Table of Contents

Growth vs overextension in mining is the single most misunderstood concept in Bitcoin operations.

Many miners believe expansion equals success, but in reality, the difference between disciplined growth and dangerous overextension determines who survives cycles and who disappears.

In Bitcoin mining, expansion is often mistaken for progress.

New miners associate growth with success. More machines, more megawatts, more hashrate. But history shows that most mining failures do not come from lack of ambition. They come from confusing growth with overextension.

The strategic difference between growth and overextension is not speed.

It is control.

In mining, growth strengthens your position.

Overextension silently destroys it.

And the line between the two is thinner than most operators realize.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

Why Scaling Is the Most Dangerous Phase in Mining

Mining is capital intensive, operationally complex, and brutally competitive. Every expansion decision introduces new layers of risk:

• Power contracts

• Cooling capacity

• Maintenance throughput

• Network stability

• Cash flow predictability

• Failure correlation

• Regulatory exposure

Growth amplifies performance.

Overextension amplifies fragility.

Most miners do not fail because they scale.

They fail because they scale before their infrastructure is ready.

What Strategic Growth Actually Means in Mining

Growth is not measured by how fast you add machines.

Strategic growth is defined by three conditions:

1. Capital Efficiency Improves as You Scale

In healthy growth:

– Cost per TH declines

– Uptime remains stable or improves

– Maintenance velocity scales with fleet size

– Power utilization becomes more efficient

– Revenue variance decreases

Growth should reduce risk per unit, not increase it.

If your risk per machine is rising as your fleet grows, you are no longer scaling.

You are overextending.

2. Infrastructure Leads Hardware, Not the Reverse

In disciplined operations:

– Power capacity is secured before deployment

– Cooling is validated before load increases

– Network topology is stress-tested

– Repair throughput is sized ahead of failures

– Monitoring systems are expanded first

Overextension happens when hardware arrives faster than infrastructure matures.

This is the most common fatal mistake in mining.

3. Cash Flow Remains Predictable

Strategic growth stabilizes revenue.

Overextension destabilizes it.

If expansion introduces:

– Larger payout variance

– Delayed break-even timelines

– Liquidity stress

– Forced asset sales

– Difficulty sensitivity

Then scaling is no longer a growth strategy.

It is a leverage trap.

What Overextension Looks Like in Practice

Overextension rarely announces itself.

It usually begins with optimism:

“We’ll fix the cooling later.”

“We’ll hire more technicians soon.”

“We’ll optimize firmware after deployment.”

“Power will stabilize next month.”

Then come the symptoms:

• Rising downtime

• Repair backlogs

• Hashrate volatility

• Unexpected throttling

• Increasing operational noise

• Declining margin quality

At this point, growth has already turned into structural risk.

Why Institutions Scale Slower Than Retail Miners

Retail miners often chase peak cycles.

Institutions chase survivability.

Professional miners expand slower because they understand one core truth:

Mining is not a growth race. It is a capital preservation business.

Institutional scaling prioritizes:

– Failure correlation control

– Geographic diversification

– Power redundancy

– Repair throughput

– Cash flow stability

– Regulatory insulation

They scale only when the entire system is ready.

Retail miners often scale when only the hardware is ready.

The Hidden Cost of Overextension: Failure Correlation

Overextension increases something far more dangerous than downtime:

correlated failures.

When too many machines share:

• The same cooling zone

• The same power feed

• The same firmware

• The same rack design

• The same maintenance schedule

Failures no longer occur randomly.

They occur in clusters.

Clustered failures are what turn small problems into operational crises.

Strategic growth reduces correlation.

Overextension concentrates it.

Why Overextension Destroys More Miners Than Bear Markets

Bear markets are visible.

Overextension is silent.

During downturns, disciplined miners survive because:

– Their cost structure is controlled

– Their uptime is stable

– Their capital is protected

– Their expansion was paced

Overextended miners fail because:

– Debt accumulates

– Repairs backlog

– Liquidity dries up

– Forced shutdowns begin

– Assets are sold at cycle lows

Most miners who disappear in bear markets did not fail because of price.

They failed because they scaled incorrectly in the bull market.

How Bitmern Mining Designs Growth Without Overextension

At Bitmern Mining, scaling is treated as an engineering and financial discipline, not a marketing exercise.

Growth decisions are guided by:

• Power margin availability

• Cooling headroom

• Repair throughput capacity

• Network redundancy

• Monitoring scalability

• Geographic risk balance

• Capital recovery timelines

This ensures that:

– Uptime remains stable above 96%

– Failure clusters are minimized

– Cash flow remains predictable

– Infrastructure leads hardware

Because sustainable mining is not about maximum hashrate.

It is about maximum control per unit deployed.

