Block rewards are the lifeblood of Bitcoin mining—miners receive newly minted bitcoins (plus transaction fees) for validating and adding new blocks to the chain. But these rewards are not constant; they shrink over time on purpose. Understanding why and how is essential for any serious miner.

What Are Block Rewards?

When a miner successfully mines a block, they receive:

- Block subsidy — new bitcoins created by protocol

- Transaction fees — fees from the transactions included in that block

That total is the “block reward.”

The block subsidy component is what changes over time, through a predetermined schedule built into Bitcoin’s protocol.

Why Do Block Rewards Shrink?

Shrinking block rewards is a core design choice by Satoshi in the Bitcoin protocol. The reasons include:

- Controlled supply & scarcity

Bitcoin has a fixed maximum supply of 21 million coins. To avoid infinite inflation and to mimic scarcity (like gold), the reward must decline over time. - Halving mechanism

Every 210,000 blocks (roughly every four years), the block subsidy is cut in half. This is called a halving. - Transition to fee-based security

As block rewards approach minimal levels, transaction fees become more significant. Eventually, miners will rely more on transaction fees for incentive to secure the chain. - Incentives for innovation & efficiency

Shrinking rewards force miners (and hosting services) to optimize—use better hardware, reduce energy cost, improve uptime—to remain profitable.

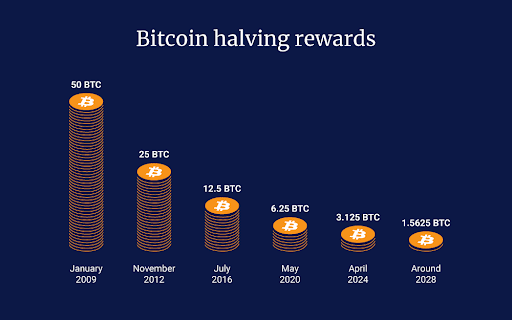

Historical Reward Shrinks: A Quick Timeline

- At Bitcoin’s launch (2009), the block subsidy was 50 BTC per block.

- Subsequent halvings reduced it to 25, then 12.5, then 6.25 BTC, and most recently to 3.125 BTC in April 2024.

- The next halving is expected in 2028, when the block reward drops to 1.5625 BTC.

What Shrinking Rewards Mean for Miners

- Lower margin for inefficient operations

As block subsidy shrinks, miners with high power costs or inefficient rigs risk becoming unprofitable if they don’t optimize. - Transaction fees gain importance

Over time, fees will make up a bigger share of miner income, especially in high-usage periods. Bitmern already notes that as block rewards decline, transaction fees become more crucial in overall earnings. - Pressure to upgrade hardware & efficiency

The incentive to deploy more efficient ASICs (lower watts per hash) increases as the reward per block falls. Bitmern’s emphasis on efficient hardware is directly aligned with this trend. - Long-term dependence on network usage

As subsidy disappears, network activity (transactions, fees) must stay strong for miners to remain compensated.

How Bitmern Helps Navigate Shrinking Rewards

Bitmern’s model is designed to mitigate the risks of declining block subsidies:

- Efficient, high-performance hardware: Helps maintain profitability even as block rewards shrink.

- Low-cost energy sites (Ethiopia, U.S.) reduce the impact of shrinking rewards.

- Maximized uptime & monitoring: Ensure every possible earning moment is captured.

- Focus on fee income & diversification: As rewards drop, fee income and operational efficiency become key.

The Bottom Line

Shrinking block rewards are essential to Bitcoin’s economic model. They preserve scarcity, control inflation, and push mining toward innovation and efficiency. For miners and hosting operators, adapting to this dynamic is not optional—it’s central to survival.