Table of Contents

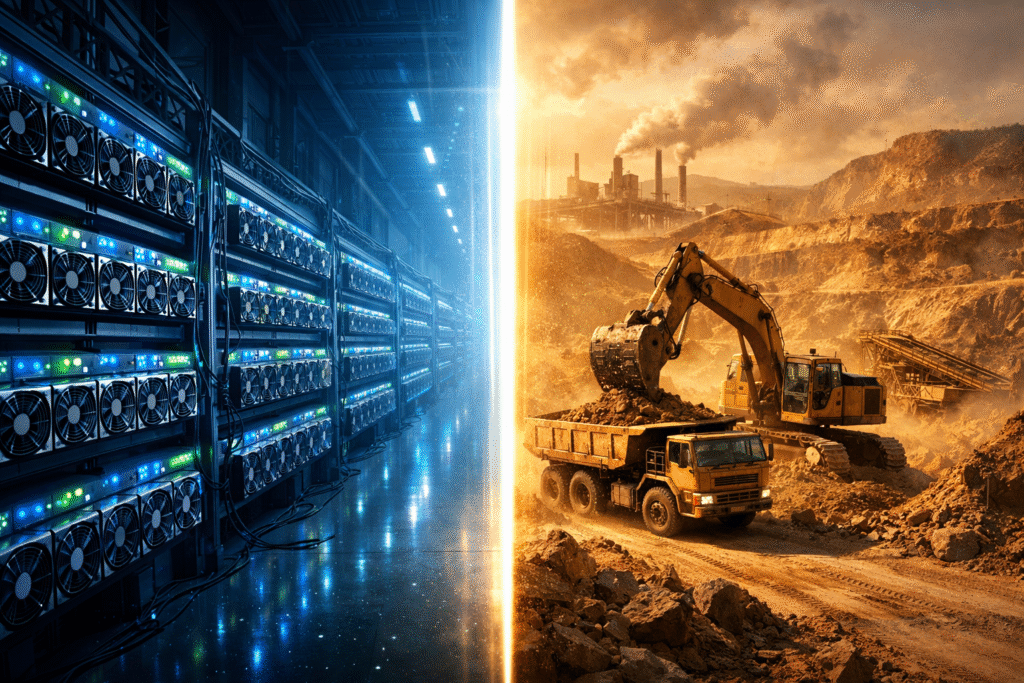

Bitcoin mining vs commodity production is one of the most misunderstood comparisons in modern financial markets.

At first glance, mining Bitcoin appears similar to extracting oil, gold, or copper. Energy goes in, raw material comes out, and producers sell into a global market.

In reality, Bitcoin mining operates under a completely different economic, technical, and structural model.

These differences explain why some miners survive multiple cycles while others disappear, why infrastructure matters more than location, and why institutional operators treat mining as digital manufacturing rather than traditional extraction.

Understanding this distinction is critical for anyone investing in mining infrastructure, hosting, or hardware today.

Why Bitcoin Mining Is Not Traditional Commodity Production

In traditional commodities, production is constrained by geology, geography, and physical scarcity.

In Bitcoin mining, production is constrained by network difficulty, software rules, and competitive computation.

Oil wells deplete. Gold veins run dry. Copper grades decline.

Bitcoin never runs out.

What changes is the difficulty of producing each unit, not the availability of the resource itself.

This single distinction reshapes everything from capital allocation to infrastructure design and long-term profitability.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Bitcoin Mining vs Commodity Production: The Core Structural Difference

At the heart of bitcoin mining vs commodity production lies a fundamental asymmetry:

• Commodity producers control output

• Bitcoin miners compete for fixed output

In oil, producers can drill more wells to increase supply.

In gold, higher prices justify lower-grade extraction.

In Bitcoin, total production is fixed by protocol.

No matter how many miners join the network, only a fixed number of bitcoins are issued per block.

This creates a zero-sum production environment where efficiency, uptime, and infrastructure determine survival.

Traditional Commodity Production Is Volume Driven

In traditional commodities, scale increases production linearly.

More rigs produce more barrels.

More mines produce more ounces.

More equipment increases output.

Producers compete by expanding capacity.

Costs matter, but volume ultimately drives revenue.

This encourages:

• aggressive expansion

• geographic consolidation

• leverage against reserves

• long project timelines

Once infrastructure is built, marginal production often declines slowly.

Bitcoin Mining Is Efficiency Driven, Not Volume Driven

Bitcoin mining behaves differently.