Learn more about disciplined infrastructure scaling: https://bitmernmining.com/

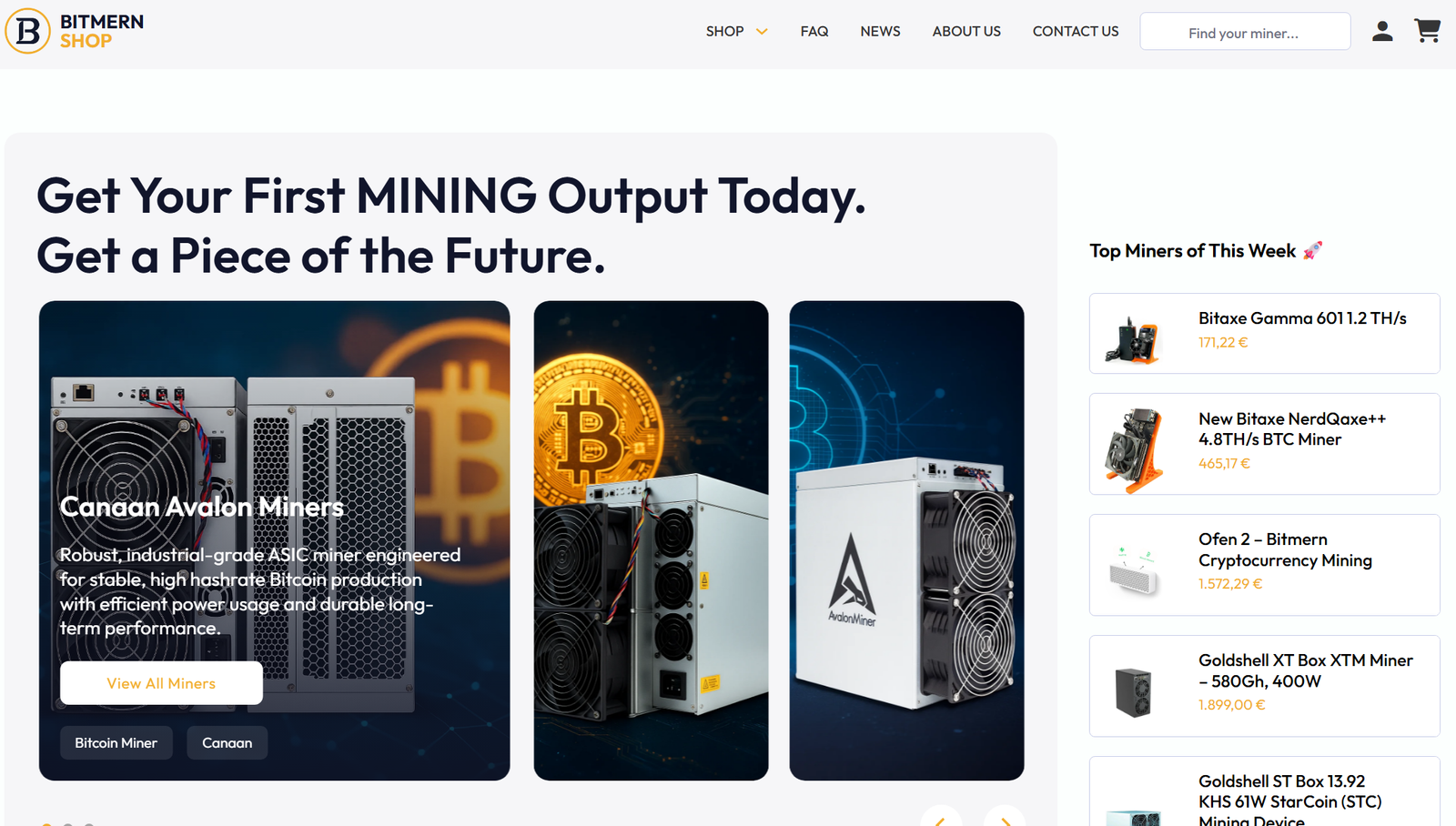

How the Bitmern Shop Enables Disciplined Expansion

Overextension often begins at the moment of hardware acquisition.

Buying mismatched generations, unverified units, or poorly refurbished miners dramatically increases:

• Failure rates

• Spare complexity

• Repair variance

• Firmware instability

• Maintenance friction

The Bitmern Shop is structured to support strategic growth, not reckless expansion.

It provides:

– Verified hardware

– Known efficiency profiles

– Predictable failure behavior

– Compatible firmware stacks

– Hosting-ready configurations

This allows miners to:

– Scale in controlled batches

– Reduce repair variance

– Maintain uniform fleet behavior

– Simplify operations

Explore disciplined expansion options here: https://shop.bitmernmining.com/

Growth Is Sequential. Overextension Is Simultaneous

One of the clearest differences between growth and overextension is sequencing.

Strategic growth follows this order:

- Power secured

- Cooling validated

- Network expanded

- Monitoring deployed

- Repair capacity scaled

- Hardware installed

Overextension reverses it:

- Hardware purchased

- Power stretched

- Cooling improvised

- Monitoring added later

- Repairs overwhelmed

- Revenue destabilized

Sequence determines survival.

Why Slower Growth Often Produces Higher Long-Term Returns

This is counterintuitive, but consistently true.

Miners who scale slower often generate higher lifetime returns because:

– They avoid forced shutdowns

– They minimize fire-sale liquidations

– They preserve capital through cycles

– They accumulate during capitulation

– They survive long enough to compound

Fast scaling looks impressive.

Slow scaling lasts.

The Strategic Test: Can Your Infrastructure Absorb Failure?

A simple rule separates growth from overextension:

If a single failure can materially damage your operation, you are already overextended.

Healthy growth means:

– Failures are isolated

– Redundancy absorbs shocks

– Repairs restore quickly

– Revenue remains stable

Overextension means:

– Failures cascade

– Downtime clusters

– Cash flow swings

– Risk compounds

Mining is not about avoiding failure.

It is about designing systems that remain stable when failure is inevitable.

Final Perspective: Growth Builds Businesses. Overextension Ends Them.

Every major mining collapse in the past decade followed the same pattern:

• Rapid expansion

• Infrastructure lag

• Rising variance

• Repair bottlenecks

• Liquidity stress

• Forced liquidation

The winners were not the ones who grew fastest.

They were the ones who never confused growth with overextension.

In mining, ambition without discipline is not progress.

It is delayed failure.

The miners who survive cycles are not those who chase scale.

They are those who scale only when the system is ready.

And that is the true strategic difference between growth and overextension.