Table of Contents

Government Bitcoin mining is no longer a theory. According to VanEck, it is already happening.

A single line from a recent VanEck analysis was enough to trigger intense discussion across crypto, energy, and geopolitical circles: up to 13 governments are already involved in Bitcoin mining with state support.

This is not a forward-looking hypothesis or a speculative scenario. According to VanEck, government bitcoin mining is an active, ongoing process, and it is far more widespread than most market participants realize.

What makes this development significant is not just the number. It is the nature of the involvement. VanEck is not referring to isolated experiments or symbolic gestures by crypto-friendly nations. The firm is pointing to state-linked Bitcoin mining, where governments directly or indirectly support mining operations through energy access, infrastructure, land, or sovereign investment structures.

This shifts the narrative around who participates in Bitcoin’s supply creation.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

What VanEck Actually Said and Why It Matters

The statement comes from a formal VanEck analysis examining Bitcoin’s role within global energy systems. In that context, the firm highlights that as many as 13 governments are already mining Bitcoin using surplus energy resources, rather than allowing that energy to go unused.

VanEck deliberately avoids publishing a definitive list of the countries involved. That omission is not accidental. The wording “with support from central governments” leaves room for a wide spectrum of involvement.

This includes:

- State-owned energy companies hosting mining infrastructure

- Sovereign wealth funds investing in mining operations

- Public-private partnerships where governments provide power, land, or grid access

- State-backed entities monetizing stranded or excess energy via Bitcoin mining

In other words, government bitcoin mining does not always look like a ministry running ASICs directly. In many cases, it operates quietly within existing energy and infrastructure frameworks.

The Confirmed Cases: El Salvador and Bhutan

While VanEck does not name all 13 countries, two cases are publicly documented and undisputed.

El Salvador

El Salvador has openly declared its Bitcoin mining activities using geothermal energy from state-owned volcanic power plants. The Bitcoin mined is added directly to national reserves, reinforcing the country’s strategy of treating Bitcoin as a strategic monetary asset.

This is not a pilot program. It is an integrated national policy linking energy production, mining, and sovereign balance sheets.

Bhutan

Bhutan represents a more understated but equally important example. Through Druk Holding & Investments, the country’s sovereign investment arm, Bhutan has been mining Bitcoin using surplus hydroelectric power for several years.

Unlike El Salvador, Bhutan did not market this initiative publicly. The activity became known through financial disclosures and investigative reporting, highlighting how quietly government bitcoin mining can operate.

Why Governments Mine Bitcoin Instead of Buying It

The natural question is obvious. Why would governments choose mining over purchasing Bitcoin on the open market?

The answer is energy.

For states with surplus, stranded, or underutilized electricity generation, Bitcoin mining functions as a conversion mechanism. It turns excess kilowatt-hours into a globally liquid, censorship-resistant asset.

Mining allows governments to:

- Monetize energy that cannot be exported efficiently

- Reduce waste in remote or overbuilt energy regions

- Build Bitcoin reserves at an effective cost below market prices

- Stabilize energy grids by providing flexible demand

In this context, Bitcoin is not viewed as a speculative asset. It is treated as an energy-derived commodity.

Understanding the “13 Governments” Figure

The figure cited by VanEck does not imply that 13 governments have publicly announced national Bitcoin mining programs.

More likely, it includes:

- State-owned utilities hosting mining farms

- Joint ventures between governments and private miners

- Sovereign funds allocating capital to mining infrastructure

- Strategic energy agreements tied to mining operations

This explains why most of these activities remain invisible to the broader market. They are not branded as crypto policy. They are energy policy decisions with financial outputs.

A New Class of Miners Enters the Network

Government bitcoin mining introduces a fundamentally different type of participant into the ecosystem.

Unlike private miners, states:

- Operate on multi-decade horizons

- Are less sensitive to short-term price volatility

- Often have structurally lower energy costs

- Can absorb longer periods of low profitability

This does not threaten Bitcoin’s decentralization. The protocol remains permissionless and neutral.

However, it does change the competitive landscape.

What This Means for Bitcoin Supply Dynamics

Bitcoin’s supply issuance is fixed at the protocol level. Government miners do not increase supply.

What they change is distribution behavior.

State-linked miners are less likely to:

- Panic sell during downturns

- Liquidate holdings to meet short-term obligations

- Exit mining during temporary margin compression

This introduces a layer of supply that behaves differently from leveraged or publicly traded miners. Over time, this can reduce sell pressure during stress periods.

While the market focuses on ETF inflows, this quieter accumulation layer may gradually influence supply dynamics.

Energy Sovereignty and Bitcoin Mining

For governments, Bitcoin mining is increasingly viewed through the lens of energy sovereignty.

Instead of exporting raw energy at low margins or letting excess capacity go unused, mining enables:

- Domestic monetization

- Strategic asset accumulation

- Infrastructure utilization optimization

This reframes Bitcoin mining as part of national energy strategy rather than purely financial speculation.

Why This Trend Favors Professional Mining Infrastructure

Government bitcoin mining is not about hobbyist setups. It relies on:

- Industrial-scale infrastructure

- High uptime requirements

- Long-term operational discipline

- Tight integration with energy systems

This environment favors professional operators who understand both mining economics and infrastructure execution.