Adding more machines does not increase network production.

It only increases your share of competition.

This creates:

• constant margin compression

• hardware obsolescence risk

• difficulty escalation

• infrastructure sensitivity

Revenue is not proportional to installed capacity.

It is proportional to relative efficiency.

This is why professional miners prioritize:

• uptime stability

• cooling architecture

• power pricing structure

• firmware optimization

• maintenance discipline

At Bitmern Mining, infrastructure design focuses on maximizing effective production, not nominal hashrate.

Difficulty Adjustment Makes Mining Self-Correcting

Traditional commodity markets respond slowly to oversupply.

Oil gluts take years to rebalance.

Copper surpluses depress prices for cycles.

Bitcoin mining corrects every two weeks.

When miners leave:

• difficulty drops

• remaining miners earn more

• margins stabilize

When miners flood in:

• difficulty rises

• inefficient operators exit

• capital reallocates

This feedback loop makes mining a dynamic production system, not a static extraction industry.

It also explains why disciplined operators accumulate advantage during downturns.

Hardware Is Capital Equipment, Not Extraction Tools

In commodities, equipment extracts a physical resource.

In Bitcoin, hardware produces probability.

Each ASIC generates hash attempts, not guaranteed output.

Revenue is stochastic.

Variance matters.

This creates:

• production volatility

• payout smoothing via pools

• infrastructure risk exposure

• uptime sensitivity

Professional miners treat hardware as financial instruments, not machinery.

At the Bitmern Shop, hardware selection prioritizes:

• efficiency curves

• degradation profiles

• firmware compatibility

• cooling integration

• resale liquidity

Because in mining, the wrong hardware destroys capital faster than low prices.

Energy Is the Primary Raw Material

In commodities, energy is an input.

In Bitcoin mining, energy is the raw material.

Bitcoin is not mined from the ground.

It is converted from electricity into secured digital scarcity.

This changes:

• location strategy

• power contracting

• grid integration

• renewable utilization

• geopolitical exposure

Mining does not chase deposits.

It chases stable, low-cost, reliable power.

This is why Bitmern Mining operates infrastructure in power-optimized jurisdictions and integrates renewable and surplus energy sources for long-term stability.

Commodity Producers Hedge Price. Miners Hedge Survival.

Traditional producers hedge output prices.

Futures, options, and long-term offtake contracts protect revenue.

Bitcoin miners hedge operational risk:

• power price volatility

• uptime risk

• hardware failure

• hosting reliability

• network difficulty

Price matters, but infrastructure survival matters more.

This is why institutional miners focus on:

• uptime guarantees

• redundancy design

• cooling resilience

• rapid maintenance cycles

At Bitmern Mining, operational stability is treated as a financial control system, not a technical feature.

Inventory Works Differently

In commodities:

• inventory is stored physically

• costs accumulate

• quality degrades

• storage is expensive

In Bitcoin:

• inventory is digital

• no decay

• no storage loss

• global liquidity

Miners can:

• sell immediately

• hedge dynamically

• accumulate strategically

This makes mining closer to financial production than industrial extraction.

Capital Cycles Are Shorter and More Brutal

Commodity projects operate on decades.

Mining operates on months.

Hardware generations refresh annually.

Difficulty adjusts biweekly.

Margins compress quickly.

This rewards:

• disciplined scaling

• batch deployment

• infrastructure sequencing

• staged capital release

It punishes:

• aggressive expansion

• over-leverage

• slow deployment

• poor hosting choices

Bitmern Mining designs hosting and scaling frameworks that match mining’s compressed capital cycle rather than commodity timelines.

Why Infrastructure Dominates in Bitcoin Mining

In commodities, reserves dominate value.

In mining, infrastructure dominates survival.

The winners are not those with:

• most machines

• cheapest hardware

• highest leverage

They are those with:

• highest uptime

• lowest effective power cost

• best cooling efficiency

• fastest maintenance response

• disciplined expansion

This is why Bitmern Mining positions itself as an infrastructure-first mining company, not a hardware reseller.

