Table of Contents

Bitcoin mining is not a short-term trade, yet many new entrants approach it as if it were. They buy hardware during bull markets, expect immediate returns, and panic when conditions shift. This mindset consistently leads to losses, not because mining is unprofitable, but because it is fundamentally misunderstood.

Bitcoin mining is an infrastructure business. Like energy, data centers, or logistics, it rewards operators who think in years, not weeks. Short-term speculation and long-term mining economics do not operate under the same rules.

This article explains why mining cannot be treated like a short-term trade and how professional operators, including Bitmern Mining, structure mining as a long-term, cash-generating asset.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

The Common Misconception: Mining Like a Trade

Most short-term thinking comes from comparing mining to buying Bitcoin directly. Traders buy BTC, wait for price appreciation, and exit. Some assume mining works the same way: buy hardware, wait a few months, and sell the rewards.

Mining does not behave like this.

A miner’s return is influenced by:

- Network difficulty

- Uptime consistency

- Electricity pricing

- Infrastructure efficiency

- Hardware lifecycle

- Hosting reliability

None of these variables stabilize in a few weeks or months.

Mining is production, not speculation.

Bitcoin Mining Is a Capital Deployment, Not a Flip

When capital is deployed into mining, it is converted into:

- Physical hardware

- Power commitments

- Hosting agreements

- Operational risk exposure

Unlike trading, capital is not liquid. ASICs cannot be instantly sold at fair value during market stress. Facilities cannot be turned on and off without cost. Power contracts remain active regardless of Bitcoin’s price.

This is why bitcoin mining is not a short-term trade. The exit friction alone makes short-term thinking structurally flawed.

Difficulty Adjustments Punish Short-Term Thinking

Bitcoin’s difficulty adjusts roughly every two weeks. When new hashpower enters the network, difficulty rises and compresses margins.

Short-term miners often enter when profitability appears high, only to see margins shrink rapidly as difficulty catches up. By the time they react, the market has already repriced.

Long-term miners expect this. Their models assume:

- Rising difficulty

- Margin compression cycles

- Periods of reduced profitability

Mining rewards patience and operational discipline, not timing tricks.

Hardware Lifecycles Are Measured in Years

ASIC miners are not disposable tools. Their economic lifespan often spans:

- Multiple market cycles

- Several difficulty regimes

- Different firmware and efficiency phases

Short-term operators often underestimate:

- Maintenance costs

- Downtime impact

- Performance degradation

- Cooling and environmental stress

Professional operators optimize hardware across its full lifecycle, not just its first few months. This long-term optimization is where real returns are generated.

Uptime Compounds Over Time, Not Overnight

Uptime differences of just a few percentage points may seem minor in the short term. Over a year, they are decisive.

For example:

- 98% uptime vs 92% uptime can mean weeks of lost production

- Lost production is unrecoverable

- Downtime does not pause network difficulty

This is why infrastructure-first operators focus on:

- Redundant power

- Stable cooling

- Proactive maintenance

- 24/7 monitoring

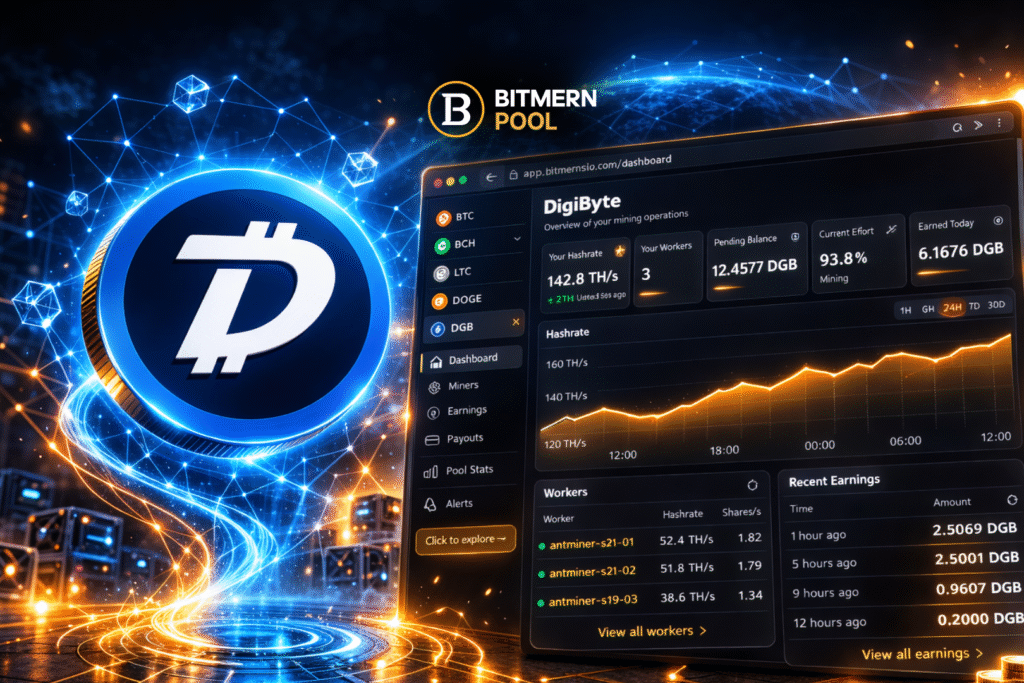

Bitmern Mining builds mining operations around uptime compounding, not short-term performance spikes.

Mining Revenue Is Smoother Than Bitcoin Price

Short-term traders react to price volatility. Miners experience something different.

Mining revenue is:

- Distributed daily

- Smoothed across time

- Less sensitive to intraday price moves

While price matters, production consistency matters more. Over long horizons, miners benefit from sustained network participation rather than timing exits.

This cash-flow dynamic is precisely why institutional players approach mining as infrastructure, not speculation.

Hosting Quality Determines Long-Term Outcomes

Short-term miners often choose hosting based on price alone. This is a costly mistake.

Low-cost hosting frequently hides:

- Power instability

- Hidden downtime

- Poor maintenance

- Weak response times

- Contractual rigidity

Professional hosting prioritizes:

- Predictable uptime

- Power stability

- Transparent SLAs

- Scalable capacity

Bitmern Mining’s hosting model is designed to support long-term miners who understand that infrastructure quality directly impacts multi-year returns.

Why Institutions Never Treat Mining as a Trade

Institutional miners do not enter and exit based on monthly price action. They:

- Plan multi-year deployments

- Secure long-term power

- Optimize capital efficiency

- Hedge operational risks

They understand that mining profitability emerges from execution, not timing.

Retail miners who adopt this same mindset dramatically increase their survival rate.