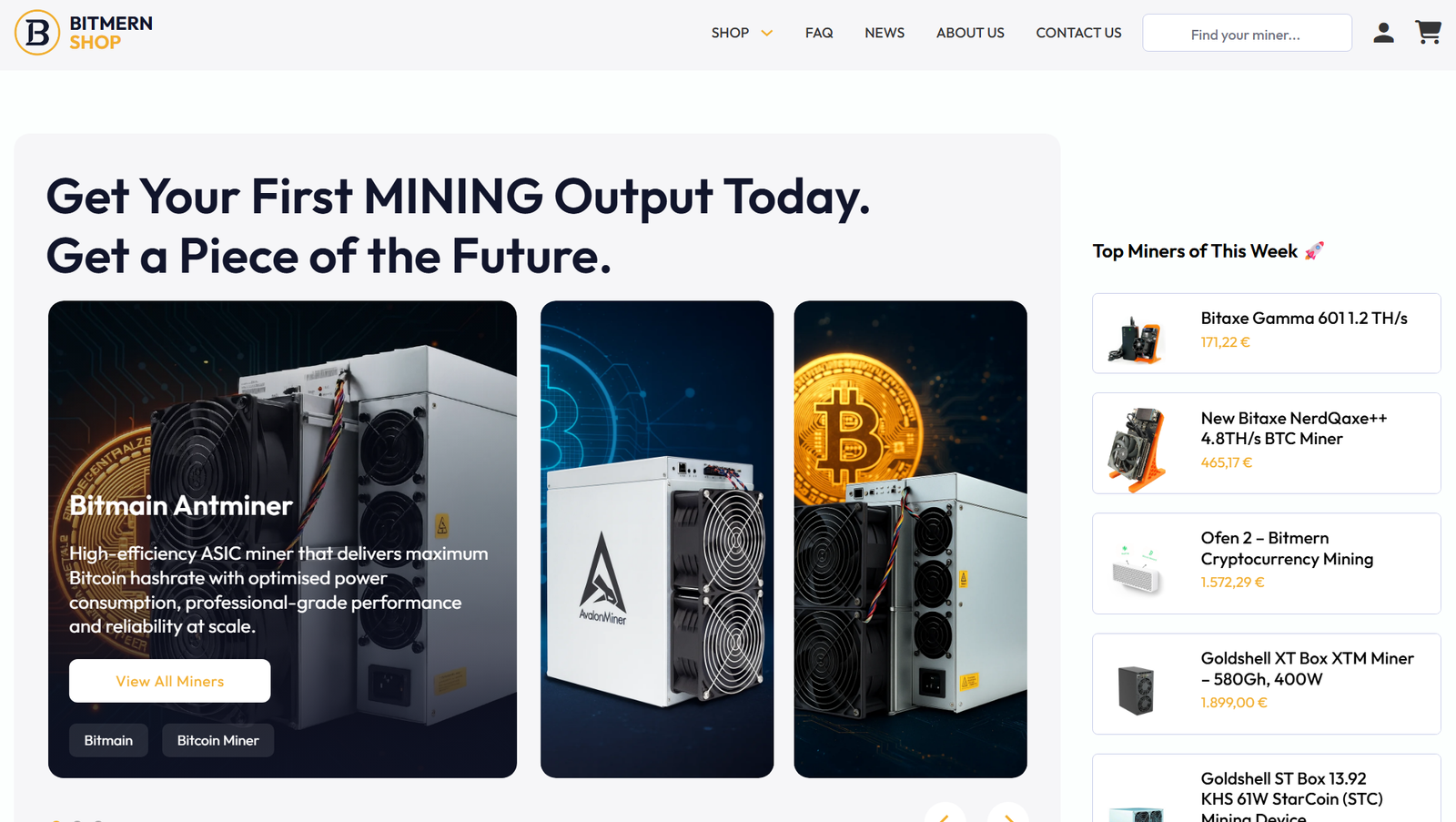

This is where companies like Bitmern Mining operate.

Bitmern Mining focuses on professionally managed, infrastructure-first mining solutions designed for long-term resilience rather than short-term cycles. You can explore their approach here:

https://bitmernmining.com/

Hardware Access Becomes Strategic

As state participation grows, access to reliable mining hardware becomes increasingly important.

Governments and institutional players prioritize:

- Proven ASIC reliability

- Predictable performance

- Long operational lifespans

- Supply chain consistency

Retail-grade or poorly supported hardware struggles in these environments.

The Bitmern Mining Shop focuses on curated mining hardware aligned with professional standards, supporting miners who want to operate sustainably alongside institutional and state-backed participants: https://shop.bitmernmining.com/

The Quiet Power Shift the Market Is Missing

While headlines focus on ETFs, flows, and price predictions, government bitcoin mining is building quietly in the background.

It does not move markets overnight.

It does not generate hype.

It does not need publicity.

But over time, it reshapes who produces Bitcoin, how it is held, and how supply behaves under stress.

Final Perspective

If VanEck’s analysis is accurate, Bitcoin has already entered a new phase.

It is no longer mined exclusively by private individuals, public companies, and pools. Governments are now participants, not regulators watching from the sidelines.

This does not compromise Bitcoin’s principles. It validates them.

Bitcoin remains neutral, blind, and mathematical. It allows anyone, including states, to compete on equal terms.

And in doing so, it continues to prove that power in Bitcoin is earned through execution, not permission.