In Bitcoin mining, electricity cost can make or break profitability. Bitmern strategically operates in two standout locations—Ethiopia and Indiana (USA)—to optimize power costs and boost returns for its clients.

Ethiopia: Hydropower’s Hidden Advantage

- Ultra-low electricity rates: Around 3.2 ¢/kWh—a fraction of typical U.S. commercial rates.

- Surplus hydroelectric power is redirected from the Grand Ethiopian Renaissance Dam (GERD) to mining, turning what would be wasted energy into a $55M+ revenue stream for EEP in 10 months.

- This enables Bitmern to host both top-tier ASICs and older-generation models, extending their lifecycle and maintaining high ROI.

- Due to cooler high-altitude climate and renewable power, miners run efficiently with reduced cooling costs

USA: Indiana’s Data-Center Ready Setup

- Stable, competitive power around 11–12 ¢/kWh for large-scale operations.

- Supportive infrastructure: fast grid connections, reliable power, and declared state incentives .

- Data-center-level cooling and security ensure consistent uptime and lower operational risks.

Bitmern’s Dual-Region Strategy

| Region | Electricity Cost | Advantages |

|---|---|---|

| Ethiopia | ~3.2 ¢/kWh | Renewable hydro, cooler climate, rejuvenates aging ASICs |

| Indiana, USA | ~11–12 ¢/kWh | Stable grid, data-center infrastructure, regulatory clarity |

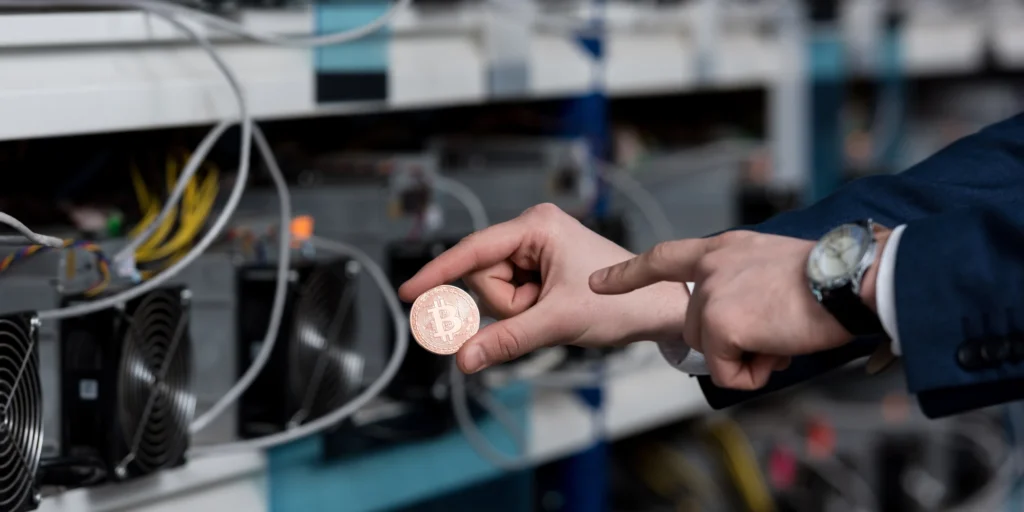

Why Power Costs Dominate Mining ROI

- Electricity accounts for ~70–80% of operational expenses.

- By sourcing power below industrial U.S. averages, Bitmern maximizes profitability across all hosted rigs.

Final Takeaway

Power cost defines mining success.

Bitmern’s operations in hydropower-rich Ethiopia and grid-ready Indiana offer clients unmatched advantages:

- Lower input costs

- Longer asset life

- Higher and more reliable returns

Ready to capitalize on low-cost mining?

Explore Bitmern’s hosting plans in Ethiopia and the USA:

bitmernmining.com