Table of Contents

Scaling slower increases total returns in Bitcoin mining far more often than aggressive expansion. This idea contradicts the instinct of many miners who believe that faster growth automatically leads to higher profits. In reality, rapid scaling tends to magnify mistakes, while disciplined, controlled growth compounds efficiency.

Bitcoin mining is not a race to deploy the most machines as quickly as possible. It is a long-term infrastructure game where capital preservation, uptime consistency, and operational discipline determine who survives and who disappears.

This article explains why slower scaling often leads to higher total returns and how professional operators like Bitmern Mining structure growth to maximize long-term outcomes.

For mining fundamentals and global industry context:

https://bitcoin.org/en/bitcoin-paper

The Psychological Trap of Fast Scaling

Fast scaling feels productive. More machines, more hashrate, more perceived income. This logic works in theory but breaks down in real-world mining operations.

Rapid expansion often hides:

- Infrastructure mismatches

- Power bottlenecks

- Cooling constraints

- Maintenance overload

- Cash flow stress

These issues do not appear immediately. They emerge weeks or months later, when capital is already locked in and difficult to reverse.

Miners who scale slowly see these problems early and adjust before they become expensive.

Scaling Slower Increases Total Returns by Protecting Capital

Every dollar deployed into mining hardware is capital at risk. Scaling too quickly concentrates risk at the worst possible moment, before operations are fully optimized.

Slower scaling allows miners to:

- Validate hosting performance

- Measure real uptime versus advertised uptime

- Stress-test cooling and power systems

- Confirm maintenance response times

- Optimize firmware and efficiency settings

Capital deployed after validation is far more productive than capital deployed blindly.

This is one of the core reasons scaling slower increases total returns over full market cycles.

Infrastructure Always Lags Hardware Expansion

Hardware can be purchased in days. Infrastructure cannot.

Power upgrades, transformer capacity, cooling airflow, network redundancy, and staffing scale far more slowly than ASIC shipments. When miners expand hardware faster than infrastructure, performance degrades quietly.

Symptoms include:

- Rising temperatures

- Hashrate throttling

- Increased failure rates

- Extended downtime during repairs

Slower scaling keeps infrastructure ahead of hardware, not behind it.

Uptime Compounds, Downtime Multiplies Losses

Uptime is not linear. Losing 5% uptime does not mean losing 5% profit. It often means losing far more due to missed blocks, difficulty adjustments, and maintenance overlap.

Miners who scale aggressively often experience:

- Simultaneous failures across large fleets

- Maintenance backlogs

- Extended downtime during peak network difficulty

Slower scaling spreads risk across time, allowing uptime improvements to compound instead of collapse under load.

Difficulty Adjustments Favor Disciplined Growth

Bitcoin’s difficulty mechanism continuously penalizes inefficient hashrate. When miners deploy large amounts of hardware quickly, they often do so at the same time as others, accelerating difficulty increases.

Slower scaling allows miners to:

- Deploy during lower competition windows

- Optimize before difficulty rises

- Avoid paying peak prices for hardware and hosting

This timing advantage is subtle but powerful over multiple difficulty epochs.

Cash Flow Stability Beats Peak Hashrate

Peak hashrate looks impressive on dashboards. Cash flow stability keeps miners alive.

Fast scaling often creates:

- High upfront costs

- Delayed ROI

- Liquidity pressure

- Forced selling during downturns

Slower scaling aligns:

- Hardware payments

- Hosting costs

- Bitcoin production

- Reinvestment cycles

Stable cash flow enables miners to survive volatility and reinvest when others are forced out.

Why Institutions Scale Slower Than Retail Miners

Institutional miners rarely rush deployments. They scale in phases, even when capital is abundant.

They prioritize:

- Risk-adjusted returns

- Infrastructure resilience

- Predictable performance

- Capital efficiency

Retail miners who emulate this approach dramatically improve survival rates. This is not about being cautious. It is about being precise.

