Table of Contents

Ethiopia bitcoin mining hydropower is becoming one of the most discussed combinations in global mining, and not because of a marketing slogan. It is happening because Ethiopia has been building real generation capacity and, at the same time, a real mining and data-center industry has been forming around low-cost electricity. What has also happened, in parallel, is a wave of claims that the country is about to launch “government-backed” or “state-sponsored” Bitcoin mining.

Let’s separate what is confirmed from what is not, using only verifiable reporting.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

What is confirmed: Ethiopia’s hydropower buildout is real, and it changes the mining map

The single biggest driver behind the Ethiopia bitcoin mining hydropower thesis is the Grand Ethiopian Renaissance Dam (GERD). Ethiopia inaugurated the GERD in 2025, and the project has been positioned as a core pillar of economic development. Reuters reported the dam reached full capacity of 5,150 megawatts, making it Africa’s largest hydroelectric dam.

That matters for mining for a simple reason: large-scale, stable generation is the foundation for industrial power contracts. It does not automatically mean “free electricity,” and it does not automatically mean “state-run mining.” But it does support the idea that Ethiopia can run more energy-intensive industries than it could in the past, including data centers.

What is not confirmed: a clear, public “state-sponsored Bitcoin mining program”

The claim you shared says: “Prime Minister Abiy Ahmed announced plans for state-sponsored Bitcoin and crypto mining by harnessing surplus hydropower.”

Based on the reputable sources available in recent reporting that I can verify right now, I can confirm Abiy Ahmed has publicly framed GERD as a national development project with large-scale electricity benefits. What I cannot verify from a reliable primary news source is a specific, official announcement that Ethiopia is launching a government-run Bitcoin mining operation as a formal state program.

That does not mean Ethiopia is “anti-mining.” It means we should not label it “government-backed” unless there is a documented policy announcement, a tender, a budget line, a state-owned mining entity, or an official regulatory framework explicitly describing state sponsorship.

So the honest version is:

Ethiopia is scaling hydropower and enabling industrial electricity demand. Private-sector mining and data-center activity can logically expand in that environment. But “government-backed Bitcoin mining” is not a confirmed public program in the reporting we can cite today.

Why “surplus hydropower” does not automatically mean cheap, stable mining revenue

Even if Ethiopia has surplus generation at certain times, mining profitability is still shaped by delivery, not generation.

Here are the operational filters that decide whether Ethiopia bitcoin mining hydropower becomes real returns or just a good headline:

Contract structure and enforcement

Industrial power is never just a “rate.” It is a contract: availability, penalties, load profile, curtailment rules, maintenance windows, billing method, and dispute resolution. Two miners can pay the “same rate” on paper and have completely different outcomes in real operations.

FX and payment rails

Cross-border miners care about invoicing currency, settlement, escrow structures, and operational cash flow. That is not “bearish,” it is basic risk management.

Why Ethiopia is still attracting miners even without an official “state mining program”

Ethiopia does not need to run state-owned miners to become relevant. A country can become a mining hub simply by having:

- scalable generation

- predictable industrial power contracting

- available sites and infrastructure

- a growing ecosystem of operators, technicians, and import channels

That is why the Ethiopia bitcoin mining hydropower narrative persists. It is not about a press conference. It is about whether the infrastructure and commercial rails exist to support long-duration mining operations.

In practice, the market often moves first. Governments then respond later with clearer rules as the industry becomes too big to ignore.

The investor lens: why this matters for Bitcoin, not just miners

Mining is not only a business. It is the production layer of Bitcoin’s security budget. As block subsidies decline over time, the network increasingly relies on efficient miners who can survive volatility and keep hashrate resilient.

What Ethiopia represents, if done right, is a new supply of renewable-powered hashrate that can diversify global mining geography. That can be good for network robustness and good for miners who can execute with professional infrastructure.

But again, the key phrase is “if done right.” Mining does not reward optimism. It rewards execution.

How to approach Ethiopia bitcoin mining hydropower as a serious operator

If you want this topic to be more than content, here is the operational approach that separates professional miners from tourists:

1) Treat Ethiopia as an infrastructure decision, not a price decision

If your entire plan is “cheap power,” you are already late. The real edge is uptime, service response time, replacement logistics, firmware control, and stable power delivery.

