Table of Contents

The best time to buy a miner is one of the most common questions in Bitcoin mining because timing affects everything from payback speed to long-term ROI stability. Bitcoin’s market cycles create big shifts in hardware pricing, network difficulty and hosting availability. That means miners who buy at the wrong time often pay more, earn less, and lose the advantage that smarter investors secure months earlier.

This article breaks down the real data behind market cycles and explains whether the best time to buy a miner is before, during, or after major Bitcoin rallies and how hosting and electricity stability can completely change the outcome.

Why Timing Matters More Than Most New Investors Realize

Mining ROI is driven by the relationship between:

- Hardware price

- Electricity cost

- Network difficulty

- Bitcoin market cycles

When Bitcoin rises, miner prices rise.

When difficulty rises, earnings fall.

When electricity is unstable, ROI collapses.

This is why identifying the best time to buy a miner is critical, especially for investors scaling into multi-machine infrastructure who need predictable long-term profitability.

Hosting conditions also matter and this is where BitmernMining’s sites in Ethiopia and the USA give investors a major cost advantage with stable, low electricity pricing.

1. Buying a Miner Before a Bitcoin Rally

Buying before the rally is widely considered the highest-ROI timing window, especially among institutional and large-scale miners.

Advantages of Buying Before a Rally

- Hardware prices are at their lowest point.

Manufacturers and resellers discount inventory during quiet market phases, sometimes 30–60% below peak cycle prices. - Hosting capacity is available and affordable.

Before demand surges, investors can secure long-term electricity rates and hosting slots in cost-efficient regions like Ethiopia. - Difficulty is lower.

Fewer miners online = more BTC earned per machine. - Payback period is longest but most stable.

Investors avoid hype-driven premiums and build a cost-efficient fleet.

This is why many experts argue the best time to buy a miner is when Bitcoin is sideways and social media is quiet not when the crowd rushes in.

2. Buying a Miner During a Bitcoin Rally

This is when most beginners enter and when hardware becomes the most expensive.

What Happens During a Rally

- ASIC prices jump rapidly often 40% to 120% higher.

- Hosting availability tightens.

- Difficulty rises as more miners activate machines.

- Shipping delays increase due to demand overload.

Pros

- Higher short-term earnings because hashprice increases.

- Payback seems faster only if you bought early in the rally.

Cons

- You are paying the highest hardware prices of the cycle.

- Difficulty climbs shortly after, reducing revenue.

- ROI becomes unpredictable and often overestimated.

This is why the best investors rarely consider a rally the best time to buy a miner. It’s a reactive move instead of a strategic one.

3. Buying a Miner After a Bitcoin Rally

After the rally, conditions stabilize, but profitability becomes more competitive.

What Happens Post-Rally

- Difficulty remains elevated.

- ASIC prices fall slightly, but rarely return to pre-rally lows.

- Bitcoin usually corrects, lowering hashprice.

Pros

- More stable environment for long-term planning.

- No FOMO pricing on miners.

- More predictable earnings curves.

Cons

- Difficulty is higher, meaning less BTC per TH.

- ASIC prices remain inflated compared to the previous bear phase.

Buying after a rally works best for long-term miners who prioritize consistent output rather than aggressive ROI.

But it is not the best time to buy purely for returns.

Bitcoin mining infrastructure insights can be validated through bitcoin.org mining overview.

What Professional Investors Actually Do

Experienced mining investors use a simple rule:

Buy ASIC miners before the market gets hot and secure hosting with stable electricity pricing long before demand surges.

Their strategy focuses on:

- Low hardware prices

- Low difficulty

- Accessible hosting

- Stable electricity

When all four align, the best time to buy a miner is obvious before the crowd sees it.

BitmernMining’s Ethiopia site is a perfect example: low-cost, stable electricity + high uptime makes timing even more impactful.

Electricity: The Hidden Factor That Determines Whether Timing Even Matters

Even if you buy a miner at the perfect time, unstable electricity pricing can erase your ROI.

That is why smart investors combine good timing with good hosting.

BitmernMining provides:

- Stable electricity rates

- 95%+ uptime

- Professional operations

- Locations in low-cost regions (Ethiopia + USA)

- Predictable monthly operational expenses

This stability ensures that choosing the best time to buy a miner actually results in real ROI, not wasted potential.