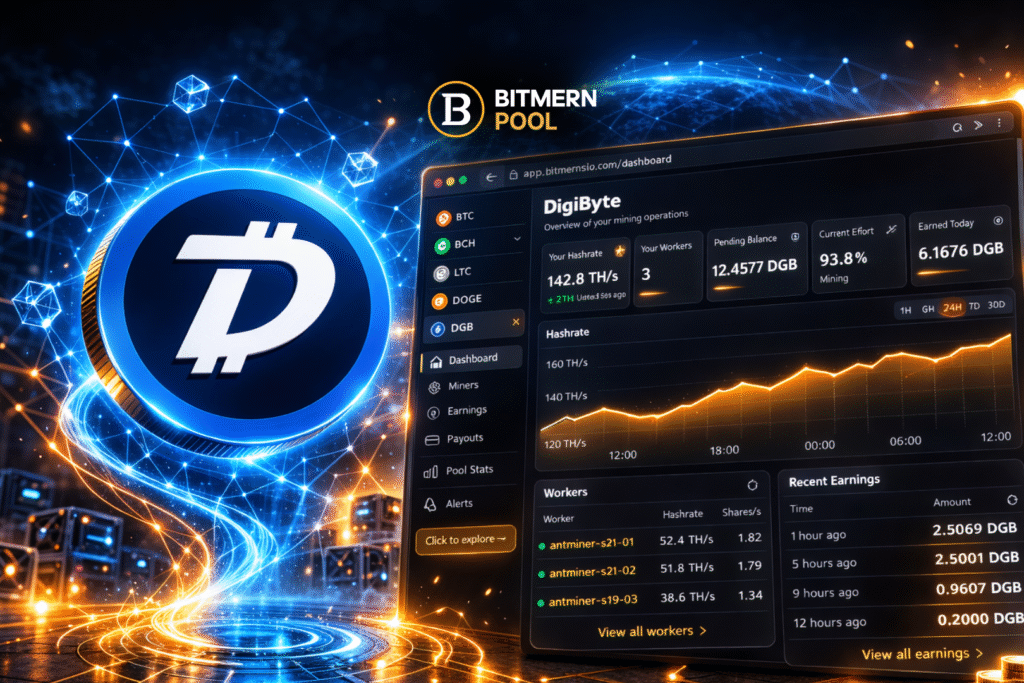

The Role of Bitmern Mining in Disciplined Scaling

Bitmern Mining is built around infrastructure-first growth, not hardware-first hype.

Across its operations, Bitmern Mining focuses on:

- High uptime facilities

- Power stability

- Cooling efficiency

- Incremental scaling blocks

- Transparent performance metrics

This approach ensures that each expansion phase improves overall returns instead of diluting them.