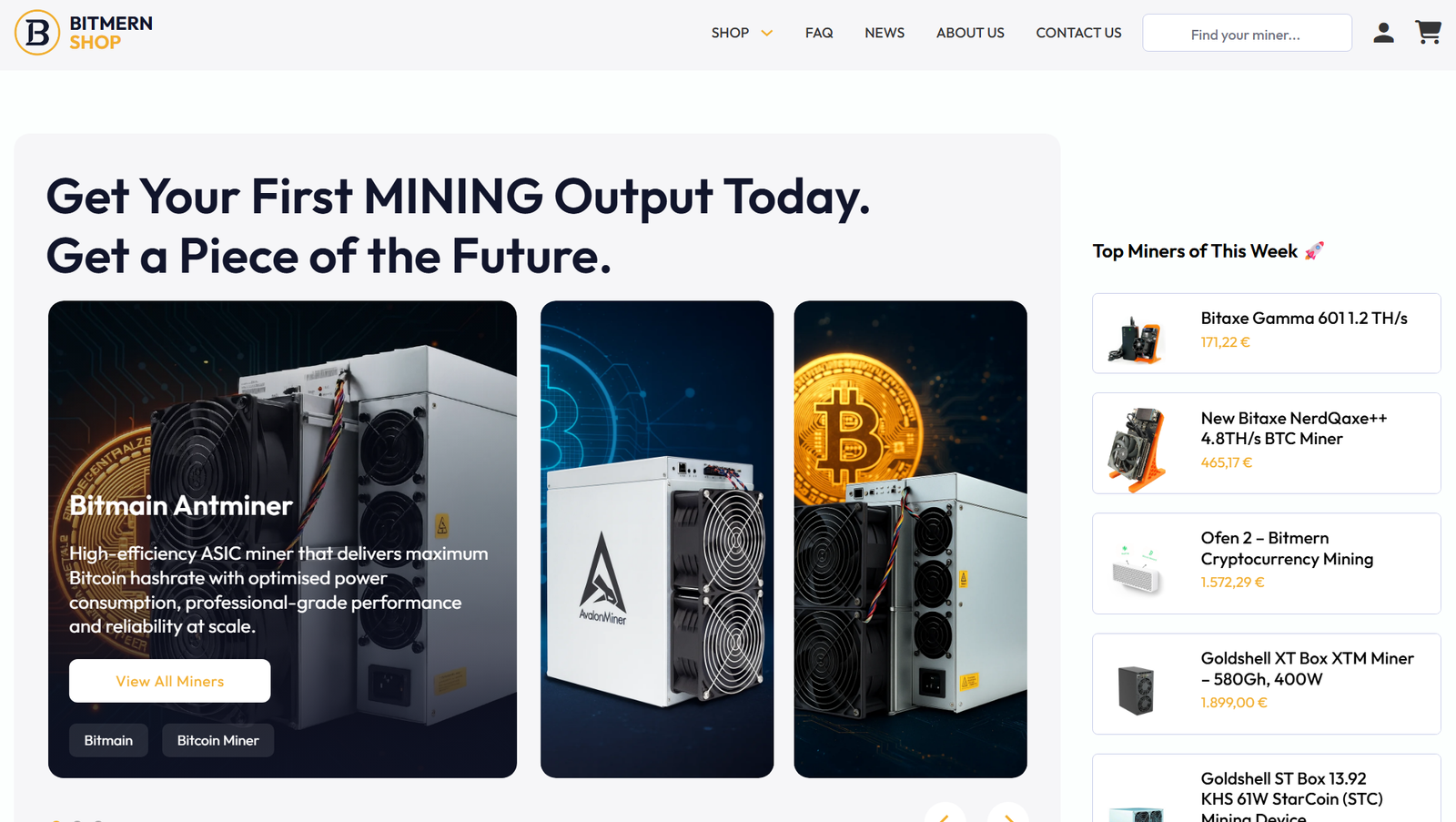

2) Buy hardware that matches the infrastructure reality

High-efficiency ASICs can help, but only if they are deployed into the right environment. Hashrate is not revenue if your environment causes throttling, failures, or frequent shutdowns.

If you want verified purchase routes and straightforward sourcing, the Bitmern Shop exists specifically for direct acquisition of miners with a clean buying flow. Start here: https://shop.bitmernmining.com/

3) Use hosting that is built for continuity, not marketing

The most expensive mining problems are not the visible ones. They are the hidden ones: delayed repairs, unclear responsibility, inconsistent reporting, and operational drift.

This is where professional hosting matters, especially in emerging mining regions where logistics and servicing discipline make or break returns.

If your goal is to explore hosting options and the operational layer behind them, review Bitmern Mining here: https://bitmernmining.com/

4) Model revenue like a business, not a chart

A real mining plan models:

- uptime assumptions

- downtime scenarios

- service response time

- curtailment windows

- difficulty changes

- pool strategy

- operating reserves

A miner who models this properly will not be surprised. A miner who does not will call it “bad luck.”

The bottom line

Ethiopia bitcoin mining hydropower is a real trend because the energy buildout is real and industrial demand is real. Reuters confirms the scale of GERD and the development focus around generation and electrification constraints.

What is not confirmed, based on verifiable reporting I can cite right now, is a formal public announcement of a state-run Bitcoin mining program as an official government-backed operation.

So the clean, 100% accurate takeaway is:

Ethiopia is becoming increasingly relevant to bitcoin mining because hydropower scale is growing and the market is responding. If you treat it as an infrastructure and execution play, it can be a serious opportunity. If you treat it as a headline trade, it becomes a risk.

And if your next step is hardware or hosting decisions, keep it simple: explore Bitmern Mining for professional options (https://bitmernmining.com/) and use the Bitmern Shop for verified hardware sourcing (https://shop.bitmernmining.com/).