Table of Contents

Location agnostic bitcoin mining is not a marketing phrase. It is a structural reality built into how Bitcoin mining works at a physical, economic, and network level. While most industries are constrained by geography, regulation, logistics, or consumer proximity, mining operates under a different set of rules. It does not need customers nearby, financial hubs, or developed infrastructure clusters. It needs only three things: energy, connectivity, and execution.

This distinction is why Bitcoin mining has quietly become one of the most globally flexible industries in the modern economy, even as many still misunderstand how and why it works.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

What “Location-Agnostic” Really Means in Mining

In most industries, location defines cost structure, market access, labor availability, and regulatory exposure. Manufacturing requires ports and supply chains. Finance requires legal frameworks and talent density. Data centers require proximity to networks and customers.

Bitcoin mining is different.

A mining operation does not sell to local consumers. It does not ship physical goods. It does not rely on regional demand. It contributes hashpower to a global network and receives compensation directly from the Bitcoin protocol.

The output is digital. The settlement is global. The rules are uniform.

This means that a mining facility in Ethiopia, Iceland, Texas, or rural South America competes on equal protocol terms with facilities anywhere else in the world.

Energy, Not Geography, Is the Primary Constraint

The dominant cost in mining is energy. Not rent. Not labor. Not logistics. Energy.

This single fact reshapes everything.

Mining gravitates toward:

- Surplus energy

- Stranded energy

- Underutilized generation

- Regions with energy oversupply or inefficiencies

That is why mining often appears in locations traditional industries ignore. Hydropower regions with excess capacity. Remote areas with seasonal overproduction. Developing grids that cannot export electricity efficiently.

In these environments, mining becomes a buyer of last resort for energy that would otherwise be wasted.

This is not theoretical. It is already happening at scale.

Why Bitcoin Mining Does Not Follow Traditional Industrial Clusters

Most industries cluster for efficiency. Silicon Valley for tech. Wall Street for finance. Shenzhen for manufacturing.

Mining does not benefit from clustering in the same way.

In fact, clustering often increases risk:

- Higher competition for energy

- Grid congestion

- Regulatory visibility

- Price sensitivity

Mining benefits from dispersion. Distributed operations reduce correlated risk and improve resilience. This is why professional mining strategies increasingly favor geographic diversification over concentration.

Location agnostic bitcoin mining is not about randomness. It is about strategic dispersion around energy availability.

The Network Does Not Care Where You Are

Bitcoin’s protocol is blind to geography.

It does not reward miners for being in developed countries. It does not penalize remote regions. It does not adjust rewards based on jurisdiction, labor costs, or infrastructure maturity.

A valid block from anywhere in the world is treated exactly the same.

This neutrality is one of Bitcoin’s most underappreciated design features. It removes location-based privilege and enforces a purely computational competition.

As long as a miner can connect reliably and perform the work, the network accepts the result.

Connectivity Requirements Are Minimal Compared to Other Industries

Another reason mining is location agnostic is its low connectivity requirement.

Mining does not require low-latency, high-bandwidth infrastructure. It requires stable, consistent connectivity, not speed. Even relatively basic internet connections are sufficient to operate profitably.

This opens doors to regions where:

- Fiber infrastructure is limited

- Enterprise-grade connectivity is unavailable

- Traditional data center development would be impossible

Mining can operate where other digital industries cannot.

Labor Is a Secondary Variable, Not a Limiting Factor

Unlike manufacturing or services, mining does not scale with labor. Once infrastructure is deployed, ongoing operations require minimal human input.

This reduces dependence on:

- Skilled local labor markets

- Wage competition

- Population density

Remote monitoring, automation, and standardized hardware have made mining increasingly independent from local workforce availability.

This further decouples mining success from geography.

Regulation Shapes Risk, Not Capability

Regulation matters, but it does not determine whether mining can operate. It determines how it should be structured.

In some regions, regulation increases cost. In others, it introduces uncertainty. In still others, it creates opportunity.

The key point is this: regulation does not eliminate mining’s location-agnostic nature. It simply shifts where capital prefers to deploy at a given moment.

Mining moves faster than regulatory harmonization. This dynamic is why mining geography is fluid, not fixed.

Infrastructure Is the Real Differentiator

If location does not define success, what does?

Infrastructure.

Successful miners invest in:

- Power stability

- Cooling design

- Electrical engineering

- Monitoring systems

- Redundancy planning

These factors matter more than country, climate, or proximity to financial centers.

This is where professional operators separate themselves from hobbyists.