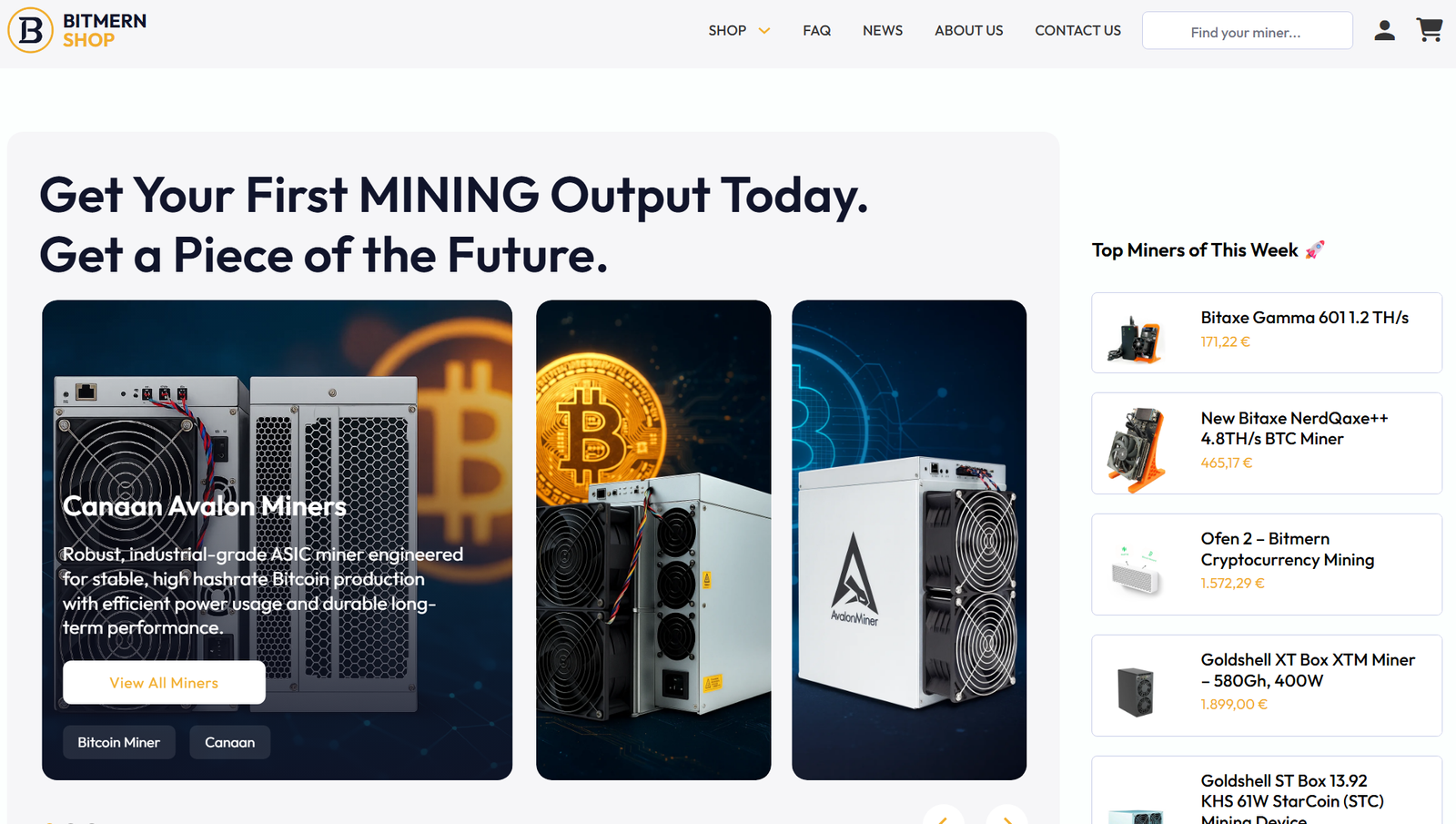

The Role of the Bitmern Shop in Modern Mining Production

As mining evolves away from commodity extraction and toward digital manufacturing, hardware sourcing becomes strategic.

The Bitmern Shop supports miners by offering:

• verified ASIC hardware

• batch-optimized purchasing

• infrastructure-compatible models

• hosting-ready configurations

• international logistics

Instead of treating hardware as inventory, professional miners treat it as infrastructure components within a larger production system.

Final Perspective: Mining Is Digital Manufacturing, Not Extraction

Bitcoin mining is not oil drilling.

It is not gold mining.

It is not commodity extraction.

It is digital manufacturing under competitive scarcity.

Where:

• production is probabilistic

• supply is fixed

• competition is global

• infrastructure is destiny

Understanding bitcoin mining vs commodity production is the difference between speculative mining and institutional mining.

And in this new production era, survival belongs to those who build systems, not those who chase machines.

At Bitmern Mining, infrastructure, hosting, and hardware are designed for exactly that reality.