Table of Contents

Bitcoin has gone through multiple brutal bear markets.

Price collapses of 70–80%.

Media declaring Bitcoin “dead.”

Investors panic selling.

Yet one thing has never disappeared: mining.

Bitcoin mining survives every bear market, not because miners are lucky, but because the system itself is designed to endure price cycles. The operators who understand cost structure, infrastructure, and long-term incentives remain active long after short-term speculators exit.

This article explains why bitcoin mining survives bear markets, what separates surviving miners from those who fail, and how professional hosting and scale play a decisive role.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Bitcoin Mining Is Not a Price Bet

The first misunderstanding is thinking mining is purely a bet on Bitcoin’s short-term price.

It isn’t.

Mining is a production business, not a trading strategy.

Miners generate BTC continuously, regardless of daily price fluctuations.

This is why bitcoin mining survives bear markets while traders disappear.

When price falls:

- Traders lose capital immediately

- Miners continue producing BTC at a known operational cost

The difference is time horizon.

Fixed Production vs Variable Market Price

Bitcoin mining operates on a simple economic structure:

- Revenue: BTC earned per block share

- Costs: electricity, hosting, maintenance, hardware depreciation

Price volatility affects revenue valuation, but production continues.

This is critical. Bitcoin mining survives bear markets because production does not stop unless operating costs exceed sustainable thresholds.

Miners who:

- lock in stable electricity pricing

- operate efficient infrastructure

- maintain high uptime

can operate through downturns and accumulate BTC at lower effective costs.

Difficulty Adjustments Protect the Network and Miners

One of the most overlooked reasons bitcoin mining survives bear markets is difficulty adjustment.

When price drops:

- inefficient miners shut down

- network hash rate declines

- mining difficulty adjusts downward

This improves conditions for remaining miners.

Each surviving miner:

- earns a larger share of block rewards

- operates in a less competitive environment

- reduces marginal production cost per BTC

Bear markets cleanse excess capacity and reward disciplined operators.

Mining Favors Cost Control, Not Price Timing

Many miners fail because they focus on timing the market instead of controlling costs.

Bitcoin mining survives bear markets because successful miners prioritize:

- electricity price stability

- infrastructure reliability

- operational discipline

These factors matter more than price spikes.

This is why institutional miners do not chase bull market hype. They build operations that survive price compression.

The Role of Professional Hosting in Bear Markets

Home mining struggles during bear markets due to:

- volatile electricity costs

- limited cooling

- maintenance downtime

- regulatory uncertainty

Professional hosting changes that equation.

Bitcoin mining survives bear markets largely because industrial hosting allows:

- predictable operating expenses

- optimized power distribution

- professional maintenance

- reduced downtime

Facilities designed for mining keep machines running even when margins compress.

This is where serious operators separate from hobby miners.

Why Institutions Continue Mining Through Downturns

Institutions do not stop mining in bear markets. They often expand.

Why?

Because:

- hardware prices fall

- weaker competitors exit

- infrastructure becomes available

- long-term BTC accumulation improves

Bitcoin mining survives bear markets because capital with patience sees opportunity where others see fear.

Hardware Efficiency Is Only Part of the Equation

Efficient ASICs matter, but efficiency alone does not guarantee survival.

What matters more:

- uptime consistency

- power stability

- cooling efficiency

- professional monitoring

Bear markets expose weak setups quickly.

Miners running on unstable infrastructure are forced offline. Those on professional hosting continue producing.

Scaling During Bear Markets Is a Strategic Advantage

The best time to scale mining operations is often during bear markets, not bull runs.

Reasons:

- lower hardware prices

- reduced network competition

- better hosting availability

- improved long-term ROI

Bitcoin mining survives bear markets because scaling is possible when costs reset and discipline increases.