Comparing the Three Timing Strategies

| Timing Window | Hardware Cost | Difficulty | Earnings | ROI Potential |

|---|---|---|---|---|

| Before Rally | Lowest | Low | Stable | Highest |

| During Rally | Highest | Rising | High but temporary | Medium/Low |

| After Rally | Medium | High | Moderate | Medium |

Across all cycles, the best time to buy a miner for ROI-focused investors is consistently before the rally.

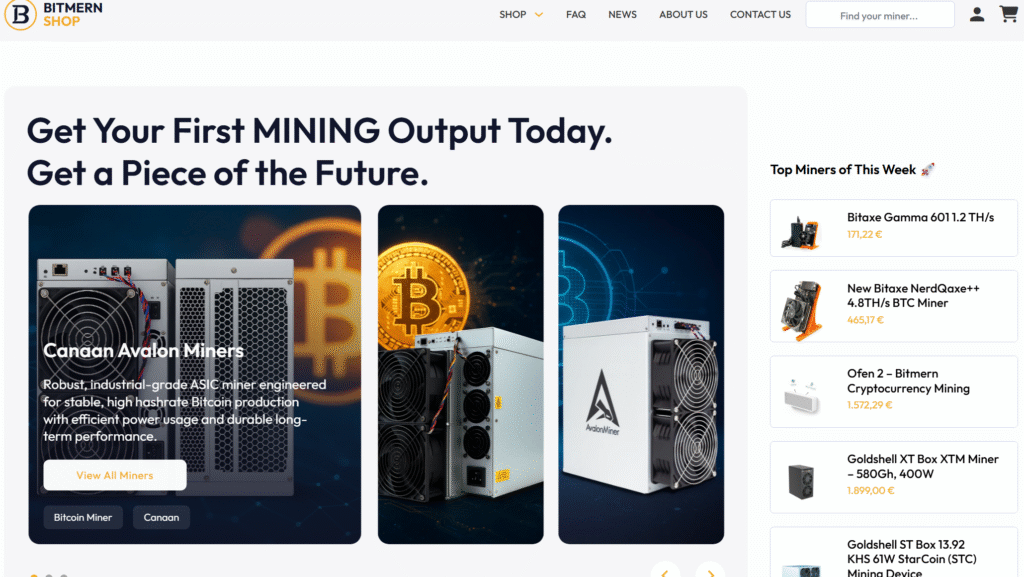

How Bitmern Shop Helps You Time Purchases Better

The Shop.BitmernMining.com marketplace allows investors to:

- See updated miner pricing

- Compare efficiency ratings

- Identify models best suited for upcoming difficulty cycles

- Avoid overpriced hardware sold during hype periods

Because Bitmern is a hardware + hosting ecosystem, investors can align:

✔ timing

✔ hardware selection

✔ hosting stability

…all in one place.

This dramatically increases the probability of profitable long-term mining.

Case Study: How Timing Affects ROI

Investor A (Buys Before Rally)

- Buys ASIC for $4,000

- Difficulty low → earns more BTC

- Hosting cost stable

- ROI in ~10–14 months

Investor B (Buys During Rally)

- Buys same ASIC for $7,000

- Bitcoin drops after rally

- Difficulty rises

- ROI in ~22+ months or never reached

Same miner.

Different timing.

Different future.

This is the core reason identifying the best time to buy a miner matters more than the model you choose.

So When Exactly Is the Best Time?

Across every cycle since 2013:

✔ The best time to buy a miner is when

- ASIC prices are low

- Bitcoin is consolidating

- Social media hype is low

- Hosting capacity is available

- Electricity pricing can be locked long-term

This combination historically produces the strongest ROI.

Conclusion

The best time to buy a miner is not during a Bitcoin rally or after one it is before the market wakes up, when hardware prices are low, difficulty is manageable and hosting is affordable.

Pairing good timing with low-cost, stable hosting amplifies ROI dramatically.

That’s why investors choose:

BitmernMining.com – stable, professional Bitcoin hosting

Shop.BitmernMining.com – trusted ASIC marketplace for every budget

With the right timing and the right infrastructure, mining becomes predictable, scalable and strategically profitable.