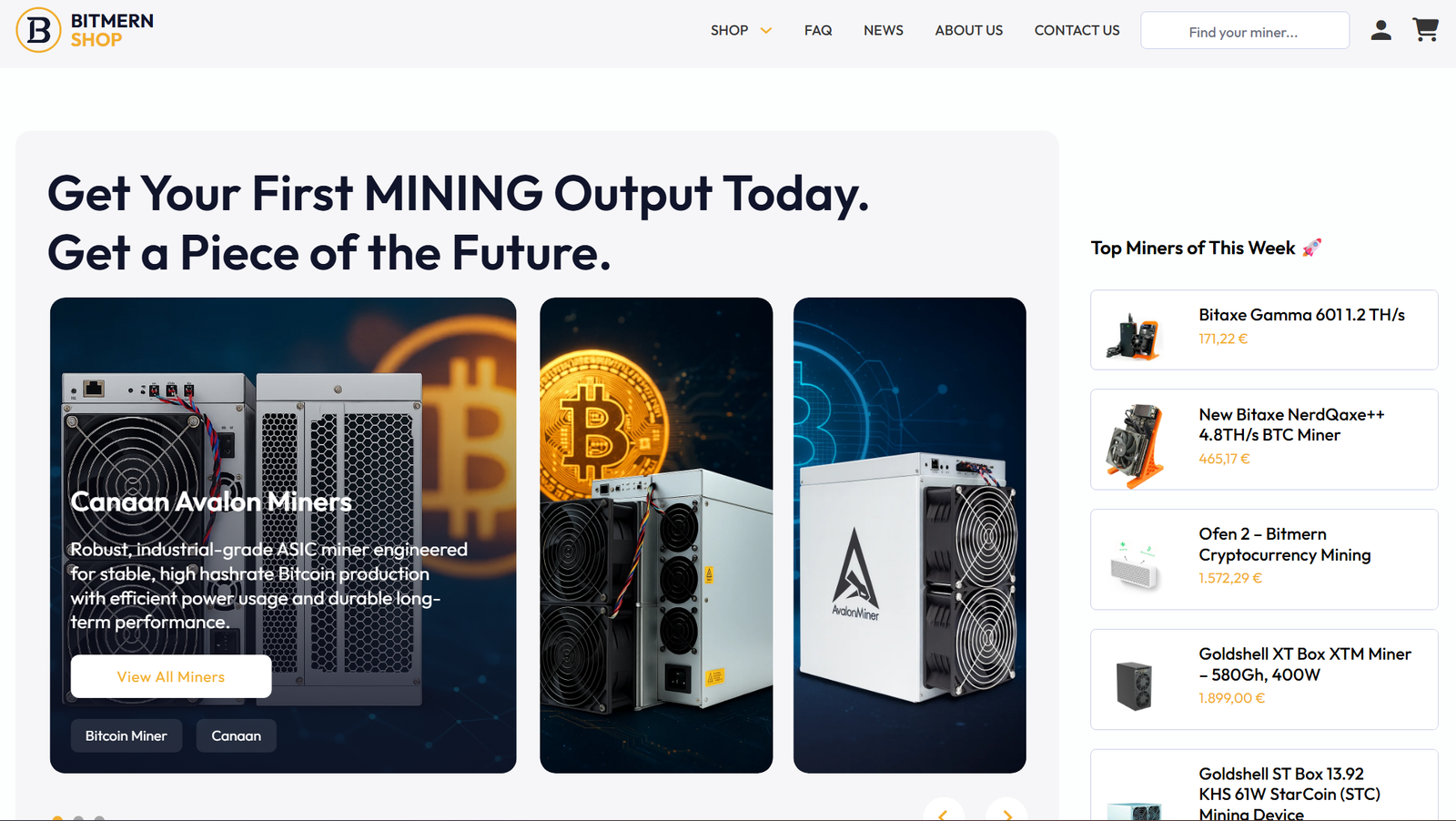

How the Bitmern Shop Supports Smarter Scaling

The Bitmern Shop at https://shop.bitmernmining.com/ is designed for miners who want controlled, intelligent expansion.

Through the shop, clients can:

- Purchase verified hardware

- Deploy gradually instead of all at once

- Choose self-hosting or Bitmern hosting

- Align hardware purchases with infrastructure readiness

This structure directly supports the principle that scaling slower increases total returns.

Slower Scaling Reduces Irreversible Mistakes

Fast scaling leaves no room for correction. Once hardware is deployed poorly, losses accumulate silently.

Slower scaling allows:

- Firmware tuning

- Cooling adjustments

- Power optimization

- Staff training

- Process refinement

Each improvement compounds future performance instead of being buried under chaos.

When Scaling Slower Actually Increases Total Returns

The conclusion is simple but counterintuitive.

- Faster scaling increases exposure to failure

- Slower scaling increases operational precision

- Precision compounds returns

- Chaos compounds losses

Scaling slower increases total returns because Bitcoin mining rewards discipline, not speed.

Final Perspective: Mining Is a Marathon of Execution

Bitcoin mining success is not decided in the first deployment. It is decided over hundreds of days of uptime, thousands of maintenance decisions, and dozens of infrastructure optimizations.

Miners who slow down, observe, and adjust outperform those who rush.

Bitmern Mining exists to support miners who understand this reality and build for longevity, not headlines.