Table of Contents

The future of Bitcoin mining in 2025–2026 is one of the most debated topics among investors, miners, and institutional analysts. Rapid difficulty growth, shrinking block rewards, electricity instability in many regions, and institutional entry are reshaping the entire landscape. For investors deciding whether mining is an opportunity or a risk, understanding these shifts is essential.

Bitcoin mining has evolved from a simple hardware purchase into a full operational strategy. Electricity stability, hosting quality, professional maintenance, and ASIC efficiency now determine whether a miner survives a full cycle or fails halfway through it. This makes the future of Bitcoin mining a far more strategic topic than in previous market cycles.

Below is a complete data-driven outlook on what is coming in 2025–2026 — and how investors can position themselves on the right side of the trend.

Why 2025–2026 Is a Turning Point for the Future of Bitcoin Mining

Several structural changes define the future of Bitcoin mining for the next two years:

1. Difficulty Growth Continues to Outpace Expectations

Even though difficulty normally increases in bull cycles, the rate of growth since 2023 has been historically strong. With more institutional-scale farms entering the network, difficulty is expected to keep rising through 2026.

Higher difficulty means:

• lower BTC output per machine

• longer ROI timelines for inefficient setups

• increased pressure on miners with expensive electricity

Only miners with stable low-cost electricity and efficient hardware remain profitable under these conditions.

2. Electricity Markets Are Becoming the Critical Factor

Across Europe and parts of Asia, domestic electricity prices continue to rise or fluctuate unpredictably. This creates systemic risk for miners operating in unstable grids.

In contrast, the future of Bitcoin mining favors:

• regions with cheap and stable electricity (Ethiopia, certain U.S. states)

• hosting models with fixed pricing

• industrial facilities built specifically for ASIC load

Electricity stability is now more important than Bitcoin price itself when calculating long-term profitability.

3. Institutional Mining Expansion Is Accelerating

Public mining companies and private funds are scaling aggressively. They are locking long-term electricity contracts and deploying large ASIC fleets with optimized infrastructure.

For individual investors, this means one thing:

You cannot compete using home electricity or unmanaged setups.

Professional hosting becomes the only viable path.

This is where BitmernMining enters: offering infrastructure that mirrors institutional standards but is accessible to individual miners.

The Opportunity: Why Bitcoin Mining Still Makes Sense in 2025–2026

Despite complexity and rising competition, the future of Bitcoin mining still carries major upside for the right type of investor. The opportunity is not gone — but it has shifted.

1. Mining Is Still the Only Way to Acquire BTC at Discount

When difficulty is high, inefficient miners lose money — but efficient miners in low-cost hosting produce BTC at a lower cost basis than buying on exchanges.

This benefit disappears completely for miners using unstable or expensive home power.

But in optimized hosting environments, mining remains a powerful long-term accumulation strategy.

2. ASIC Technology Is Becoming More Efficient

New-generation models (like those available at Bitmern Shop) have significantly better joules per terahash performance. They extend mining viability even as difficulty increases.

This plays a major role in the future of Bitcoin mining, because ASIC efficiency determines whether a miner can remain online for 24–36 months without reaching negative margins.

3. Hosting Providers Reduce Operational Risk

Modern mining hosting facilities eliminate the technical and operational burdens that were previously miner-killers:

• electrical load balancing

• heat and airflow management

• firmware optimization

• preventative maintenance

• uptime tracking

For the first time, non-technical investors can participate in mining by outsourcing the entire process to experts like BitmernMining.

The Risk: What Investors Must Avoid in 2025–2026

The future of Bitcoin mining is not risk-free. The largest dangers include:

1. Mining at Home or in Unstable Grids

This is the #1 reason miners fail.

Home circuits are not designed for constant high-load ASICs. Electricity volatility destroys ROI, and heat buildup shortens machine lifespan.

2. Buying Hardware Without Infrastructure Planning

Most investors buy a miner first — then try to find where to plug it in.

This approach is always a mistake.

The right process is:

hosting → electricity cost → infrastructure → miner

not the other way around.

