What Is CoinTracker and Why Is It Important?

What is CoinTracker? It’s a powerful portfolio tracking and crypto tax management tool designed to simplify cryptocurrency reporting for individuals and businesses. In a world where every crypto transaction could trigger a taxable event, CoinTracker helps users automatically track their gains, losses, and income across all wallets and exchanges. This makes tax filing more accurate and less stressful, helping crypto investors avoid penalties while maximizing deductions and savings.

How Does CoinTracker Work?

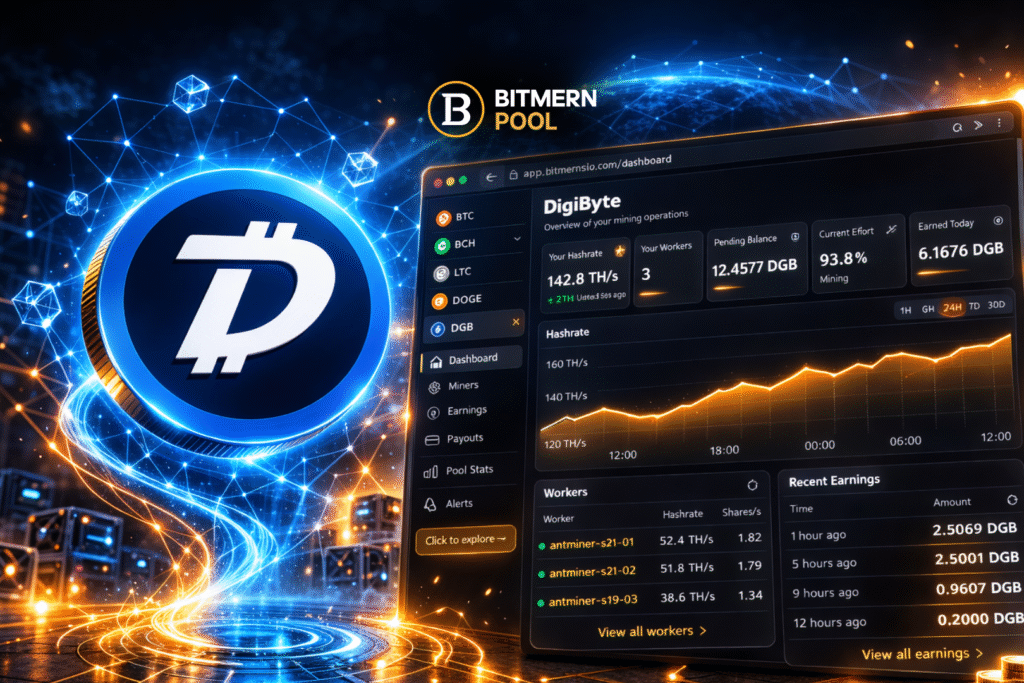

Understanding how CoinTracker works is key to appreciating its value. CoinTracker connects to your wallets and exchange accounts via APIs or manual CSV uploads. It pulls in your transaction history, calculates your cost basis, tracks capital gains and losses, and generates tax forms such as IRS Form 8949. It also provides real-time portfolio valuations. This automation is crucial for active investors who might conduct hundreds or even thousands of transactions each year. Services like Bitmern Mining similarly focus on making crypto operations more efficient through streamlined infrastructure and management.

What Features Make CoinTracker Stand Out?

Several features distinguish CoinTracker from manual tracking or other platforms:

- Auto-import of transactions from hundreds of exchanges and wallets

- Real-time portfolio tracking with market price updates

- Accurate capital gains and loss calculations

- DeFi, NFT, and mining income tracking

- One-click tax filing integration with TurboTax and other tax software

These features save users time, prevent costly reporting errors, and provide a clear, consolidated view of crypto holdings, whether mined through personal mining farms or acquired through traditional exchanges.

Who Should Use CoinTracker?

CoinTracker is useful for a wide range of users:

| User Type | Why It Helps |

|---|---|

| Active Traders | Tracks complex trade histories automatically |

| Casual Investors | Simplifies yearly tax filing |

| Miners | Calculates both mining income and subsequent gains |

| NFT Enthusiasts | Tracks purchase and sales across platforms |

| DeFi Participants | Monitors staking, lending, and yield farming |

Anyone engaging with cryptocurrency, whether mining, trading, or earning through DeFi, can benefit from understanding what is CoinTracker and incorporating it into their financial management tools.

How Does CoinTracker Help With Crypto Taxes?

One of the biggest benefits when asking what is CoinTracker lies in its tax automation capabilities. CoinTracker automatically organizes your transactions, calculates your taxable events, and generates ready-to-file forms based on local tax rules. It supports cost basis methods like FIFO (First-In-First-Out) and LIFO (Last-In-First-Out), helping investors optimize for the lowest possible tax liability. This ease of use can be a game-changer, especially for those mining crypto with operations supported by mining infrastructure management.

Is CoinTracker Secure?

Security is a top priority for any crypto tracking tool. CoinTracker does not take custody of your assets—it simply reads transaction history. All sensitive information is encrypted, and API keys are used in read-only mode, meaning CoinTracker cannot move or alter your crypto. This layered security model ensures that even active users mining or trading thousands of coins, possibly using solutions like miner purchase assistance, have peace of mind about their data.

How Much Does CoinTracker Cost?

CoinTracker offers a range of pricing options:

| Plan | Cost | Best For |

|---|---|---|

| Free | $0 | Beginners with few transactions |

| Hobbyist | ~$59/year | Occasional traders |

| Premium | ~$199/year | Active traders and miners |

| Custom Plans | Varies | Businesses and high-frequency users |

Higher-tier plans unlock more features, like DeFi and NFT tracking. Investing in CoinTracker often pays for itself in the form of reduced tax liabilities and stress-free reporting.

Can CoinTracker Handle Mining Income?

If you’re wondering what is CoinTracker’s approach to mining income, the answer is: it’s fully integrated. You can manually label incoming crypto transactions as mining rewards, ensuring they are categorized as ordinary income. Then, when you sell the mined crypto, CoinTracker will automatically calculate the capital gain or loss based on your previously recorded income basis. This dual-layer tracking is critical for miners running setups with companies like Bitmern Mining Services.

What Are the Limitations of CoinTracker?

While powerful, CoinTracker does have a few limitations:

- Complicated DeFi or NFT portfolios might still require manual edits.

- High-volume traders may find syncing thousands of transactions slow without premium support.

- Certain small exchanges may not yet have full API integration.

Still, for 95% of crypto users—including active traders, long-term holders, and miners—CoinTracker is an invaluable tool that simplifies the complex world of crypto taxation.

Why Should You Start Using CoinTracker Now?

Now that you know what is CoinTracker, it’s clear why getting started sooner is better. With crypto regulations tightening globally, tax authorities are expecting more detailed, accurate reporting than ever. CoinTracker’s automation saves time, minimizes risk, and maximizes savings. Whether you’re running a mining farm through Bitmern Mining or casually buying Bitcoin, having a professional tracking system in place is the smartest move for 2025 and beyond.

According to Wikipedia, the complexity of crypto taxation will only increase, making early organization critical to future success.