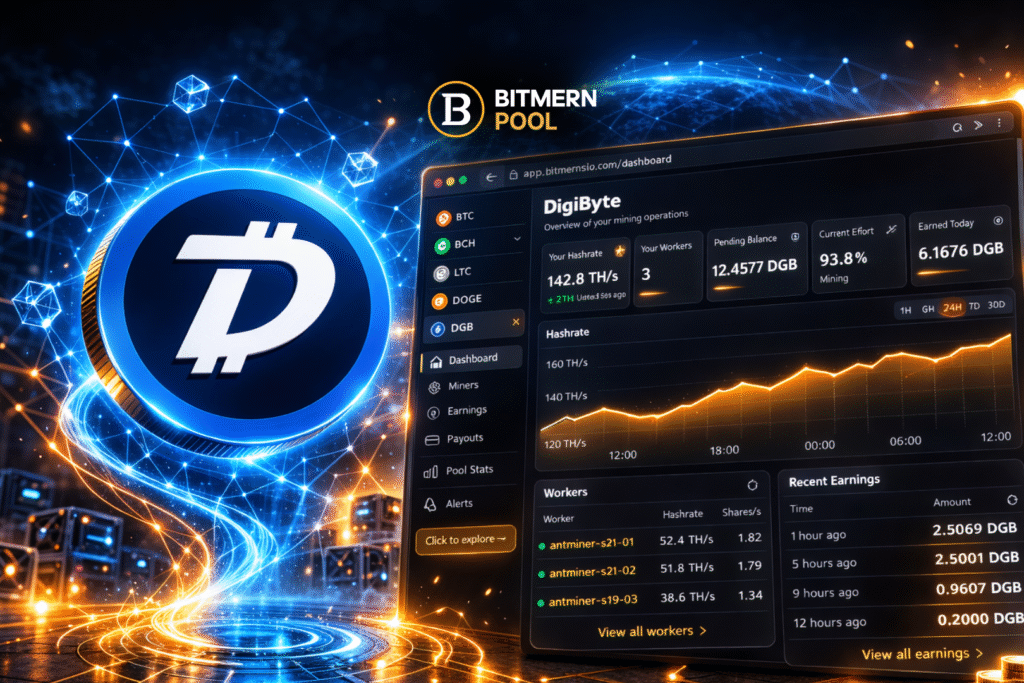

One of the most dangerous aspects of aggressive hardware buying is that problems do not appear immediately. For weeks or months, everything may look fine. Hashrate graphs look strong. Dashboards show machines online.

Then the hidden bottlenecks emerge.

Cooling systems hit thermal limits during seasonal shifts. Power circuits degrade under sustained load. Network latency increases as racks fill. Maintenance queues grow. Response times stretch. Small inefficiencies compound into persistent underperformance.

By the time these issues are visible, the hardware is already paid for and installed.

Hosting Reality Is Not Linear

Many miners assume hosting scales linearly. Ten machines run well, so one hundred will too. This assumption fails quickly in practice.

Hosting environments are optimized for specific load ranges. Beyond those ranges, everything from airflow patterns to power balancing changes. If the facility was not designed for your scale profile, adding more hardware degrades the performance of existing machines.

This is why professional operators prioritize facilities designed for growth, not just immediate capacity.

At BitmernMining, infrastructure is built with expansion margins, not just initial deployment targets. That difference determines whether scaling improves returns or erodes them.

Hardware Generations Move Faster Than Payback

Another overlooked risk is technological pacing. Buying too much hardware at once concentrates exposure to a single generation of ASICs. Difficulty adjustments, firmware improvements and newer models can compress payback windows faster than expected.

When capital is deployed gradually, miners retain flexibility. They can adapt purchase timing, adjust mix and integrate newer efficiency improvements without being locked into outdated assumptions.

Bulk purchases eliminate that flexibility.

Operational Risk Multiplies With Scale

Every miner adds operational complexity. More machines mean more points of failure. Fans fail. PSUs degrade. Hashboards develop issues. When scale outpaces staffing, spare parts and procedures, downtime becomes structural.

This is why uptime percentage matters more than peak hashrate. Ten percent downtime across a large fleet quietly destroys projected ROI.

BitmernMining structures scaling around operational readiness first, not hardware volume. Hardware is treated as a tool, not the strategy itself.

Power Commitments Become a Trap

Aggressive hardware buying often comes with aggressive power commitments. Long-term contracts, minimum usage clauses and penalties lock miners into consumption levels that may not align with real production.

If machines underperform or market conditions shift, power obligations remain. This is one of the fastest paths to margin compression during flat or declining hashprice environments.

Smart scaling keeps optionality intact.

Liquidity Risk Is Underestimated

Mining hardware is not as liquid as many believe, especially at scale. Selling hundreds of machines quickly almost always requires discounts. Transport, redeployment and buyer availability become constraints.

Miners who scale too fast often discover that unwinding positions costs far more than anticipated.

Gradual scaling preserves liquidity. Overextension destroys it.

Institutions Do Not Scale This Way

Large mining firms, funds and infrastructure-backed operators do not deploy hardware aggressively without operational proof. They scale in tranches. Each tranche must validate uptime, efficiency and cash flow consistency.

Retail and semi-professional miners often do the opposite. They buy first and hope operations catch up later.

That gap explains why outcomes diverge so dramatically.

Hardware Should Follow Infrastructure, Not Lead It

The core mistake is sequencing. Hardware should follow infrastructure readiness, not lead it. Facilities, power design, cooling systems, staffing and monitoring must be proven at smaller scale before expansion.

This is where BitmernMining differentiates its approach. Scaling is treated as an operational process, not a purchasing event.

And through the Bitmern Shop, hardware is aligned with infrastructure that is already designed to support it properly, not force-fit after the fact.

Hardware sourcing: https://shop.bitmernmining.com

Industrial hosting solutions: https://bitmernmining.com

The Real Cost Is Time

The most expensive cost of buying too much hardware too fast is not financial. It is time. Time spent fixing preventable issues. Time spent renegotiating contracts. Time spent recovering lost efficiency.

In mining, time equals blocks. Lost time is unrecoverable.

Final Thought

Scaling mining operations is not about speed. It is about control. The fastest-growing miners on paper are often the first to stall or fail when conditions tighten.

Sustainable mining growth is deliberate, operationally grounded and infrastructure-led.

Hardware is the last step, not the first.