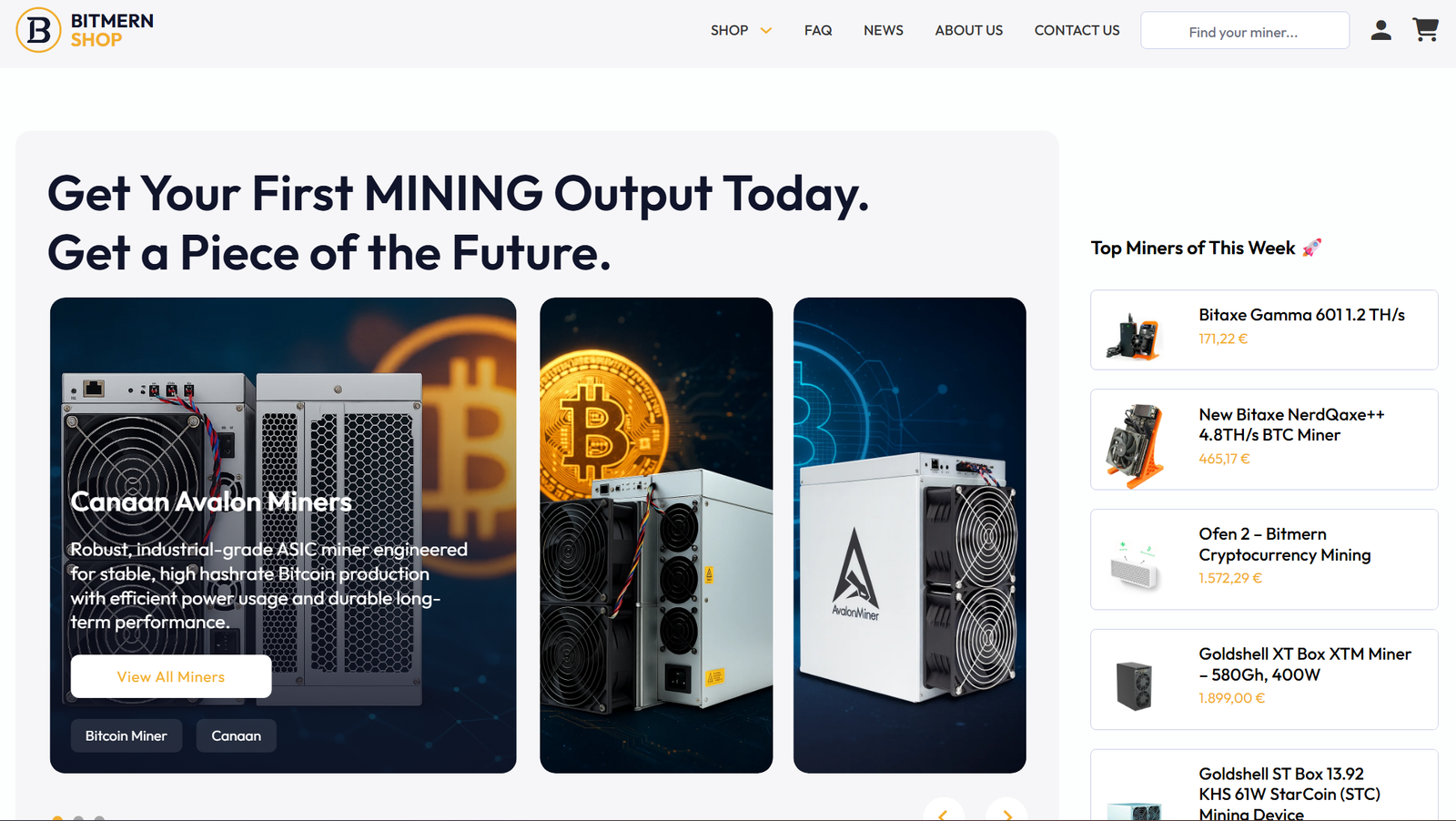

The Role of the Bitmern Shop in Long-Term Mining

The Bitmern Shop is built specifically for miners who think long-term.

Through shop.bitmernmining.com, clients can:

- Purchase verified mining hardware

- Avoid gray-market risks

- Deploy with Bitmern hosting or self-host

- Scale progressively instead of all at once

This structure supports disciplined growth, not speculative overexposure.

Why Bitcoin Mining Is Not a Short-Term Trade, Revisited

To summarize:

- Mining capital is illiquid

- Difficulty adjusts against short-term entrants

- Hardware rewards long-term optimization

- Uptime compounds slowly but powerfully

- Hosting quality defines outcomes

- Institutions treat mining as infrastructure

Bitcoin mining is not a short-term trade because the system itself is designed to punish impatience and reward operational excellence.

Final Thought: Mining Rewards Builders, Not Traders

Bitcoin mining sits at the intersection of energy, infrastructure, and finance. Those who approach it like a trade are filtered out quickly.

Those who approach it like a business build durable returns.

Bitmern Mining exists to support that second group.

For miners focused on long-term performance, infrastructure reliability, and scalable growth, mining remains one of the most misunderstood but powerful strategies in the Bitcoin ecosystem.