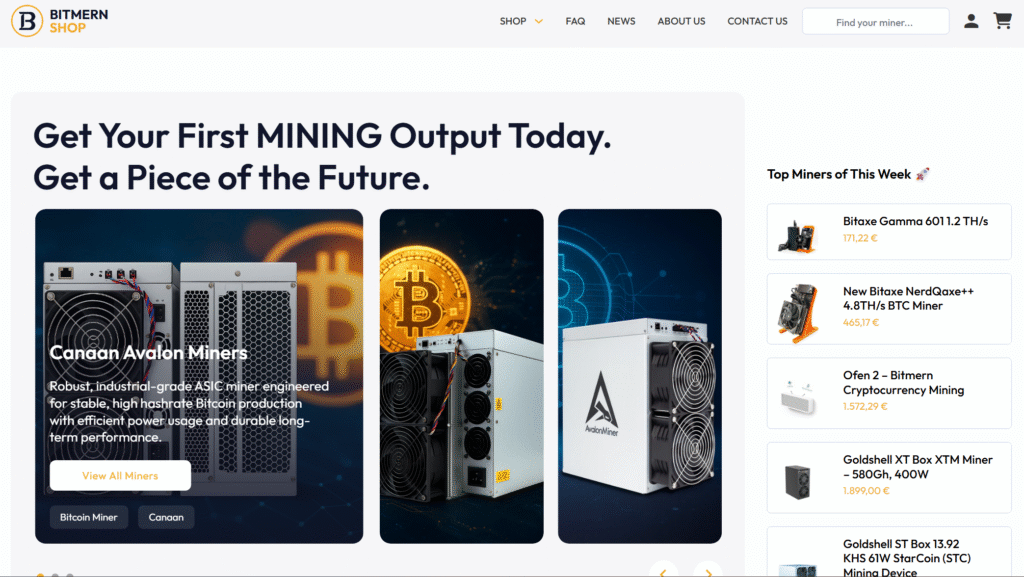

How Bitmern Fits Into This Reality

Bitmern Mining operates around one core principle:

Mining must survive full market cycles.

That means:

- stable electricity pricing

- professional infrastructure

- high uptime operations

- long-term viability, not short-term hype

This approach aligns perfectly with why bitcoin mining survives bear markets.

BITMERN CHRISTMAS MEGA DEAL: Scaling While Others Pause

Bear markets are when disciplined investors act.

Right now, Bitmern is running a Christmas offer designed specifically for scale-focused miners:

BITMERN CHRISTMAS MEGA DEAL

The biggest S21 Pro offer of the year

Buy 4 Bitmain S21 Pro

→ Get the 5th miner at 50% discount

Buy 9 Bitmain S21 Pro

→ Get the 10th miner completely free

Yes. A free S21 Pro.

No catch. No limit.

This offer is built for miners who understand that bitcoin mining survives bear markets and want to expand hash rate before the next liquidity cycle.

More details:

https://bitmernmining.com

To lock inventory before it runs out:

WhatsApp: https://wa.me/971585382409

Hardware Access Matters During Downturns

Bear markets are unforgiving to poor hardware decisions.

This is why sourcing miners through a trusted marketplace matters.

The Bitmern Shop provides:

- verified next-generation ASICs

- miners suited for industrial hosting

- models optimized for long-term operation

Hardware choices must align with infrastructure and market cycles.

Explore available miners here:

https://shop.bitmernmining.com

Why Bitcoin Mining Has Never Disappeared

Bitcoin mining has survived:

- multiple 80% price crashes

- regulatory uncertainty

- energy crises

- media skepticism

It survives because:

- it is essential to the network

- difficulty adjusts

- costs normalize

- disciplined operators remain

Bitcoin mining survives bear markets because it is built on incentives, not emotions.

Survival Is Not Accidental

Bitcoin mining does not survive bear markets by chance.

It survives because:

- production continues regardless of price

- difficulty adjusts to conditions

- infrastructure favors long-term operators

- disciplined miners plan across cycles

The miners who understand this don’t panic.

They build.

With the right hosting, hardware, and cost control, mining becomes one of the few crypto activities that functions in both bull and bear markets.

That is why bitcoin mining survives bear markets.

And that is exactly how Bitmern structures its infrastructure and offers.