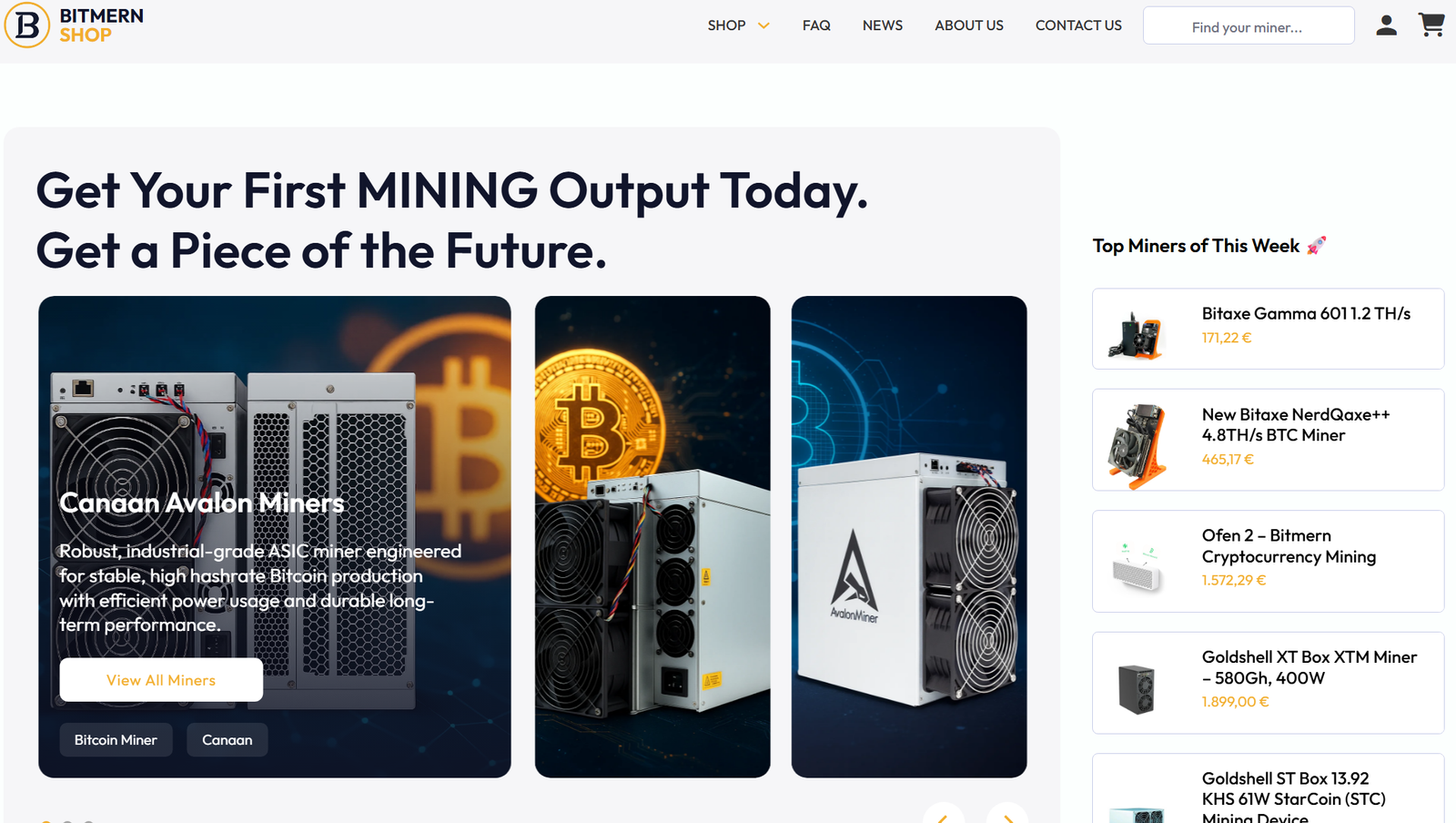

How Bitmern Mining Leverages Location-Agnostic Advantages

Bitmern Mining is built around this exact principle.

Rather than tying mining outcomes to a single region or narrative, Bitmern focuses on:

- Energy-first site selection

- Infrastructure standardization

- Risk-managed geographic deployment

- Operational consistency across locations

This approach allows clients to benefit from location agnostic bitcoin mining without taking on the complexity of site sourcing, power negotiation, or infrastructure execution themselves.

Mining is not about where you are. It is about how you operate.

Hardware Access Matters More Than Geography

Even in a location-agnostic(overly repetitive word here?) industry, hardware quality and access remain critical.

Efficient ASICs, proper power delivery, and thermal management define profitability more than latitude or longitude.

This is where the Bitmern Mining Shop plays a critical role.

Through the shop, miners gain access to:

- Verified mining hardware

- Deployment-ready equipment

- Components suited for diverse environments

Whether operating in hot climates, remote regions, or emerging energy markets, hardware reliability determines outcomes.

You can explore available mining equipment here: https://shop.bitmernmining.com/

Why This Advantage Will Matter Even More Going Forward

As global industries face:

- Rising energy volatility

- Supply chain fragmentation

- Regulatory divergence

- Geopolitical uncertainty

Industries that can operate independently of geography gain a structural advantage.

Bitcoin mining already operates this way.

It converts energy into a globally liquid asset without requiring geographic alignment between production and consumption.

Few industries can claim the same.

Final Perspective: Mining Is Global by Design

Bitcoin mining was never meant to belong to a place. It belongs to the network.

That design choice has produced one of the most location-independent industries ever built. An industry where opportunity flows to energy, not borders. Where execution matters more than address. Where infrastructure beats geography.

Location agnostic bitcoin mining is not a trend. It is a permanent feature of the system.

And operators who understand this reality are the ones positioned to survive every cycle.