3. Using Outdated or Inefficient ASICs

In the 2025–2026 environment, inefficient hardware becomes unprofitable extremely fast.

Only next-generation ASICs remain competitive long-term.

How BitmernMining Fits Into the Future of Bitcoin Mining

BitmernMining is built exactly for the challenges that define the future of Bitcoin mining. The company focuses on:

• stable, low-cost electricity in Ethiopia and the USA

• professional setup, installation, and maintenance

• uptime-first operations

• a 95% minimum operating rate

• portfolio-scale hosting for both small and large investors

Bitmern Mining removes the risks that destroy most mining operations and turns mining into a managed, predictable asset class rather than a technical experiment.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

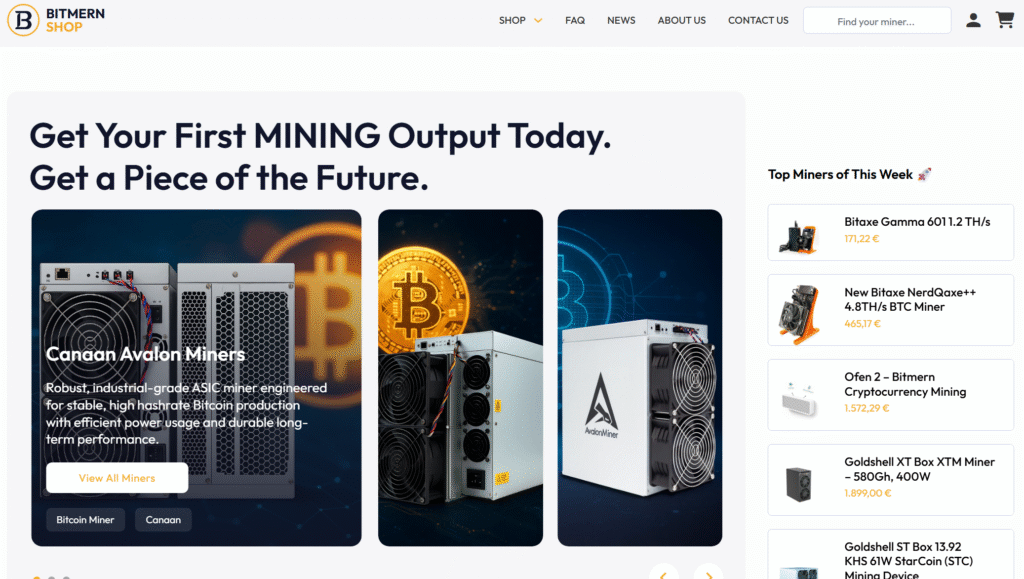

Hardware Matters: Bitmern Shop as the Trusted Source

The future of Bitcoin mining increasingly depends on ASIC efficiency.

Bitmern Shop provides:

• the newest-generation miners

• verified equipment

• safe logistics

• hardware selected for long-term difficulty cycles

You can explore the catalog here:

https://shop.bitmernmining.com

The right hardware paired with the right hosting is the formula for mining success in 2025–2026.

The Real Answer: Opportunity or Risk?

The future of Bitcoin mining is:

An opportunity for investors who:

✔ use low-cost managed hosting

✔ choose efficient ASICs

✔ avoid electricity volatility

✔ think in 24–36 month cycles

✔ build BTC position through long-term accumulation

A risk for investors who:

✘ mine from home

✘ use old hardware

✘ ignore electricity stability

✘ treat mining as short-term speculation

Mining has not become worse — it has simply become more professional.

Conclusion: Mining in 2025–2026 Rewards Strategic Investors

The future of Bitcoin mining will be shaped by electricity stability, ASIC efficiency, and professional hosting infrastructure. Those who position themselves correctly will continue to acquire BTC below market cost and benefit from long-term block reward cycles.

For investors ready to mine without operational risk:

BitmernMining.com — professional hosting with stable electricity

Shop.BitmernMining.com — next-gen ASICs for 2025–2026 deployment

Mining is no longer a hobby.

It’s an infrastructure-backed investment — and Bitmern is built for exactly this future.